LexisNexis GLP Index: commercial law

Will demand for commercial law expertise grow, decline or simply stay the same in 2023 and beyond?

The LexisNexis GLP Index pulls together the latest datapoints to provide some powerful predictions on the future of commercial law.

Commercial law in 2023

Unlike other practice areas of the law, the commercial lawyer can be pulled into almost all aspect of a business’s operations, from product inception and creation, to supply chain logistics, to business development.

That’s why our research team decided against focusing on a list of specific tasks commercial lawyers might commonly do to measure demand; instead, looking at a broader range of metrics that have more of an impact on trade and commerce.

For instance, we looked at trade imports and exports, and foreign investments, and the performance of top performing companies, and the cost of fuel. These metrics might not directly relate to the workloads of commercial lawyers, but they act as a powerful and far more accurate proxy for market growth, giving us a feel for the current demand for commercial lawyers.

What we uncovered was quite extraordinary. Despite the UK separating from the EU, the pandemic causing all sorts of supply chain issues, war in Europe, rising inflation and the threat of a recession, the LexisNexis GLP Index still tells a story of growth for commercial law. This report captures a handful of the many trends driving change across the practice area.

Dylan Brown

Content Lead, LexisNexis

Justas Garmus

Lead Analyst, LexisNexis

Overview of GLP findings

Find out how demand for commercial law will grow in the coming months and years.

The combined workload of commercial lawyers is predicted to remain in steady demand until at least Q1 2024

That's according to the latest GLP Index, which pulls from hundreds of datapoints to predict demand for legal expertise across multiple practice areas.

Measuring demand for commercial law is no small feat. The pure breadth of subject matter expertise a commercial lawyer can deliver to an organisation can span across everything from product creation, to supply chain and distribution, to sales and marketing.

That's why, when creating the index, our research team looked at a broad range of metrics that have more of an impact on commerce than specific legal work.

National and global trade import and export figures, for instance, were included to act as a proxy for market growth. Foreign direct investment, supply chain and business investment figures were used to measure business health. Performance figures of the UK's top earning companies were used alongside the number of new and dissolving companies to gain an insight into demand for commercial lawyers within those companies.

By analysing the past and present performance of these and other datapoints, we were able to get a feel for the appetite for commercial lawyers in the near and distant future.

The above index shows there's been two major dips in demand for commercial lawyers over the last few years - towards the end of 2019 and the start of 2020. However, demand quickly bounced back in 2021.

The forecasted outlook, which relies on historic data, predicts steady growth from 2022 through to 2024, returning to a higher point than seen in previous years.

Demand is anticipated to grow by 1% over 2022 as a whole when compared against 2021. In 2023, demand is expected to grow by an additional 4% when compared against 2022's growth.

Scroll down for in-depth research and analysis on the key trends driving change across commercial law.

Demand for commercial law is predicted to grow in 2022 and 2023

Trading troubles

A look into the post-Brexit trade landscape and the impact recent events will have on commercial lawyers.

Strong trade import and export numbers means steady work for commercial lawyers, as their workloads are closely tied to the sales and distribution functions of most organisations.

UK trade has been hit by a flurry of trials and tribulations in recent years. The nation's official separation from the EU, the myriad of challenges brought on by pandemic, rising inflation and the threat of a recession, to name but a few.

These factors combined have created so much uncertainty, the Office of National Statistics (ONS) - the gatekeepers of the nation's data - have admitted it's now "difficult to assess the extent to which trade movements reflect short-term trade disruption or longer-term supply chain adjustments."

However, when looking at annual figures, imports have clearly bounced back after falling in 2020 - undoubtedly as a result of the supply chain issues brought on by the pandemic. Exports followed a similar trend, although experiencing a less dramatic U-turn.

The two key drivers for growth when looking at both imports and exports are machinery and transport equipment and chemicals. Fuel imports are also rising, although imports from Russia continue to fall.

Despite the disruption, trade imports and exports appear relatively stable and similar to what we've seen during pre-pandemic and pre-Brexit times. This indicates stability for commercial lawyers.

Another stream of work will come through post-Brexit legislation. Both businesses and lawyers are operating in anticipation of the promised post-Brexit bonfire of EU legislation. For UK businesses well-established in the EU market, this means doubling up on compliance and advice in respect of UK and EU regimes.

By way of example, the recent changes to the now separate EU and the UK vertical block exemptions, which came into effect on 1 June 2022, show that there is some consistency and alignment in approach, but there are also marked differences. Commercial decisions will have to be made whether to operate different approaches to the EU and UK markets or settle with a compromise based on the most restrictive approach of both markets, where that is achievable.

The aforementioned challenges have also had an impact on supply chains issues, making it increasingly difficult for businesses to acquire and maintain their stock.

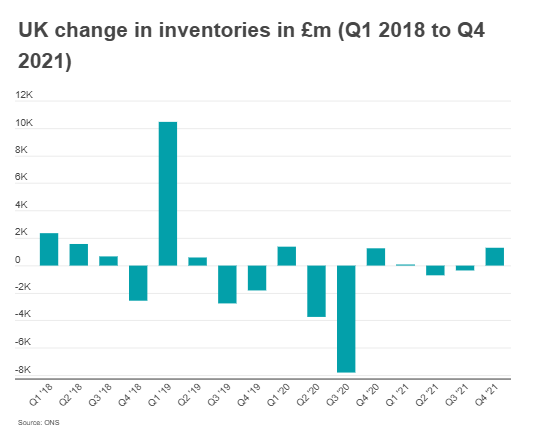

The UK changes in inventories graph makes clear the impact these events have had on trade. In Q2 and Q3 of 2020, we can see the toll the pandemic took on trade, with retail, construction, manufacturing and motor trades driving this fall.

The same trend applies when looking at the UK exit dates from the EU. Inventory prices dropped during the original EU exit date (29 March 2019) and the extended date (31 October 2019) - they also dipped when the UK actually left the EU on 31 January 2020. However, when the EU exit transition period came to a close (31 December 2020), inventory prices went up.

These events have a direct impact on the workloads of commercial lawyers, who are often closely connected to their business's supply chain operations - managing contracts, understanding new legislation and helping the business to meet regulations.

The continued divergence between UK and EU legislation means we are in a period of review and reshaping of commercial relationships for supply of goods and services, which requires commercial lawyers to stay on top of legal developments in both markets. Uncertainty in the development of legislation isn’t great for businesses looking for solutions, and flexibility needs to be built into commercial relationships.

The return to near-normal trade imports and export figures indicates a healthy level of work for commercial lawyers

Most commercial lawyers work closely with their organisation's supply chain departments, managing contracts, understanding new legislation and adhering to regulations

View LexisNexis Legal Guidance on UK Block Exemptions

The real impact of investments

New changes to foreign investments could have a noticeable impact on commercial law workloads.

Looking at foreign investments involving UK companies, both inward and outward, is a useful growth indicator for commercial legal work. Not only do deals require legal work, but it also acts as a proxy for a healthy business market in which commercial lawyers operate.

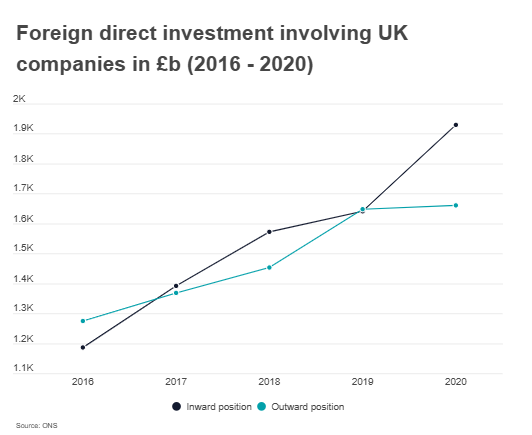

The latest ONS data, which covers up to the end of 2020, shows outward and inward foreign direct investment (FDI) positions increased in 2020 compared with 2019.

In 2020, we saw the UK’s inward FDI position continue its upward trend, increasing by £288.7 bn to £1,929 bn. Outward stock also increased, hitting £13.5 bn to £1,660 bn.

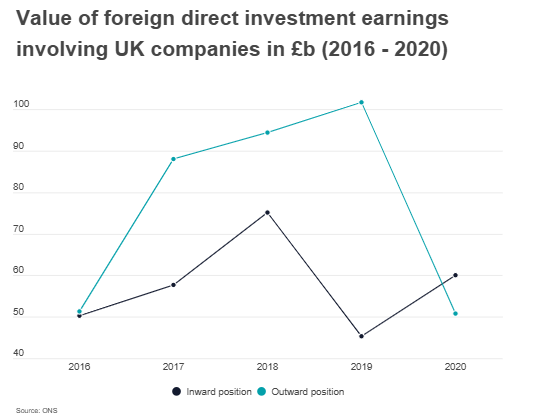

When looking at the value of outward FDI earnings, the impact the pandemic had on the profits of UK companies from their affiliates in other countries is clear.

The total value of outward earnings halved, dropping from £101.7 bn in 2019 to £50.8 bn in 2020. This took the value of outward earnings slightly below the 2016 value (£51.3 bn).

After rising for three consecutive years, inward earnings dipped massively in 2019, yet rebounded again during the pandemic settling at £60 bn.

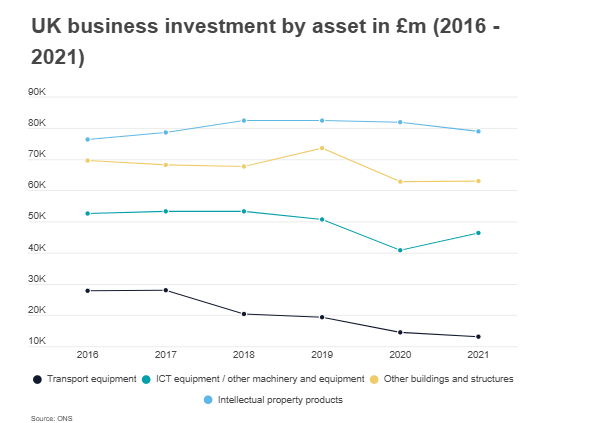

When looking at investments by assets within the UK, we can see business investments dipped during 2020 as a result of COVID-19, although investment figures steadied during 2021. Investments in intellectual property, on the other hand, continued to stay relatively stable, at just under £79m hinting at strong demand and stability overall.

It's also worth noting the UK’s new National Security and Investment (NSI) Act, which introduced new requirements for foreign direct investment (FDI) in certain business sectors, but especially in the tech space.

In a recent Pinsent Masons article, Senior Associate , Paul Williams, says: "The UK government considers that the NSI Act is going to result in far more regulatory scrutiny of transactions from an FDI standpoint."

There is a major fear that this new act will put off many overseas buyers or investors, who may see this as yet another hoop to jump through.

Inward and outward foreign investments increased during the pandemic, indicating plenty of work for commercial lawyers

The value of outward investment earnings took a huge hit during the pandemic

Technology investments have generated a lot of work for commercial lawyers in recent years

Business buoyancy

A healthy business market means a healthy workload for commercial lawyers

The creation or dissolution of companies doesn't generate a massive amount of work for commercial lawyers. What it does give us, however, is a rough estimate of the number of companies at which commercial lawyers can work for or offer services to.

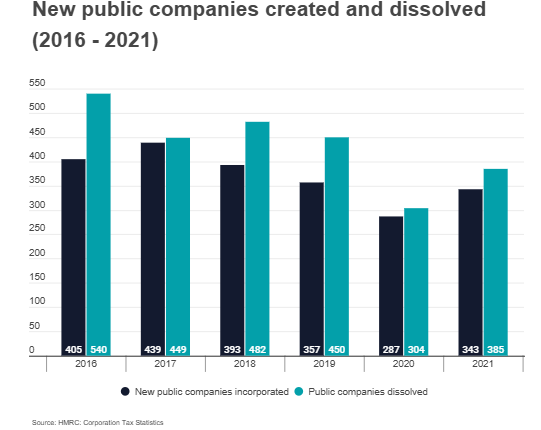

The number of new public companies on the market dropped from 357 in 2019 to a much lower 287 in 2020. The impact of the pandemic is painstakingly clear - but, fortunately, not long-lasting. The number of new public companies rose almost 20% from 2020 to 2021, at 343. The number of dissolving companies also went up, but the gap between new and dissolving companies lessened considerably when compared to previous years.

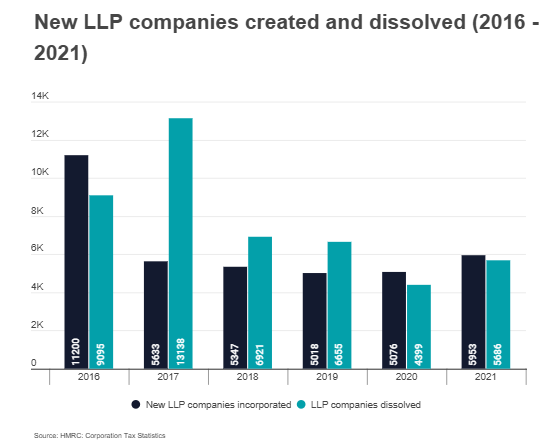

We also incorporated data of new and dissolving LLP companies into our index, which showed that the pandemic had very little impact on figures. In fact, the number of new companies increased from 2019 to 2020 (5,018 to 5,078) and again in 2021 (5,953).

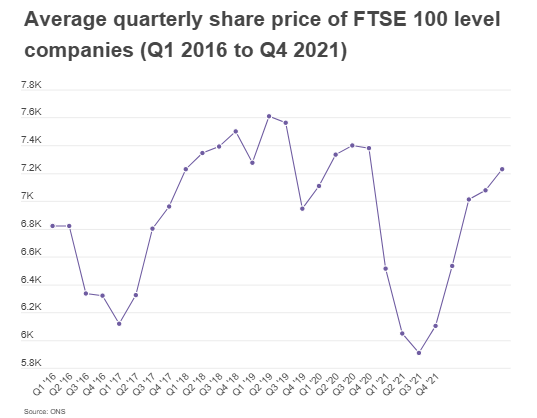

We also looked at the share prices of FTSE 100 level companies to measure their health. Strong peaks or troughs could indicate more or less work for commercial lawyers, as with economic hardship comes mass redundancies, fewer investments and an unwillingness to take financial risks.

Although job salaries weren't included in our index (singling out commercial lawyers is a near impossible task), it's worth highlighting the legal industry's current salary bubble and its direct impact on business operations.

Our Rise of the Legal Consultants report, which was published in February 2022, highlighted the average earnings of lawyers across the UK. When looking at law firms of all shapes and sizes, equity partners make approximately £130k annually. Salaried partners make almost half that number, at £75k. Associate solicitors make £65k on average.

Yet, some of the numbers seen in recent news events show new graduates earning £130k at top law firms. Both Freshfields Bruckhaus Deringer and Clifford Chance made news headlines recently for raising salaries for newly qualified lawyers to £125k.

While these numbers only reflect a small part of the legal market, what they do show is intense competition for fresh talent - and a strong demand for legal work. Freshfields Bruckhaus Deringer, Clifford Chance and most of the top international law firms offer services that are closely connected to commercial law as a practice area.

The number of newly created public companies rebounded in 2021, hinting at more work for commercial lawyers

The number of new LLP companies was higher than the number of dissolving companies for the second year running

The UK's top performing companies generate a massive amount of work for commercial lawyers

Sustainable sustainability

Commercial lawyers play a crucial role in helping organisations to set and meet their ESG goals.

One current, hot-topic for lawyers across the board, and for commercial lawyers in particular, is supporting their business's ESG goals.

There's plenty of ESG-related regulations being created in the EU, and the UK has its own ESG legislative initiatives, too. However, to have had the intended impact on the environment, the regulation and legislation we are seeing now is really what should have been introduced many years ago.

The real driver behind ESG initiatives is businesses, not regulators or legislators. It’s businesses that are under pressure from their stakeholders and customers to be good corporate citizens and demonstrate a good ESG record.

Commercial lawyers are in a unique position to support the ESG agenda, whether as external advisers or in-house legal counsel. They’re dealing with the teams in sales, product development, operations and procurement as well as the C-suite. With this 360 degree view of a business’s supply chain, in-house lawyers are well-placed to develop an end-to-end ESG compliant contract lifecycle strategy. This can be achieved by incorporating ESG initiatives across supplier due diligence, ensuring compliance is built into the contract management system, spotting problems on the horizon and re-wiring contracts to support and develop ESG policy.

The challenge is finding the right ESG path for the business. Companies are at different stages of their ESG evolution. At one end of the scale, you have B-Corps, whose entire ethos is based on being a sustainable and ethical corporate citizen. They have sustainability written into their DNA – it permeates their contracts, policies, strategies, products and customer bases.

You also have the multi-nationals who have traditionally built their business for profit, but have significant resources to weave an ESG ‘layer’ into what they do. For suppliers partnering with these organisations, it is important to price the cost of delivering the shared ESG ambition. For SMEs or mid-market businesses who have lesser resources, there is a serious risk of overcommitting and underdelivering.

The agenda set by the larger, multi-nationals who are driving the supply-chain standard may not be what their smaller B2B suppliers are yet set up to deliver against.

In addition, we’re beginning to see open-source sustainability-focused contract clauses being adopted by businesses. These provide an excellent starting point, but there are risks.

Some sustainability template clauses contain highly-technical and detailed net-zero obligations. These can be helpful, but if the business signing up to these conditions isn’t strategically set up to fulfil the same agenda, that’s a contract breach waiting to happen. Not only do suppliers have to understand their obligations and capacity to fulfil the criteria being set by demanding customers, but those customers also need to understand that their commitment to sustainability can only be as good as their least committed supplier.

Businesses really need to understand the scope of the contractual obligation, and how the business will satisfy its obligations. Consensus on ESG compliance is important in the supply chain. Without it, there is potential for a gap between expectation, obligation and practice, and that's where there's potential for dispute and liability.

The changing needs of in-house legal teams

Budgets are squeezed. Resources are slim. Here's how in-house teams are managing workloads.

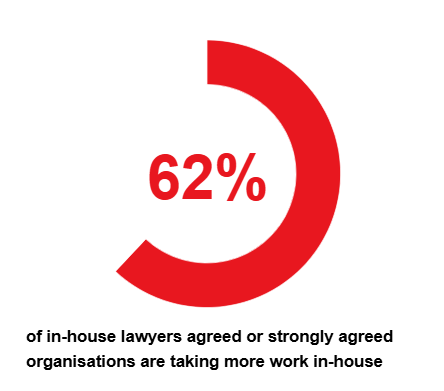

A recent LexisNexis survey of 120 in-house legal teams hinted at an increased need for legal departments to manage work internally and increase their own specialist knowledge as opposed to relying on their law firm partners.

Almost two-thirds agreed or strongly agreed that legal teams will continue to grow as more and more work takes place in-house, while half said the level of specialist knowledge is akin to what you’d expect to find at a traditional law firm.

Squeezed external legal spend budgets are likely to be driving increased demands on in-house legal teams, resulting in ever-expanding workloads.

The need to bring lawyers with specialist knowledge in-house is most likely to derive from specific needs; for example, technology is integral to the operation of modern businesses and the necessity for skills in this area, and associated data protection and compliance knowledge, is promoting their development. The COVID-19 pandemic has further increased the need for internal specialist employment expertise.

Increased specialisation is more likely to occur in larger, in-house teams where resources allow. Smaller teams may struggle to manage existing workloads and provide the level of expertise required.

In-house teams are increasingly expected to be strategic business advisers, often steering senior leadership on risk compliance and sensitive commercial initiatives. In-house lawyers are close to the business and well placed to be part of the key decision-making process.

They need the resources to allow them to adapt their role and this is often found by outsourcing low risk, repetitive tasks to alternative providers, legal technology solutions and upskilling the business to negotiate and process contracts (for example, through the use of training and playbooks).

However, regardless of their internal skillsets and expertise, in-house legal teams will continue to rely on their law firm partners. This can be demonstrated by simply looking at the revenue streams of law firms during the height of the pandemic. In 2020, the legal services sector generated £36.78bn, a small but significant increase from 2019's £36.77bn. And again in 2021, revenues increased to £41.58bn.

International commercial matters, for example, is a line of work that frequently raises complex questions that external law firms (particularly those with the resources and reach of the larger firms) are ideally placed to handle.

Collaborative contracts

Why some companies are taking a collaborative approach to contract management.

In an effort to improve efficiencies, some in-house legal teams are moving towards more balanced, advanced negotiated positions in their standard terms and conditions.

Traditionally seen by management in some sectors as ‘blockers’ to deals by their risk averse approach, legal teams with management approved positions on key areas and more realistic expectations built into their templates may find their deals are agreed more quickly, without compromising on risk.

Furthermore, standard terms and conditions underpinned by commercial logic and supported by training and playbooks mean that in-house teams or external legal spend can focus on the non-standard and high risk engagements.

Wanting to increase the productivity of your legal team?

A University of Manchester study found:

Lawyers using Lexis+ for legal research and guidance save...