The LexisNexis Gross Legal Product (GLP) Index 2024

Scroll down to continue reading.

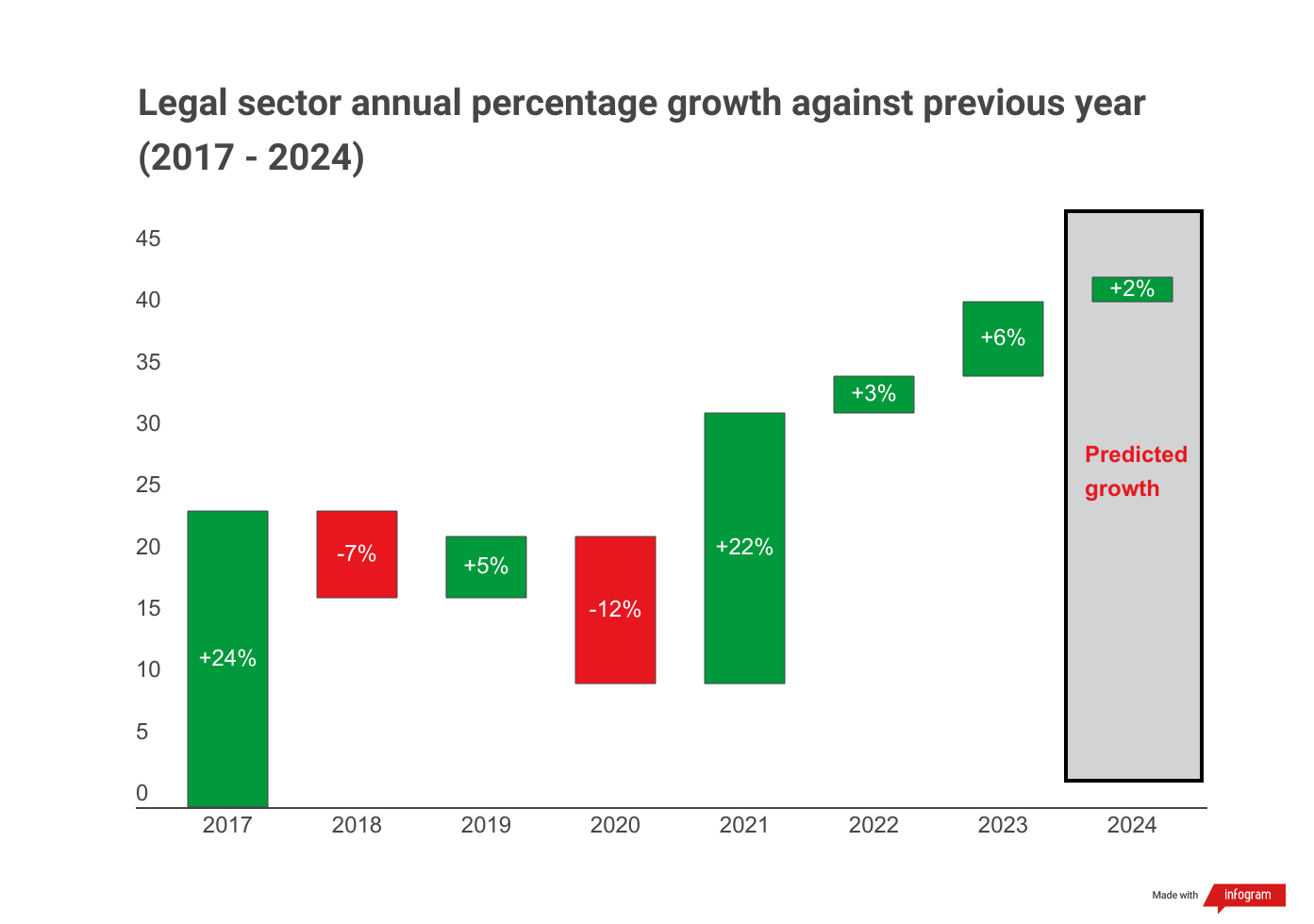

The LexisNexis GLP Index predicts demand for the legal services sector will grow by +2% in 2024 when compared against 2023.

But is this a sign that the sector is bouncing back, or is it burning out?

And which areas of the law will increase, inflate, fizzle or flop?

Steady – slightly subdued – growth, but growth nonetheless.

Nothing quite ruins the resoundingly positive message of growth like slapping "subdued" in front of it.

Yet, considering the geopolitical and macroeconomic headwinds that have battered the professional services industry for the last 18 months, subdued growth is an overwhelmingly positive message to be sharing.

After a sharp spike in demand in 2021 (+22%), when the lockdown eventually lifted, the Gross Legal Product (GLP) Index shows demand for the legal sector as a whole has climbed steadily ever since (+3% in 2022; +6% in 2023).

Drawing from this historic data, the Index predicts demand for legal services to grow by +2% over the course of 2024.

This growth speaks more to the legal sector's resilience, ability to innovate, and drive to power forward than it does to its impregnability.

However, we live in unpredictable times, and growth could easily accelerate well beyond +2%. According to the latest Lloyds Bank's Business Barometer, business optimism has rebounded to its highest level since before Russia invaded Ukraine a year and a half ago.

When looking at specific areas of the law, the Index predicts strong growth across property, immigration, and restructuring and insolvency law. Both property and immigration law rebounded in last year's GLP, after several years of decline, so this growth is very promising indeed.

Demand for competition and risk and compliance law has flattened after experiencing steady growth in 2022 and 2023.

On the less fortunate end of the spectrum, demand for criminal law expertise has continued its downward descent.

We've pulled together insights and commentary for all 12 practice areas of the law included in the Index to add value to your planning for 2024 and beyond.

Dylan Brown

Content Lead, LexisNexis

Skip to your practice area of the law

Commercial law

Demand for commercial law expertise is predicted to continue its upward climb in 2024.

The commercial lawyer works across everything from operations, to product inception and creation, to supply chain logistics, to business development. Measuring demand based on specific tasks can, therefore, be wildly misleading.

As a solution, our research team have included a broader range of metrics into the Index that have more of an impact on trade and commerce.

The Index revealed that workloads for commercial lawyers rose in 2017 and 2018 by +2% and +4% respectively. This was followed by a decline in 2019 and 2020, at -2% and -3% respectively – no doubt a direct result of Brexit and the pandemic, which brought about a medley of supply chain issues.

In 2021, as the lockdowns eventually came to an end, the practice area saw a huge spike in demand, growing +12% when compared to the previous year. 2022's political and economic events resulted in subdued growth (+1%), while 2023 saw a +4% increase in demand. The Index predicts this acceleration in demand to continue into next year, with a +4% growth anticipated for 2024.

Digging into the key growth drivers, we saw strong trade import and export numbers. This can mean steady work for many commercial lawyers, whose workloads are often closely tied to the sales and distribution functions. Annual ONS data for 2022 shows import and export numbers rose significantly when compared to previous years, rising to £889.2bn imports and £781.2bn exports.

Another key driver was the increase in inward and outward foreign direct investment (FDI) positions (stocks), which both increased when compared to 2020. The value of the UK's inward position increased to £2,002.4bn, while the outward position increased to £1,769.3bn. The values for both outward and inward FDI earnings increased in 2021 when compared with 2020.

These findings show some of the many reasons why the GLP Index has predicted an increase in demand for commercial lawyers in 2024.

Useful resources:

- Read supply chain sustainability practice notes

- Transparency in the procurement processes

- Terminating commercial contracts

- Assessing modern slavery risk in supply chains

Family law

Once again, family law has proven its buoyancy – with growth anticipated for 2023 as a whole.

Demand for family law expertise has risen steadily since the pandemic – and 2024 is likely to follow in the same trajectory, the GLP Index found.

Despite a rocky recession, demand for family law picked up by +2% in 2022 and +4% in 2023. This growth can be attributed to an increase in financial remedy cases and private disputes involving children.

The number of financial remedy cases dropped noticeably in 2022 as a whole, while the number of private disputes involving children stayed relatively on par with previous years. However, the latest 2023 figures show a sharp increase.

Also of note is the increase in dissolution of marriage applications. In 2022 we saw 121,182 dissolution of marriage applications, up from 2021's 108,248. While divorce is a largely-automated process, with applications taking place online and most lawyers charging a flat fee, this increase in applications could also indicate a rise in financial remedy and private dispute cases in the coming months.

With these findings in mind, the GLP Index predicts family law to grow by +3% in 2024 as a whole.

Geraldine Morris, head of family law at LexisNexis, said:

"Reported cases frequently have an international aspect, with England and Wales often the preferred jurisdiction for a financially weaker spouse or the super-wealthy."

Morris also pointed out that, from 31 January 2023, use of the MyHMCTS portal by legal professionals for financial applications that fall within the pilot scheme under the Family Procedure Rules 2010 is mandated, with the aim of reducing the current backlog.

Useful resources:

- International aspects of pensions on divorce etc

- Marital/civil partnership agreements

- Financial provision: practice and procedure

- The Family Court—judicial allocation

Competition law

After three years of exceptional growth, demand for competition law is predicted to steady itself in 2024, dropping by -5% when compared to 2023.

Despite being in the red, the Index shows there's still a huge demand for competition law expertise moving forward.

Antitrust enforcement has fast-become a subject of mainstream interest in recent years, with policymakers, academics and the media all expressing concerns that anti-competitive conduct has been on the rise.

In previous years, sharp spikes in demand have become commonplace, which could be easily linked to a number of recent events. The UK exit dates from the EU, which had a profound impact on legislation and regulation relating to competition law, is perhaps the most obvious of examples. Demand increased after the referendum on 23 June 2016, and again after the original EU exit date (29 March 2019) and around the same time as the extended date (31 October 2019). When the UK finally left the EU on 31 January 2020, demand slowly increased afterwards as the country introduced new legislative changes.

Despite the spikes, the Index shows demand for competition law is consistently growing. In 2021 competition law work went up by a whopping +83% when compared against 2020. Growth has continued, with demand rising +17% in 2022 and +32% in 2023.

Data provided by the Competition and Markets Authority (CMA) played a key role in informing our Index. The regulatory body is being given more and more power, especially when considering recent reforms to the Digital Markets, Competition and Consumer Bill.

This year so far over half of new cases taken up by the CMA were related to mergers – a total of 23 new cases altogether. This is a decline from what we saw in 2022, where 42 of 61 cases were merger related.

Useful resources:

- Competition law compliance policy precedents

- Competition compliance—gathering competitive intelligence guide for staff

- The evolving essential facilities doctrine

- Russia merger control practice notes

- Analysing vertical agreements outside the Vertical Block Exemption Regulation 2022/720

Employment law

Despite a reassuring rebound in 2022 and 2023, demand for employment law is expected to drop in 2024.

Employment law was front of mind for many during the pandemic. Remote working, mass redundancies, and the Government's furlough scheme caused organisations of all shapes and sizes to seek the advice of employment law experts.

However, despite this supposed surge in demand, employment law workloads decreased significantly during 2020 and 2021. Demand dipped by -4% in 2020, and by -29% in 2021. While the Index draws from hundreds of datapoints, this decline can be attributed to a backlog in employment tribunal claims.

Growth returned to the practice area in 2022 (+6%) and 2023 (+3%), as employment tribunal cases being received and disposed of increased.

However, demand for the practice area is set to drop yet again, with the GLP Index predicting a decline of -2% across 2024 as a whole.

A key dataset that we looked at during our analysis was the Ministry of Justice's Employment Tribunal statistics. Measuring annual statistics is currently tricky, as annual figures for 2021–2022 were not published due to the migration to the new tribunal case management.

The latest annual figures for 2022/23 show 84,396 claims were accepted – significantly lower than in previous years. The total number of disposals, on the other hand, sits at 71,316 disposals – 71% higher than that of 2020/21.

This data and others included in the GLP indicate employment law will decline in 2024.

Useful resources:

- Shared parental pay (birth) practice notes

- Retained EU law (Revocation and Reform) Act 2023—impact on employment law

- Directors’ duties: companies in financial difficulties

- Implementing a salary sacrifice

- Implementing a business reorganisation—employment issues

Risk and compliance law

The latest GLP Index predicts demand for risk and compliance law will remain stable in 2024.

A series of political, economic and pandemic-related events have caused demand for risk and compliance legal expertise to rise and fall (quite noticeably, too).

In 2017, demand for risk and compliance expertise grew by a whopping 50% when compared to the previous year. This surge was no doubt brought on to some extent by the EU's General Data Protection Regulation (GDPR), which came into effect in the UK in May, 2018, and required a complete overhaul of marketing, sales, product and customer service processes for most businesses. Yet 2018 saw demand drop by -29%.

A similar surge in demand can be seen in 2020, with the COVID-19 pandemic causing a +37% spike compared to the previous year. The pandemic caused widespread disruption and change across the board – perhaps one of the most obvious being people working from home, which posed a number of security risks. Again, this rise was followed by a noticeable fall, with demand dropping in 2021 by -42%.

2022 also saw a smaller spike in demand, with a +6% growth. This can no doubt be attributed – at least in part – to the sanctions brought about by Russia's invasion of Ukraine.

Yet, the post-Brexit, post-recession, post-pandemic market hints at overall stability.

Growth continued in 2023, with demand rising by +7% when compared to the year prior.

However, many of the latest figures we used to inform our Index, such as data from the Information Commissioners Office on enforcement notices and penalties, were relatively similar to previous years.

Therefore, growth is expected to stay roughly the same in 2024 as we saw in 2023, dropping by a meagre -1%.

One of the biggest risks dominating the R&C space right now is cyber security – while attacks are often easily avoidable, more than a third of businesses are still falling foul of breaches or attacks.

Allison Wooddisse, the head of In-house, Compliance and Practice Management at LexisNexis, says phishing remains the leading cause of cybersecurity breaches.

"It’s estimated that up to 80% of cybersecurity breaches could be prevented by implementing basic good practices – phishing only works if someone is hoodwinked by a scam email."

Your staff are your biggest risk and your first line of defence, says Wooddisse, who previously worked as a partner at Shoosmiths.

"Train, educate and reinforce, reinforce, reinforce. Phishing simulator products will engender a culture of constant vigilance. One of the most common mistakes is forgetting the simple stuff, technical measures such as firewalls, enforced password hygiene, software patching and deleting dormant user accounts."

How to hone your information security policies

Our Information security subtopic contains a wide range of guidance and tools, including Information security policy, Clear desk and screen policy, Password policy, various awareness campaigns and training materials

The do's and don'ts of direct marketing campaigns

The LexisNexis Direct marketing subtopic explains How to handle personal data for direct marketing and includes Decision trees, helping you to understand what is allowed for different types of direct marketing campaigns.

Restructuring and insolvency law

A turbulent economy has taken a toll on many business, generating plenty of work for restructuring and insolvency lawyers. The practice area is predicted to grow by +6% in 2024.

To measure the demand for restructuring and insolvency law as a practice area, the GLP Index looked at a broad range of datapoints. This included everything from company insolvencies, to compulsory liquidations, to director disqualifications, to individual bankruptcies and dozens more.

The Index revealed that demand for restructuring and insolvency law plummeted during the lockdown. After falling -18% in 2020, and then again by -12% in 2021, the practice area grew by +9% in 2022 and by +2% in 2023.

This is largely due to a rise in the total number of company insolvencies, which skyrocketed in 2022. The total number of companies that registered insolvency in 2022 was 22,109, the highest number since 2009 and 57% higher than 2021's 14,059.

The latest figures for 2023 show 12,166 new company insolvencies – working out at 55% higher than that of 2022.

It's with this in mind that we're predicting a +6% growth for restructuring and insolvency law workloads.

Useful resources:

- Interaction between the PRA, FCA and FPC

- Intercreditor agreements—effective releases

- Basic principles—the delivery-up of information and property to the insolvency office-holder

- Proof of debt practice notes

- Receivership—an introductory guide

Corporate law

After a remarkable post-lockdown boom, a series of economic and political events saw demand for corporate law work fall off a cliff in 2022. Yet, according to the latest GLP Index, corporate lawyers can expect stability in 2024.

The Index found demand for corporate law work increase by +120% in 2021 after more than a year of little to no activity. However, the war in Ukraine, the cost of living crisis and political instability caused corporate legal work to decline sharply in H1 of 2022, stabilising to -22% over the course of the year.

However, the latest data indicates that corporate lawyers can expect the same level of stability seen in pre-pandemic times. The Index predicts demand to grow by +1% over the course of 2023 and remain the same in 2024.

Annual M&A figures for 2022 show that, despite a very concerning H1, balance was eventually restored. Inward M&As fell 1,198 in 2021 to 979 in 2022, still noticeably higher than pre-pandemic levels. Outward M&As actually increased, jumping from 789 in 2021 to 810 in 2022. Foreign investment by UK companies was on par with 2021.

Provisional estimates for 2023 suggest lower mergers and acquisitions (M&A) activity at the start of 2023, but the market could pick up.

Unlike M&A activity, main market IPOs and new listings plummeted in 2022 as a whole. London Stock Exchange figures show activity fell from 88 in 2021 to 45 in 2022.

Looking at the latest figures, IPO activity on the UK main market and AIM for H1 2023 saw a +31% drop in deal numbers compared to H1 2022.

While the same level of geopolitical uncertainty can be expected in H2, there's a a healthy pipeline of IPOs, meaning the outlook is overall positive.

Useful resources for corporate law:

- General legal issues to consider in share purchase transactions

- Takeover code resources

- Getting the Deal Through: Initial Public Offerings 2024

- Marketing an initial public offer on the Main Market

- Market Abuse Regulation (MAR)—one minute guide

Property law

Another year of growth is predicted for property lawyers and conveyancers. The index predicts property law workloads to rise by +7%.

To measure growth across England and Wales' incredibly diverse property market, we looked at everything from house building data, Help to Buy schemes, mortgage lending statistics, planning applications, and stamp duty taxes.

The Index showed that demand for property lawyers and conveyancers has bopped up and down in recent years, most notably during the height of the pandemic. In 2020, we saw demand drop by -12% when compared to the previous year.

However, demand has picked up significantly since then. In our previous GLP Index, we predicted the demand for property legal expertise to grow by +7%. By looking at the latest data and comparing it with historic data, our Index is predicting property law to grow by a further +7% in 2024.

One of the biggest drivers for this is the increase in the total annual number of dwellings completed in the UK, which rose by +9% from 174,930 in 2021 to 191,010 in 2022.

However, sales across England and Wales were down over the same period, and the total annual major commercial decisions and number granted is relatively on par with recent years.

Useful resources:

- Lease surrenders practice notes

- Turnover provisions and setting and obtaining metrics from the tenant

- Commercial Property Standard Enquiries—template replies to CPSEs

- Building Safety Act 2022—role and impact of the Building Safety Regulator

- Property key future developments tracker

Criminal law

Demand for criminal law expertise is predicted to decline in 2024 by -3%.

To gain a measure for demand across criminal law as a practice area, the GLP Index looked at criminal justice statistics, Crown Court trials, Civil Court figures and dozens of others.

The Index revealed that demand for criminal law is steadily decreasing over the years. In 2018 and 2019 it fell by -6% and -2% respectively, and in 2020 during the height of the pandemic, it feel sharply by -26%.

There was a growth in 2021, when demand increased by +8% compared to 2020, but this dipped by -2% in 2022 and -4% in 2023 as a whole.

One of our key sources of data came from the Ministry of Justice's Criminal Justice Statistics Quarterly. This data revealed that the number of defendants proceeded against, offenders convicted and offenders sentenced has decreased over time.

However, the latest figures show an increase in 2022. The number of defendants proceeded against in 2022 sat at 1.19m. This is relatively similar to figures seen in 2020 and 2021, which sat at 958k and 1.07m respectively. However, both 2018 and 2019 saw roughly 200,000 more defendants proceeded against than in recent years.

The data for offenders convicted and offenders sentenced tells a very similar story. In 2022, just over a million offenders were convicted across England and Wales, and a similar amount were sentenced.

Useful resources:

- Read guidance on commencing criminal proceeding

- Civil tax fraud investigations—Code of Practice 9

- Criminal act or omission practice notes

Immigration law

Steady growth is anticipated to continue for lawyers working in immigration. An increase of +7% is expected for 2024.

The years leading up to the pandemic were a tough few for immigration lawyers, and the pandemic only escalated these troubles.

During the lockdown period, the number of visa applications plummeted, and getting applications granted became a drawn-out process.

Since then, however, the practice area has been steadily rising. The latest GLP Index found demand for immigration law is predicted to grow by +7% in 2024 - continuing the same high growth trajectory seen in 2022 (+8%) and 2021 (+8%).

While the Index pulls into account a wide range of datapoints, this growth can be attributed to an increase in work and student visas alongside settlement and citizenship applications.

The overall 2022 figures show the total number of work visas issued has almost doubled when compared to 2021, rising from 239k to 423k. Student visas have also risen drastically, from 435k to 626k. Citizenship applications are up 6%, rising from 179k to 190k.

Overall, these trends have contributed to increasing the demand for immigration lawyers.

Useful resources:

- UK and EU cross-border law enforcement and criminal justice co-operation under the TCA

- Applying under the Scale-up route

- The EU Settlement Scheme—the eligibility requirements under Appendix EU

- Brexit legislation tracker

- Sponsoring a Skilled Worker

Private client law

After two years in the red, private client law is on the rise again, with predicted growth of +5%

Measuring demand for private client law meant looking at everything from trusts and estates, to charitable donations, to the taxes of non-domiciled individuals and dozens more.

The results revealed demand for private client legal expertise experienced a significant drop during the lockdown, falling -16%. In 2021, there was a strong increase in demand, at +17% but this soon dropped by -3% in 2022 and by -1% in 2023.

In 2024, demand is expected to pick up by +5% when compared to 2023's performance.

This increase in demand can be attributed to a range of factors. Most notably, the rise in the number of total reliefs for charities and donors, which grew from £5,420m to £5,960m. An increase in capital gains tax for non-domiciled taxpayers also played a part, which grew from £336m in 2021 to £526m in 2022.

In April 2017, HMRC introduced a policy to remove permanent non-domiciled status -this resulted in at least 10,100 individuals claiming deemed domiciled taxpayer status in the UK on their self assessment tax returns in 2021. HMRC estimate the amount of UK Income Tax, Capital Gains Tax and National Insurance contributions liable by those taxpayers was at least £3,414 million.

Useful resources:

- Non-domiciliaries and the remittance basis

- Non-resident individuals—overview

Tax law

Despite the economic environment, tax law is predicted to grow in demand in 2024, with an anticipated growth of +2%.

To measure the demand for tax law as a practice area, the GLP Index looked at a broad range of datapoints. This included everything from stamp duty taxes, to the number of taxpayers and registered traders, to structural and non-structural tax reliefs, to VAT receipts and dozens more.

According to the Index, demand for tax law fell by -12% in 2020 as a result of the pandemic, but has risen steadily since. Demand increased by +27% in 2021, +9% in 2022, and +4% in 2023.

The latest annual statistics on HMRC tax receipts show total taxes increased by 10% in 2022 to 2023 from the year before, jumping from £715.5bn to £786bn.

Head of LexisNexis tax guidance, Aredhel Johnson, says HMRC continues to crack-down on tax avoidance promoters.

"The February 2023 launch of two new HMRC Manuals, being the Litigation and Settlement Strategy Manual and the Alternative Dispute Resolution Manual, could suggest that HMRC is ready and willing to continue to litigate in order to recover what it considers to be unpaid taxes."

Johnson, who worked in Squire Patton Boggs's Tax Strategies & Benefits team before moving to LexisNexis, also pointed out that the government's £79m investment over the next five years, as announced in the Autumn Statement 2022, will enable HMRC to allocate additional staff to tackle more cases of serious tax fraud and address tax compliance risks among wealthy taxpayers. This investment is forecast to bring in £725m of additional tax revenues over the next five years.

"The continuous change in tax law, both through legislative changes (such as those enacted by Finance Act 2023 and Finance (No 2) Act 2023, as well as those proposed on Legislation Day in July 2023 to be included in Finance Bill 2024) and through case law, means there is always a constant need for legal tax advice," says Johnson.

"In particular, the numerous enacted and proposed R&D changes as well as the implementation of a multinational top-up tax in the UK from the end of 2023 will see an increased need for affected businesses to ensure they are fully compliant whilst structuring their affairs in a manner which takes full advantage of any tax reliefs."

Useful resources:

- Tax—case tracker

- Tax—types of distribution—dividends

- Key dates for tax lawyers: 2023 and beyond

- Tax issues and incentives arising from assignment and licensing of IP

- State aid law and corporate taxation

Our methodology

The GLP model seeks to measure legal services demand via two sets of data:

• Direct metrics – data that measures legal activity directly (i.e. number of residential property transactions completed – each of which directly correlates with legal activity)

• Indirect proxies – underlying data that measures the factors that drive demand for legal services (i.e. number of new housing starts – which do not necessarily directly drive legal activity itself, but are a good proxy for the health of the sector).

Our research team considered almost 300 different datapoints to reach a representative basket of 10-20 metrics which are accurate proxies for legal services demand in 12 key areas of practice.

Selected for their proximity to real legal work, the quality (accuracy, reliability and frequency of update) of data source and their forward-looking predictive power.

Every metric was then weighted using recommendations from LexisNexis legal experts – High/Medium/Low (or Null) for its relevance to different areas of the legal market.

Combined, this gives a weighted average growth rate for the practice area for each market segment. Different practice areas are summed in proportion to their size or importance within each market segment.

This is based on our best estimates driven by real data:

• # of practitioners by area of practice (Small and Mid Law, from LexisNexis research)

• # of partners by Practice Area (Large Law)

• LexisNexis product usage levels by Practice Area (Corporate)

The weighted average creates an overall estimate for legal services demand for each market sector. This has been indexed from the start of 2017 to show total growth over the past few years and provide a baseline to track COVID-19 impact.

Wanting to increase the productivity of your legal team?

A University of Manchester study found:

Lawyers using Lexis+ for legal research and guidance save...

Read more LexisNexis reports

Calling time on the billable hour

Read our new report investigating the future of the billable hour according to law firms and General Counsel.

The laws of organic growth

Wanting to grow your business without M&As? These top law firms have some interesting techniques.

Rise of the legal consultants

Why are a growing number of lawyers opting to becoming legal consultants? We investigate.