LexisNexis GLP Index: private client

Will demand for private client law grow, decline or simply stay the same in 2023?

The LexisNexis GLP Index pulls together the latest datapoints to provide some powerful predictions on the future of private client law.

Private client law in 2023

The post-lockdown economic boom seemed promising for lawyers working in the private client space.

There was renewed interest in new and exciting investment opportunities - both domestic and abroad.

But the current economic environment combined with political instability and various other factors have resulted in a culture of risk aversion.

The LexisNexis GLP Index - which looks at growth for legal practitioners across multiple practice areas - took an indepth look at these statistics and more to measure growth across private client law.

It revealed that, despite the post-lockdown boom, the practice area is projected to experience negative growth in 2023.

This report captures a handful of the many trends driving change across private client law.

Dylan Brown

Content Lead, LexisNexis

Overview of GLP findings

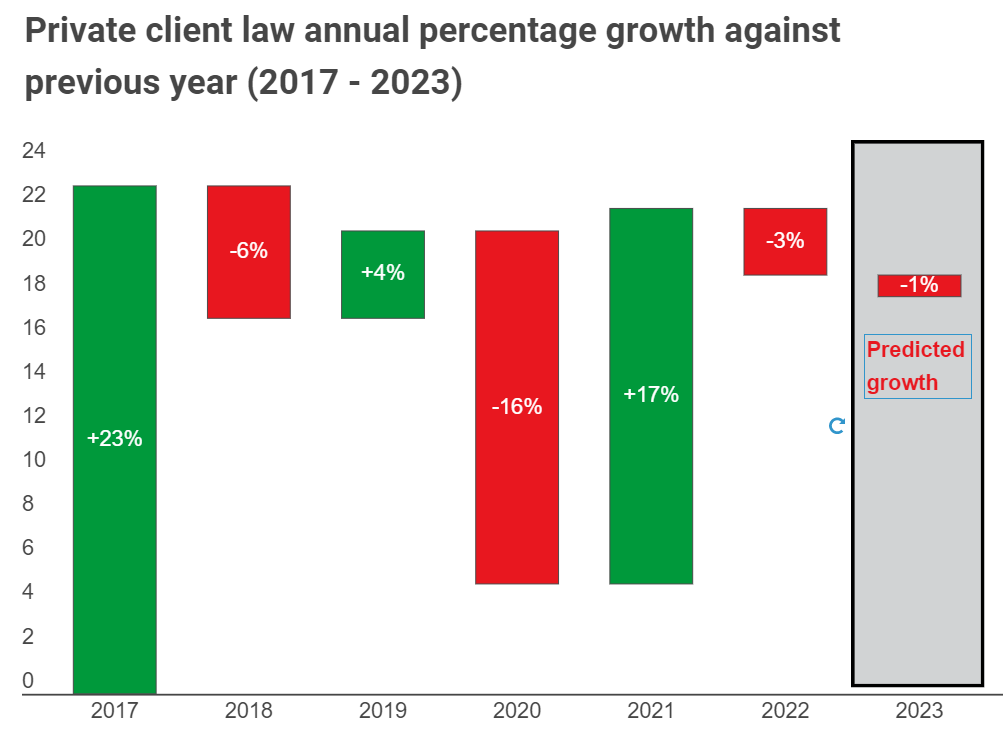

Despite a brief post-pandemic boom, private client law is predicted to decline in 2023.

That's according to the latest GLP Index, which pulls from hundreds of datapoints to predict demand for legal expertise across multiple practice areas.

To measure the demand for private client law as a practice area, the GLP Index looked at a broad range of datapoints. This included statistics regarding everything from trusts and estates, to charitable donations, to the taxes of non-domiciled individuals and dozens more.

The index revealed that demand for private client law dropped during the lockdown, at -16%. In 2021, there was a strong increase in demand, at +17% but this soon dropped by -3% in 2022 and is anticipated to decline by -1% in 2023.

Scroll down for a few of the most interesting trends driving change across private client law.

Private client law is predicted to generate -1% less work in 2023 than in 2022

Trusts

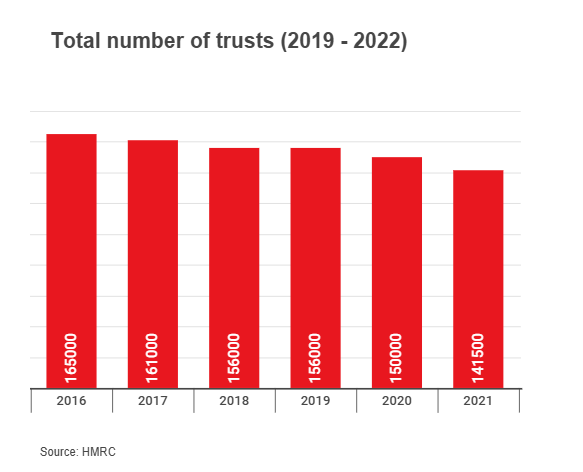

The total number of trusts in the UK is steadily declining.

When looking at the latest HMRC statistics, this trend is clear. The total number of trusts has declined by over 20,000 from 2016 through to 2021.

According to the Trust Registration Service (TRS), 198,000 trusts and estates had registered up to 31 March 2022. Around one-fifth of these trusts and estates were set up between 1 April 2021 and 31 March 2022 (38,000 new registrations) to meet the 1 September 2022 deadline for the registration of all UK express and non-express trusts.

The total income and chargeable gains of all trusts and estates was £6,510 million in 2021 (an increase of around 7% from the previous year).

The total Income Tax (IT) and Capital Gains Tax (CGT) payable on trusts and estates in the tax year ending 2021 was £1,455 million, increasing by around 5% from the previous tax year.

However, the number of Self Assessment (SA) returns has continued to decline, dropping 6% in 2021. This continues a long-term trend, with the total number of trusts and estates submitting SA returns reducing by 14% since the tax year ending 2016.

Non-domiciled taxpayers

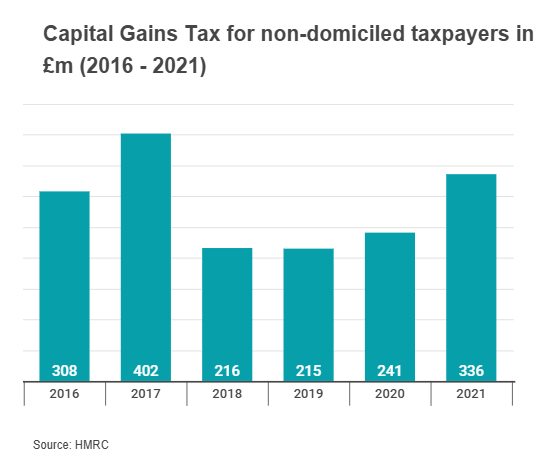

2021 statistics show there to be approximately 68,300 individuals claiming non-domiciled taxpayer status in the UK on their self-assessment tax returns, according to HMRC statistics. This was a drop from 76,500 the year prior.

These non-domiciled taxpayers were liable to pay £7,896 million in UK Income Tax, Capital Gains Tax (CGT) and National Insurance contributions (NICs).

Despite the drop in non-domiciled taxpayers, total tax and NICs liabilities stay roughly the same, at £7,878 million.

In April 2017, HMRC introduced a policy to remove permanent non-domiciled status -this resulted in at least 10,100 individuals claiming deemed domiciled taxpayer status in the UK on their self assessment tax returns in 2021. HMRC estimate the amount of UK Income Tax, Capital Gains Tax and National Insurance contributions liable by those taxpayers was at least £3,414 million.

Additional resources:

Non-domiciliaries and the remittance basis

Non-resident individuals—overview

Charity donations and tax reliefs

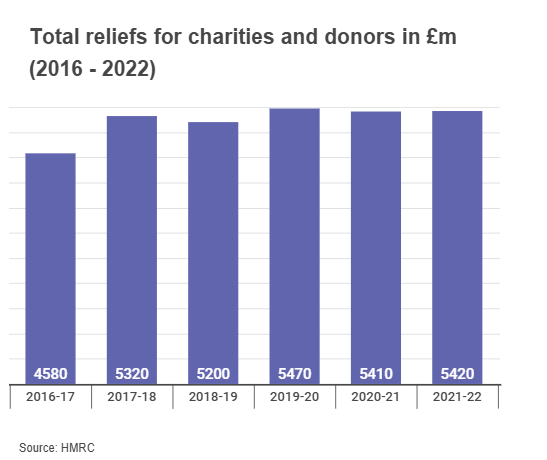

Another indicator of growth across the private client space is charitable donations.

For the 2022 tax year, tax reliefs for charities and donors sat at £5.4 billion - a 1% increase from the previous year. This is relatively on par with recent years.

Gift Aid was down 3% at £1.3 billion - a result of HMRC conducting extra risk assessments during March 2022 and will be attributed to the next financial year.

The HMRC also reported non-domestic rates (business rates) reliefs and Inheritance Tax reliefs for donations were down £2.4 billion (less than 1%) and £0.8 billion (down 4%) respectively.

The proportion of individuals declaring a donation via Self Assessment for 2021 is steady at 11% (although the number of donors has dropped 4%). Total donations declared by Self Assessment individuals for that tax year also fell, standing at £3.4 billion.

Wanting to increase the productivity of your legal team?

A University of Manchester study found:

Lawyers using Lexis+ for legal research and guidance save...