LexisNexis GLP Index: restructuring and insolvency law

Will demand for private restructuring and insolvency law grow, decline or simply stay the same in 2023?

The LexisNexis GLP Index pulls together the latest datapoints to provide some powerful predictions on the future of restructuring and insolvency law.

Restructuring and insolvency law in 2023

Work is picking up again for legal professionals working in the restructuring and insolvency space.

The government's various loan schemes which were introduced during the peak of the pandemic helped many companies and individuals stay afloat.

While this approach undoubtedly helped many, a growing number of companies and individuals are now going into the red.

The latest government figures show company insolvencies are higher now than before the pandemic - as are the number of individuals filing for bankruptcy.

The LexisNexis GLP Index - which looks at growth for legal practitioners across multiple practice areas - took an indepth look at these statistics and more to measure growth across restructuring and insolvency law.

It revealed that restructuring and insolvency law is projected to experience positive growth in 2023.

This report captures a handful of the many trends driving change across restructuring and insolvency law.

Dylan Brown

Content Lead, LexisNexis

Overview of GLP findings

As economic turmoil hits, restructuring and insolvency law is predicted to grow in 2023.

That's according to the latest GLP Index, which pulls from hundreds of datapoints to predict demand for legal expertise across multiple practice areas.

To measure the demand for restructuring and insolvency law as a practice area, the GLP Index looked at a broad range of datapoints. This included everything from company insolvencies, to compulsory liquidations, to director disqualifications, to individual bankruptcies and dozens more.

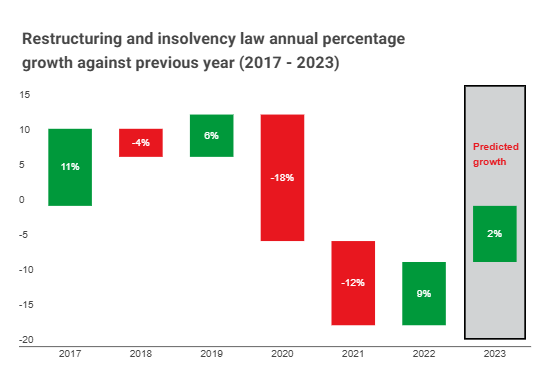

The index revealed that demand for restructuring and insolvency law plummeted during the lockdown. After falling -18% in 2020, and then again by -12% in 2021, the practice areas is expected to grow by +9% in 2022 and by +2% in 2023.

Scroll down for a few of the most interesting trends driving change across restructuring and insolvency law.

Restructuring and insolvency law is predicted to generate by 2% more work in 2023 than in 2022

Company insolvencies

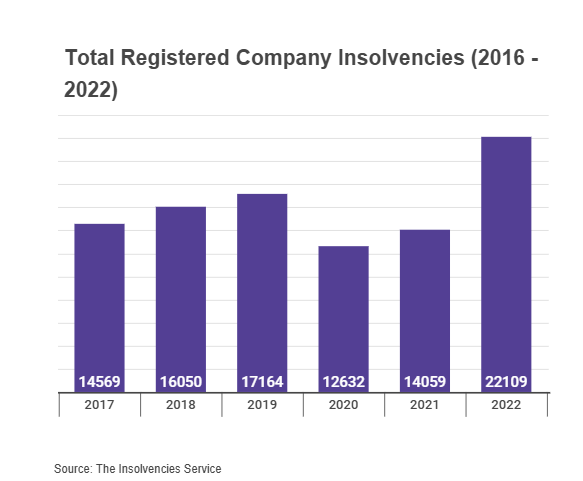

The total number of company insolvencies skyrocketed in 2022.

The total number of companies that registered insolvency in 2022 was 22,109, the highest number since 2009 and 57% higher than 2021's 14,059.

According to The Insolvencies Service, one in 202 active companies (at a rate of 49.5 per 10,000 active companies) went into insolvent liquidation in 2022 - an increase from the 32.9 per 10,000 active companies that entered liquidation in 2021, and was higher than the 41.9 per 10,000 in 2019.

This increase can be attributed to the highest annual number of Creditors’ Voluntary Liquidations (CVLs) since the start of the series in 1960, says The Insolvency Service.

Director disqualifications and the Bailout Loan Scheme

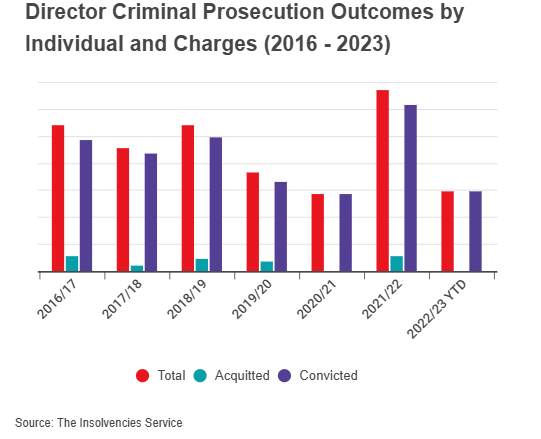

The number of directors being disqualified has dropped significantly since the pandemic, although the number of directors being prosecuted has shot up.

When looking at figures for 2021 it is clear that the number of directors being convicted jumped in 2021-22 - sitting 123. This is a considerable increase from 2020-21's 57.

This can most likely be attributed to the Government's Bailout Loan Scheme, which was introduced in March 2021 and allowed small businesses to borrow up to £50,000.

However, some directors have been accused and convicted of foul play when borrowing these sums.

Individual bankruptcies

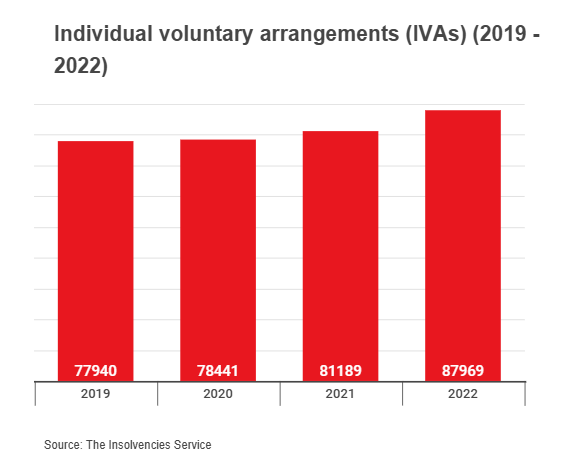

Another clear line of work for legal professionals working in the restructuring and insolvency space is work brought on as a result of individuals declaring bankruptcy.

In 2022, the number of individuals declaring individual voluntary arrangements (IVAs) has risen steadily in recent years - jumping by more than 10,000 individuals per year when comparing 2022 to 2019.

According to The Insolvencies Service, there were 7,233 IVAs registered per month on average in the three-month period ending December 2022 - a 9% increase from the three-month period ending December 2021 and 26% higher than the three-months ending December 2019.

Wanting to increase the productivity of your legal team?

A University of Manchester study found:

Lawyers using Lexis+ for legal research and guidance save...