Rise of the legal consultants

Scroll down to continue reading

A growing number of lawyers are leaving traditional firms in favour of self-employment under a revenue-share model.

We speak to lawyers and clients to uncover the benefits, and drawbacks, of this new way of working.

How Platform Businesses Are Changing The Way Lawyers Work

From flexible working to technology-driven practice, platform businesses are disrupting the industry.

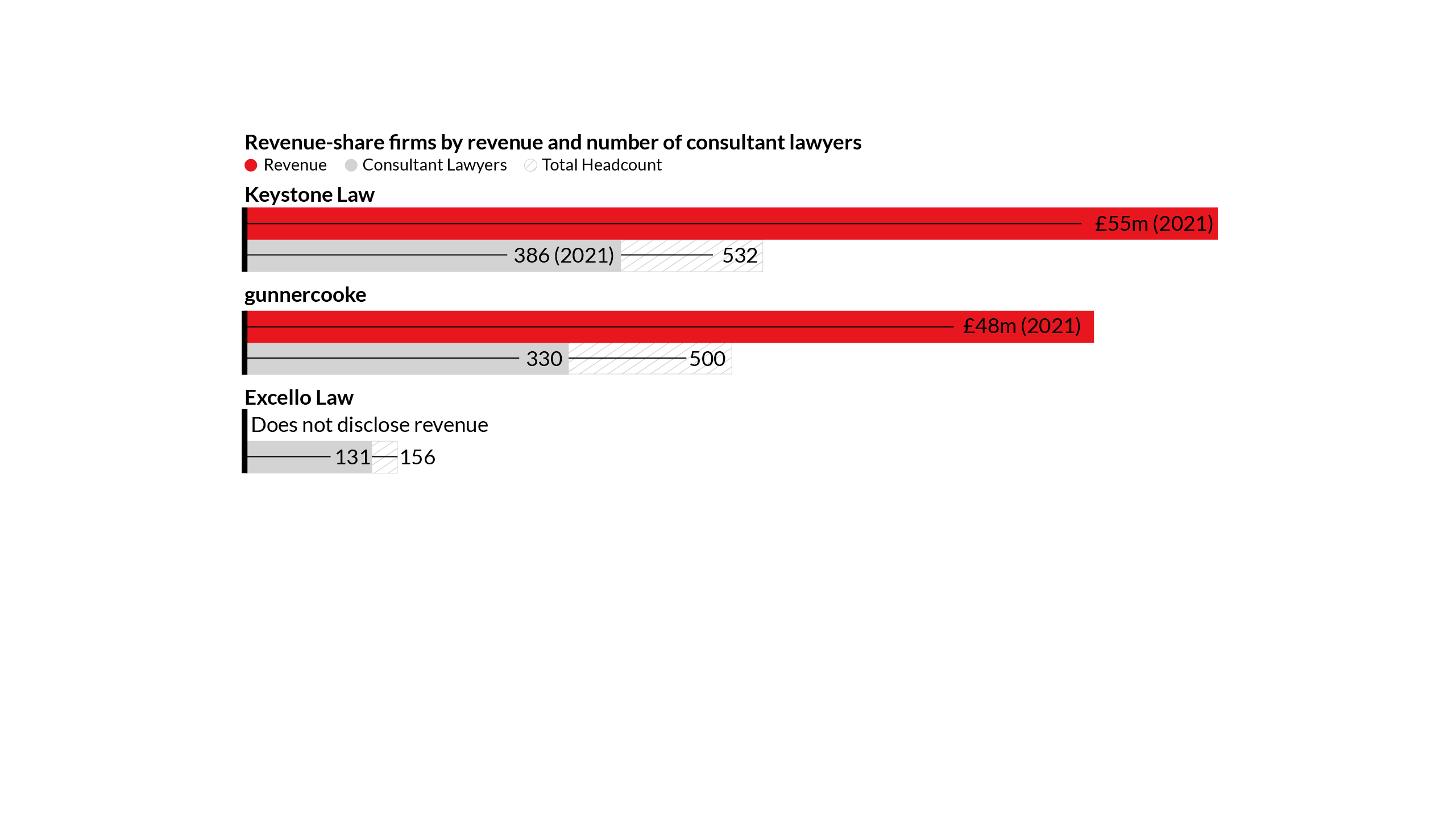

For centuries law firms have structured their businesses around the partnership model—where lawyers work their way up the ranks to eventually share in their firm’s profits. For many years that was the only way to practice as a solicitor, with those seeking an alternative career path having to move in-house to work within corporate legal departments. But the emergence of the platform business model is increasingly providing a range of alternatives for lawyers who don’t want to traverse that well-trodden route. That includes law firms launching standalone flexible resourcing businesses where lawyers are effectively hired on a job-by-job basis, either seconded with clients or supporting the firm in-house. It includes independent alternative legal services providers (ALSPs) offering on-demand lawyers. And it also includes revenue-sharing law firms where lawyers work as self-employed consultants and keep the bulk of client fees.

"It’s about work-life balance and taking control of your life."

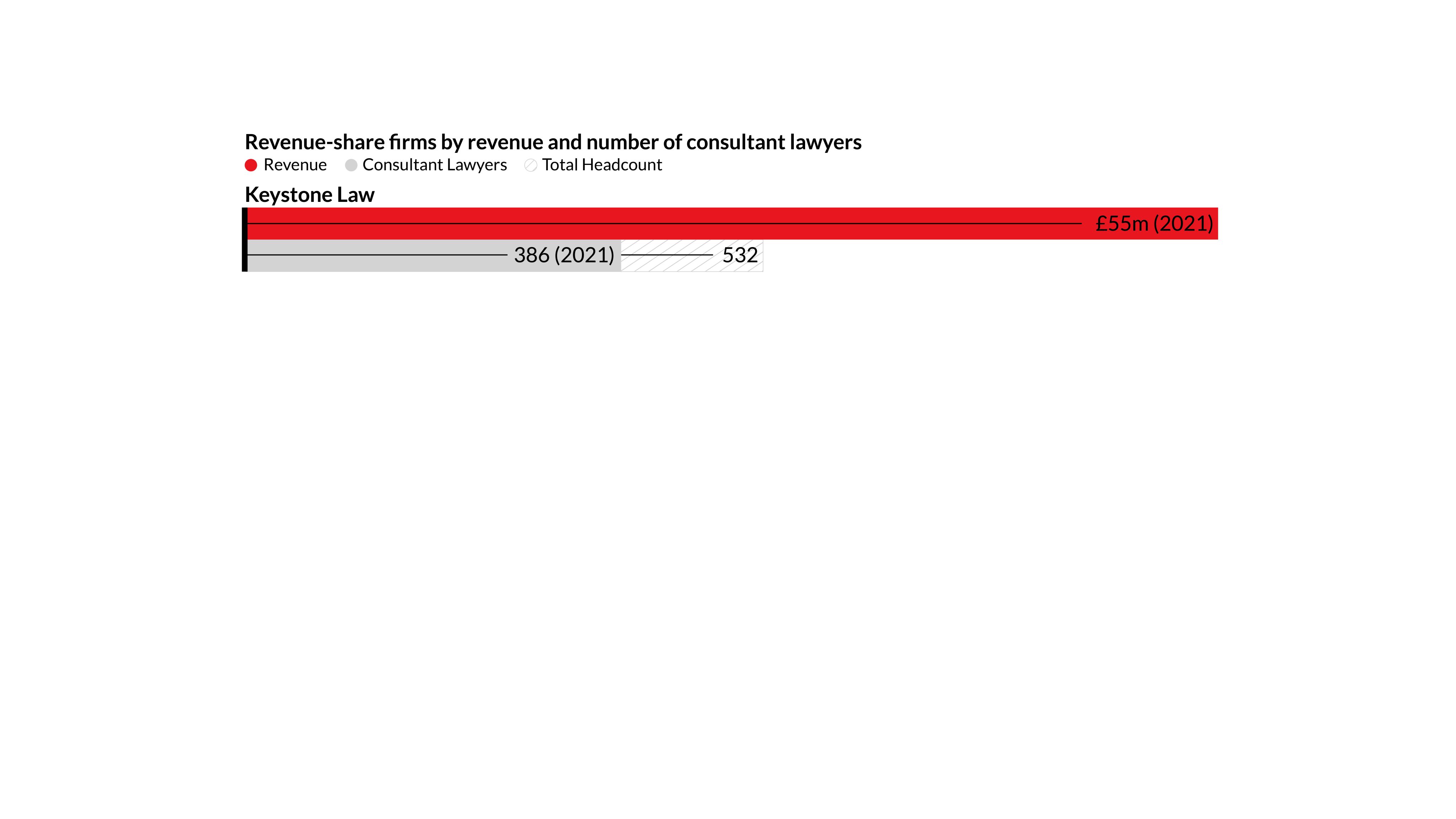

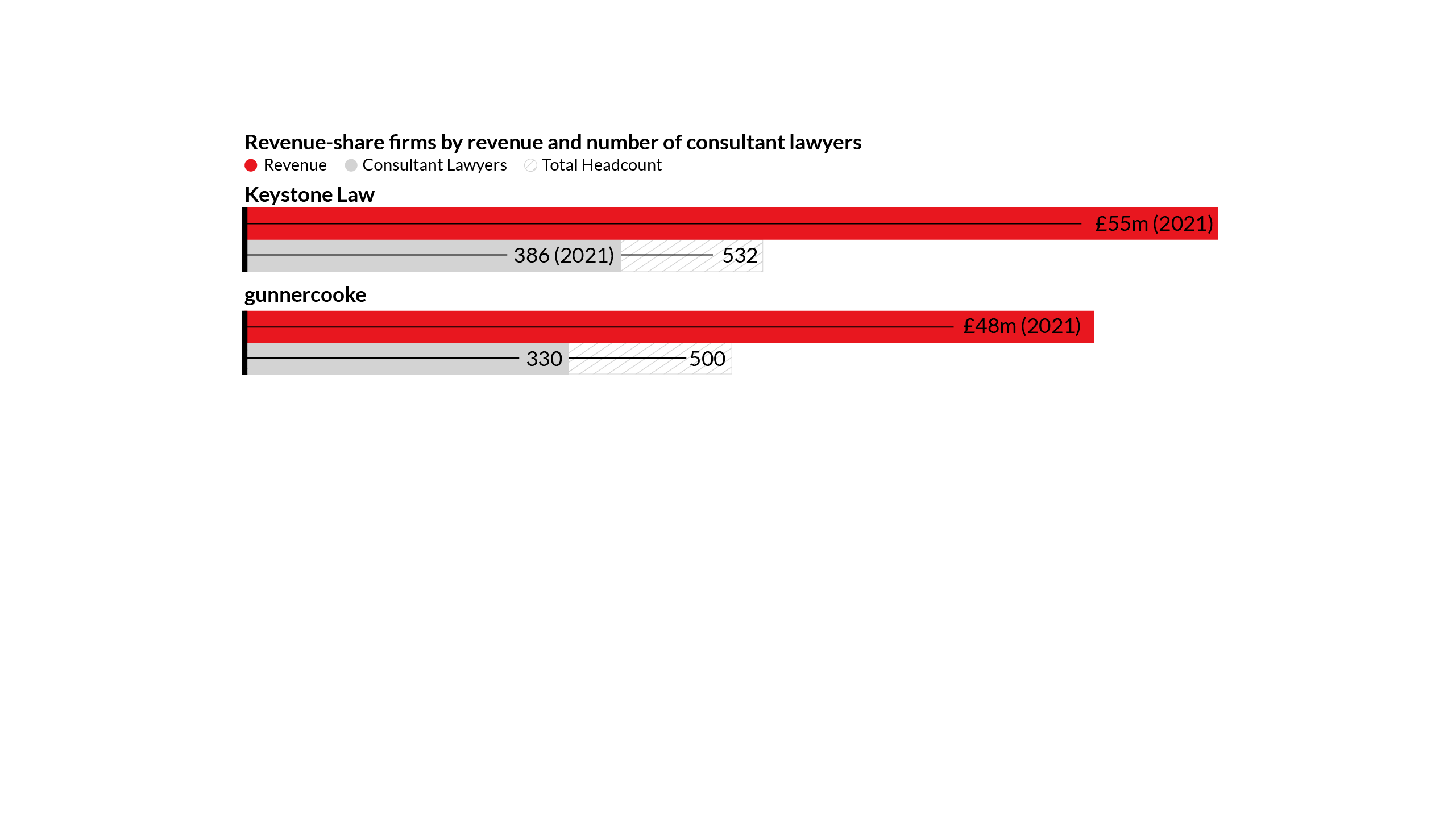

The latter type—first pioneered by Keystone Law in 2002—enables lawyers to operate their own independent practices under an umbrella brand and take home around 70% or more of their billings, with the rest paid into a central network for tech, insurance, admin and branding services. While these firms provide office space if lawyers want to use it, many typically work remotely. That freedom from not having to work in a central office might be an appeal to some, but there are other factors at play.

“Keystone is about a lot more than just remote working—it is a whole culture,” said James Knight, CEO at Keystone Law, which is a full-service law firm, covering everything from banking and finance to tax and technology, primarily operating in the midmarket legal services space. The firm hosts a line-up of high-profile clients including Nationwide, RBS and Virgin Atlantic. “It’s about the remuneration structure, it’s about the flat structure and the fact that everybody has the same deal and everybody has the same title, it’s about a lack of hierarchy—these are all things that people do really look for nowadays. It’s also about work-life balance and taking control of your life.”

Read our new report: Disloyal lawyers: has the partner track lost its lustre?

Some 60% of midlevel associates said they would consider moving jobs for a better work-life balance, while only 27% said they would leave for more money, according to American Lawyer’s 2021 Midlevel Associates survey. The consultancy model is well-suited to those wanting more control over their own workloads–but the caveat is that they are completely responsible for bringing in their own business.

“If they don’t want to work Fridays, they don’t work Fridays, if they want to take six weeks off in the summer, they take six weeks off in the summer.”

Aside from the remuneration structure, the only other key difference between this model and a traditional firm is the way lawyers are treated, says Darryl Cooke, Co-Founder and Executive Chairman at gunnercooke, whose expertise spans a range of corporate and commercial practice areas and works with clients including Santander and Hitachi Vantara.

“We’ve got 500 people now so we’re just like big law but without all the downsides,” he said. “We don’t have the bureaucracy, we don’t have the politics, we don’t have the remuneration battles, we don’t have the hourly billing targets, so we take away all the things that people don’t like about big law and give them total freedom. If they don’t want to work Fridays, they don’t work Fridays, if they want to take six weeks off in the summer, they take six weeks off in the summer.”

As well as the lifestyle benefits, the Covid-19 pandemic has also spurred sole practitioners to consider becoming consultants amid a rise in professional indemnity insurance (PII) premiums. PII premiums rose by an average of 27.3% in the spring of 2021, following another significant rise of 17.3% in 2020, according to a report by Lockton Solicitors.

For centuries law firms have structured their businesses around the partnership model—where lawyers work their way up the ranks to eventually share in their firm’s profits. For many years that was the only way to practice as a solicitor, with those seeking an alternative career path having to move in-house to work within corporate legal departments. But the emergence of the platform business model is increasingly providing a range of alternatives for lawyers who don’t want to traverse that well-trodden route. That includes law firms launching standalone flexible resourcing businesses where lawyers are effectively hired on a job-by-job basis, either seconded with clients or supporting the firm in-house. It includes independent alternative legal services providers (ALSPs) offering on-demand lawyers. And it also includes revenue-sharing law firms where lawyers work as self-employed consultants and keep the bulk of client fees.

"It’s about work-life balance and taking control of your life."

The latter type—first pioneered by Keystone Law in 2002—enables lawyers to operate their own independent practices under an umbrella brand and take home around 70% or more of their billings, with the rest paid into a central network for tech, insurance, admin and branding services. While these firms provide office space if lawyers want to use it, many typically work remotely. That freedom from not having to work in a central office might be an appeal to some, but there are other factors at play.

“Keystone is about a lot more than just remote working—it is a whole culture,” said James Knight, CEO at Keystone Law, which is a full-service law firm, covering everything from banking and finance to tax and technology, primarily operating in the midmarket legal services space. The firm hosts a line-up of high-profile clients including Nationwide, RBS and Virgin Atlantic. “It’s about the remuneration structure, it’s about the flat structure and the fact that everybody has the same deal and everybody has the same title, it’s about a lack of hierarchy—these are all things that people do really look for nowadays. It’s also about work-life balance and taking control of your life.”

Some 60% of midlevel associates said they would consider moving jobs for a better work-life balance, while only 27% said they would leave for more money, according to American Lawyer’s 2021 Midlevel Associates survey. The consultancy model is well-suited to those wanting more control over their own workloads–but the caveat is that they are completely responsible for bringing in their own business.

“If they don’t want to work Fridays, they don’t work Fridays, if they want to take six weeks off in the summer, they take six weeks off in the summer.”

Aside from the remuneration structure, the only other key difference between this model and a traditional firm is the way lawyers are treated, says Darryl Cooke, Co-Founder and Executive Chairman at gunnercooke, whose expertise spans a range of corporate and commercial practice areas and works with clients including Santander and Hitachi Vantara.

“We’ve got 500 people now so we’re just like big law but without all the downsides,” he said. “We don’t have the bureaucracy, we don’t have the politics, we don’t have the remuneration battles, we don’t have the hourly billing targets, so we take away all the things that people don’t like about big law and give them total freedom. If they don’t want to work Fridays, they don’t work Fridays, if they want to take six weeks off in the summer, they take six weeks off in the summer.”

As well as the lifestyle benefits, the Covid-19 pandemic has also spurred sole practitioners to consider becoming consultants amid a rise in professional indemnity insurance (PII) premiums. PII premiums rose by an average of 27.3% in the spring of 2021, following another significant rise of 17.3% in 2020, according to a report by Lockton Solicitors.

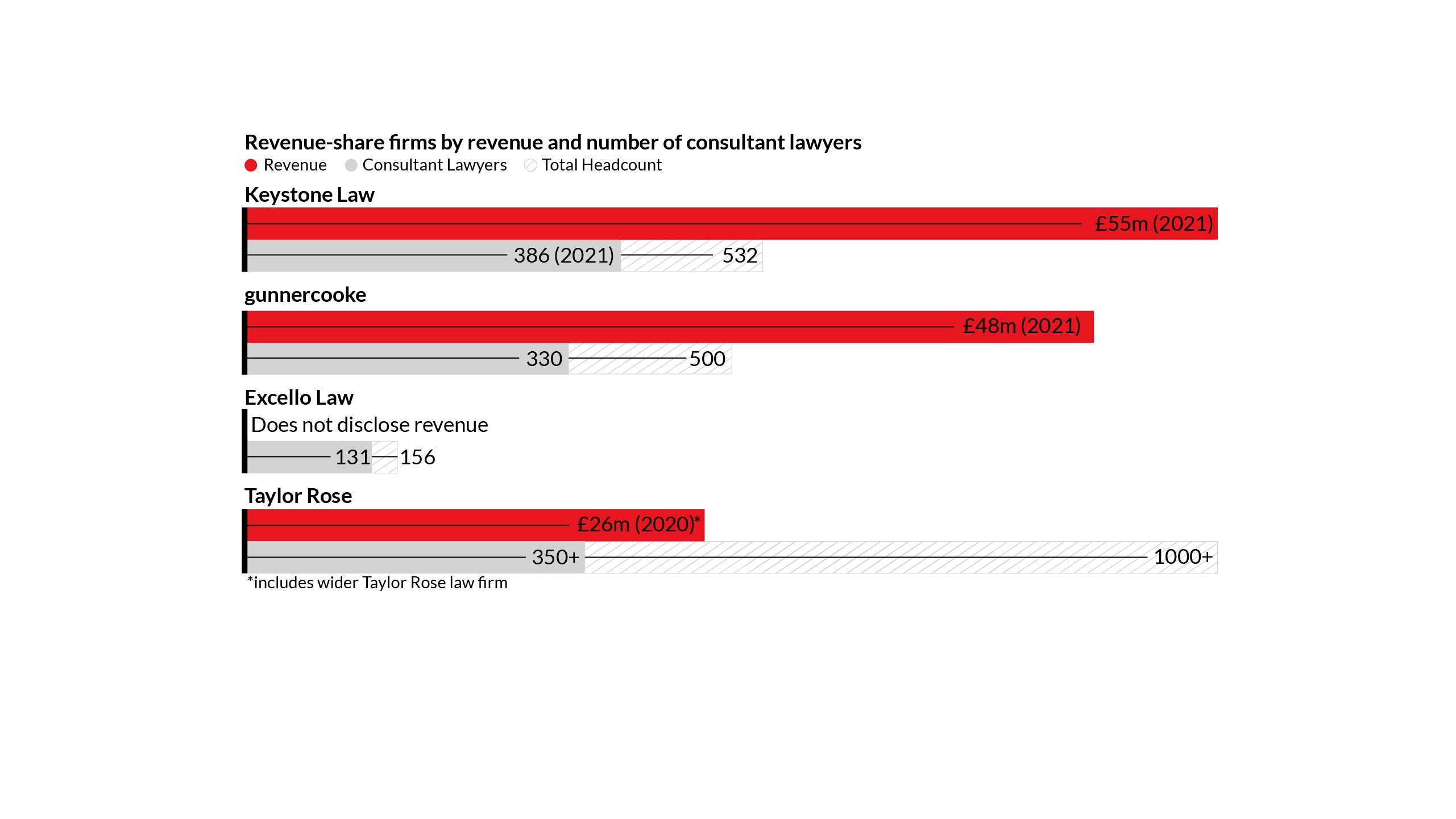

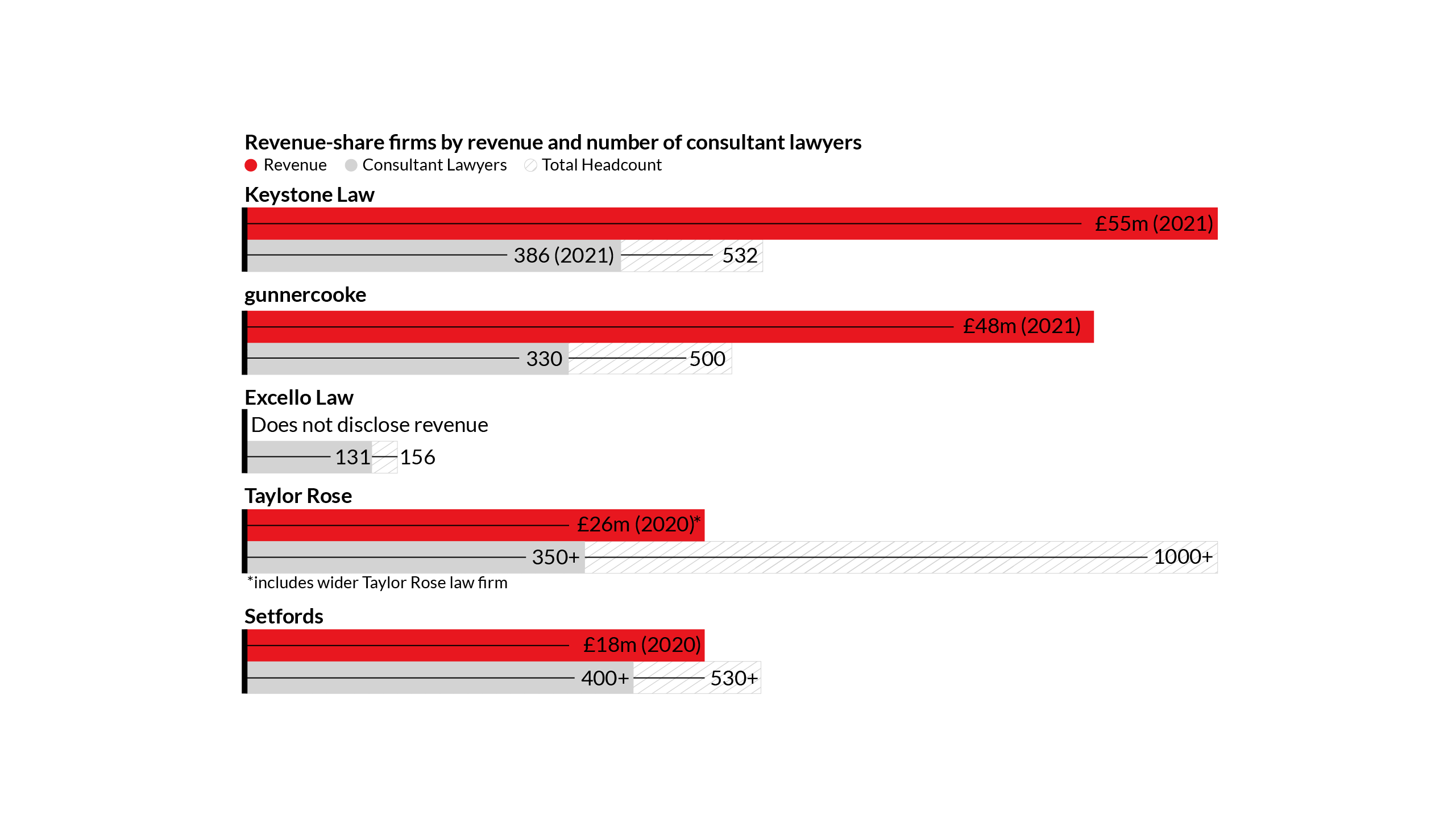

“Insurers are becoming more risk-averse in areas such as conveyancing and have been pushing up premiums to cover potentially high pay-outs,” said Adrian Jaggard, CEO of Taylor Rose, which operates a revenue-share platform for self-employed consultant lawyers alongside a traditional law firm where fee-earners are employed directly and paid a salary, with equity partners earning a share of the profits. “The number of solicitors working from home since Covid has also increased risk for insurers, particularly for those working in smaller firms without well-established risk, compliance and quality control processes. As a result, we are seeing a lot of experienced solicitors who no longer want the responsibilities of compliance and increasing operating costs.”

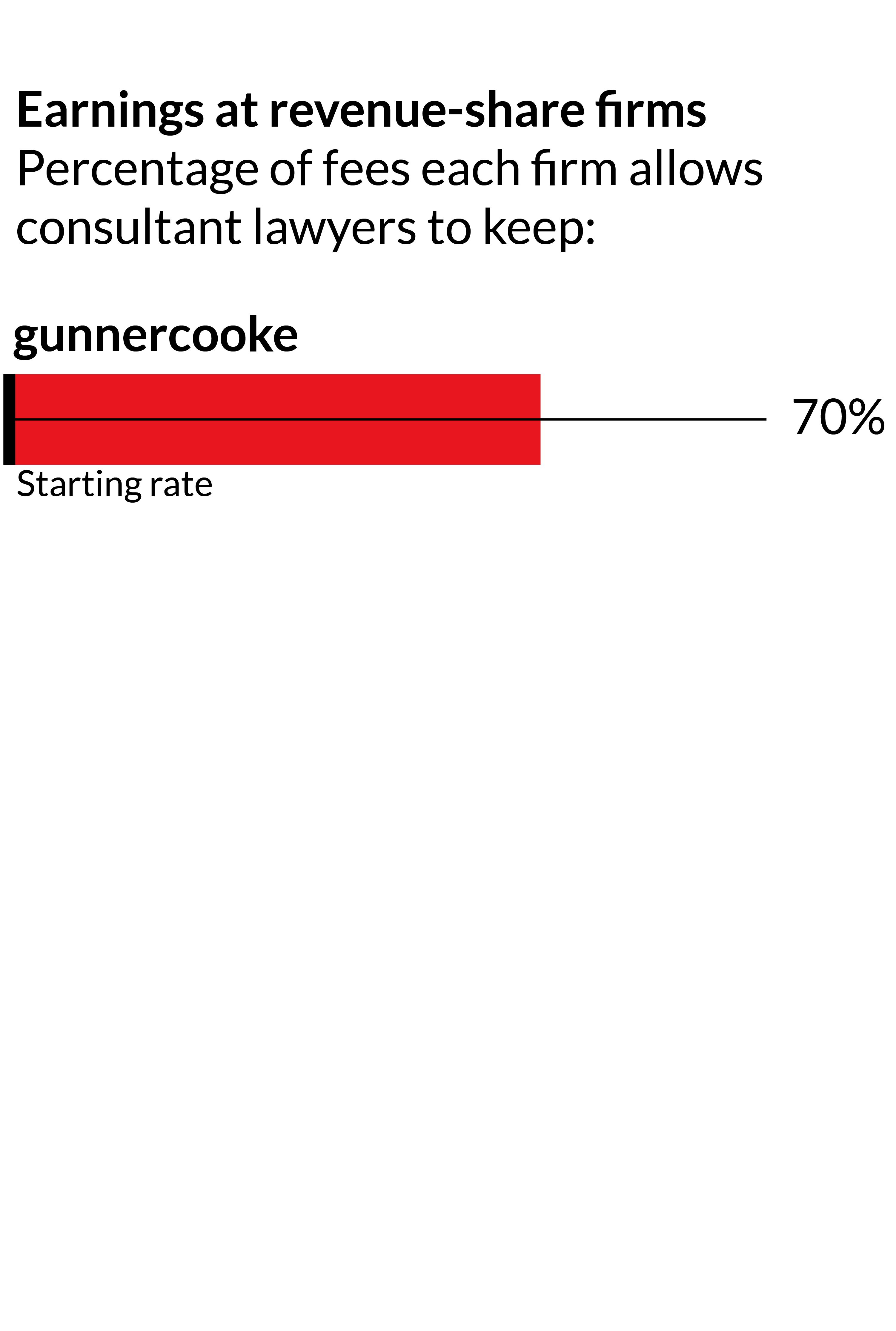

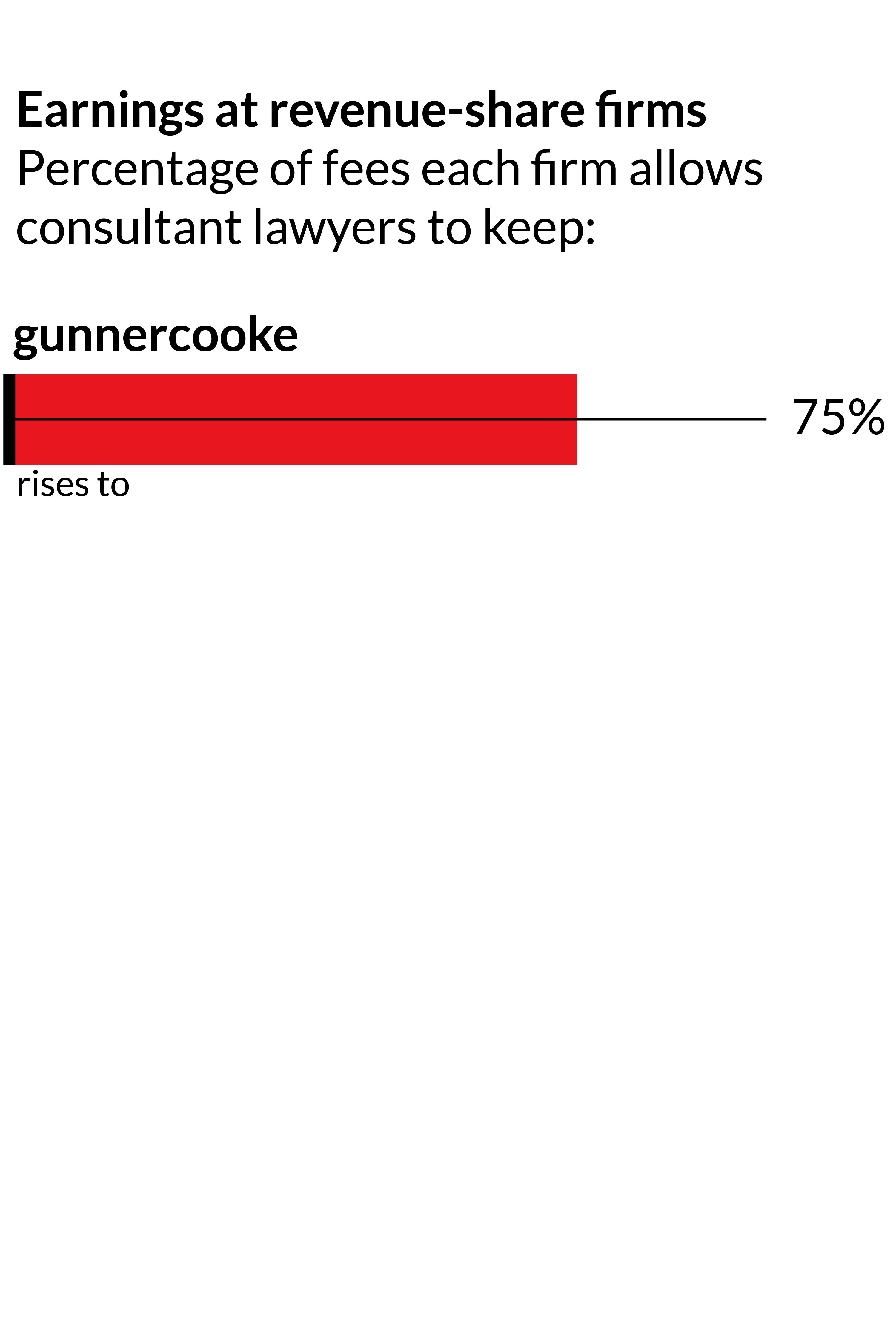

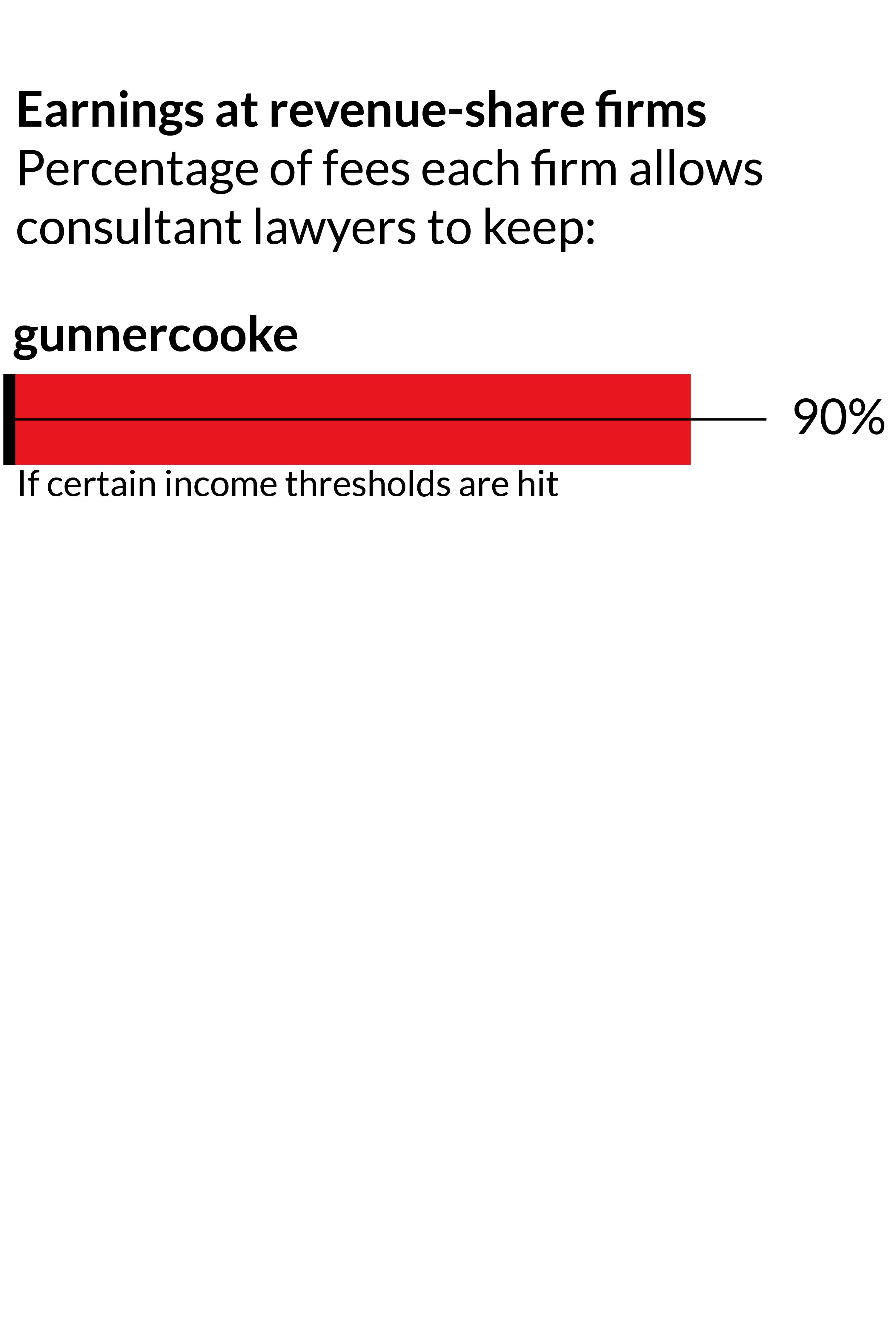

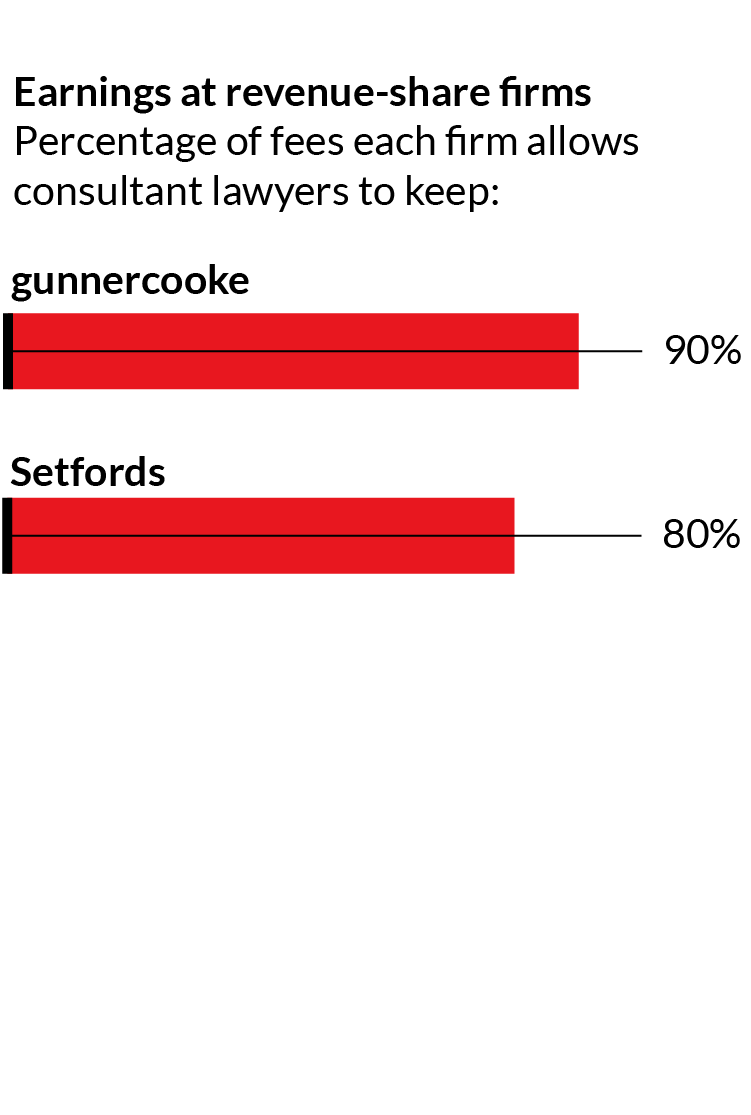

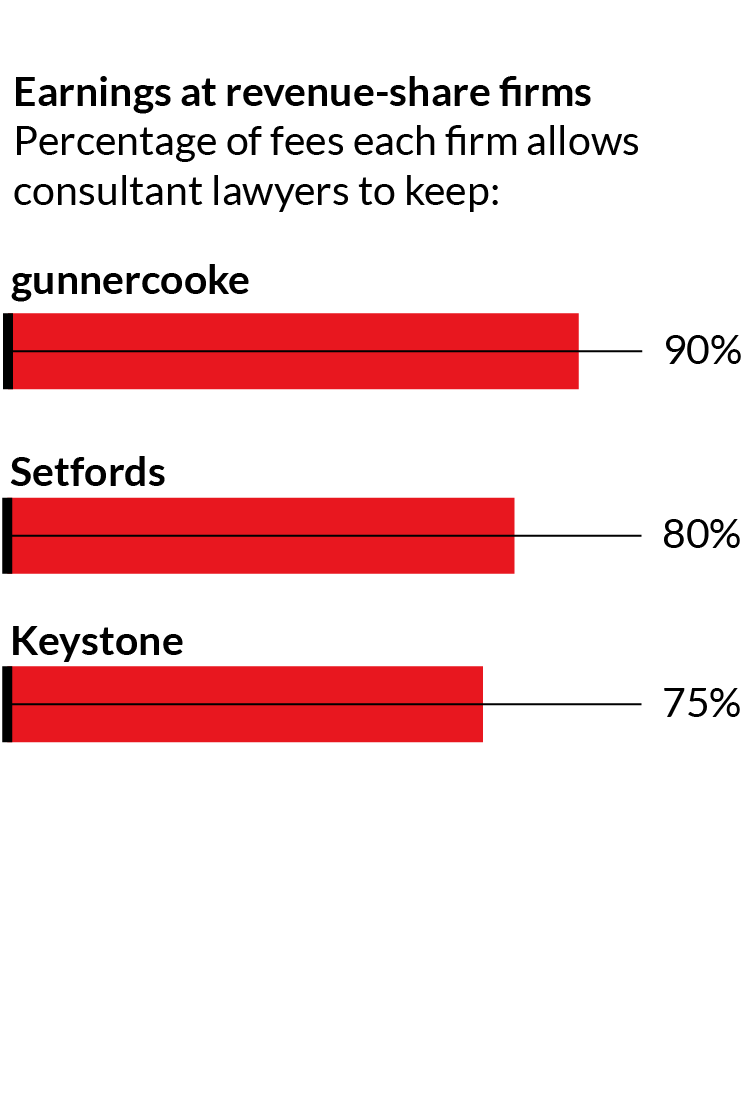

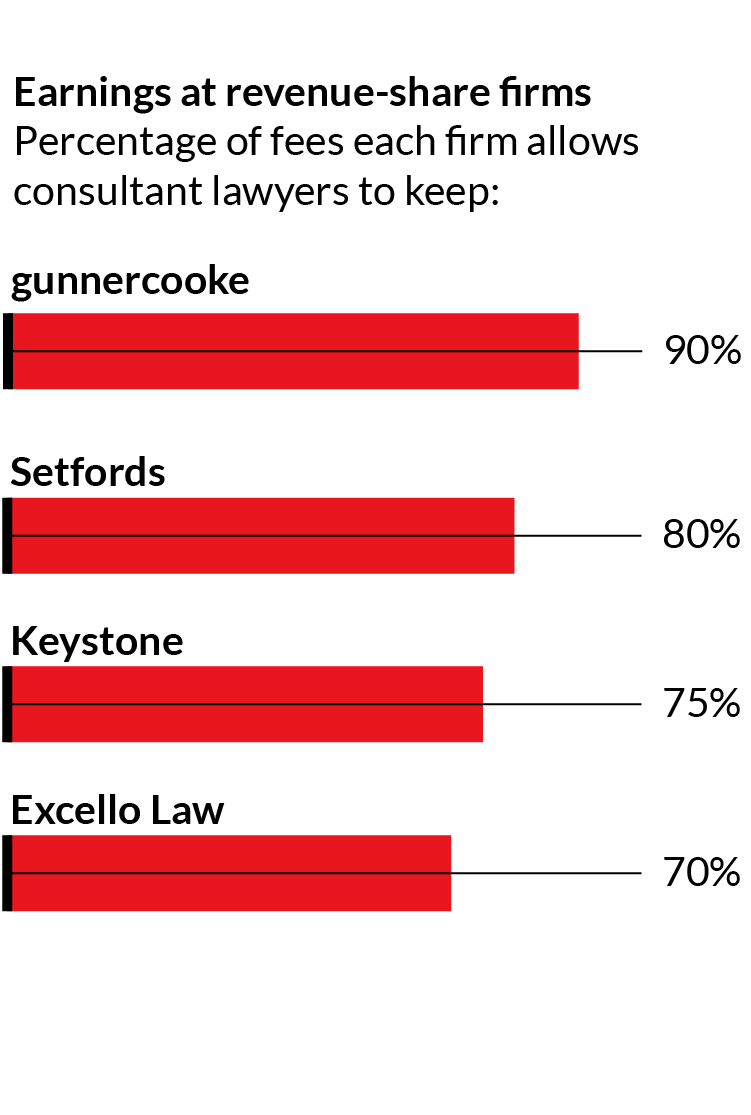

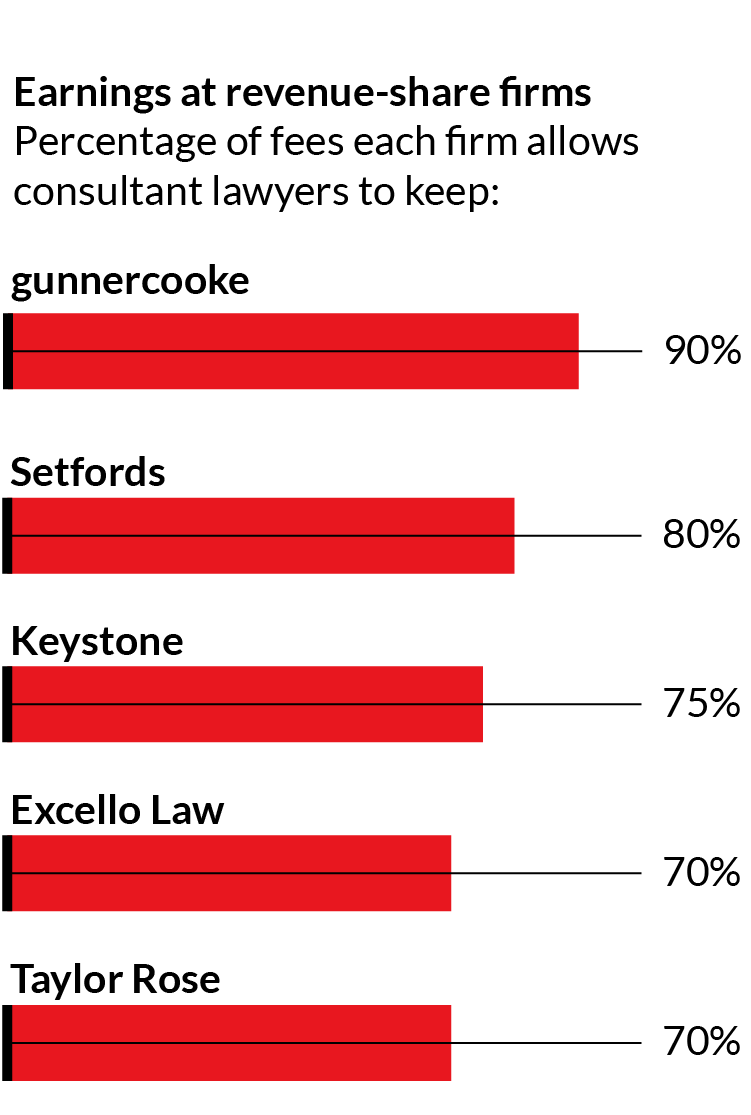

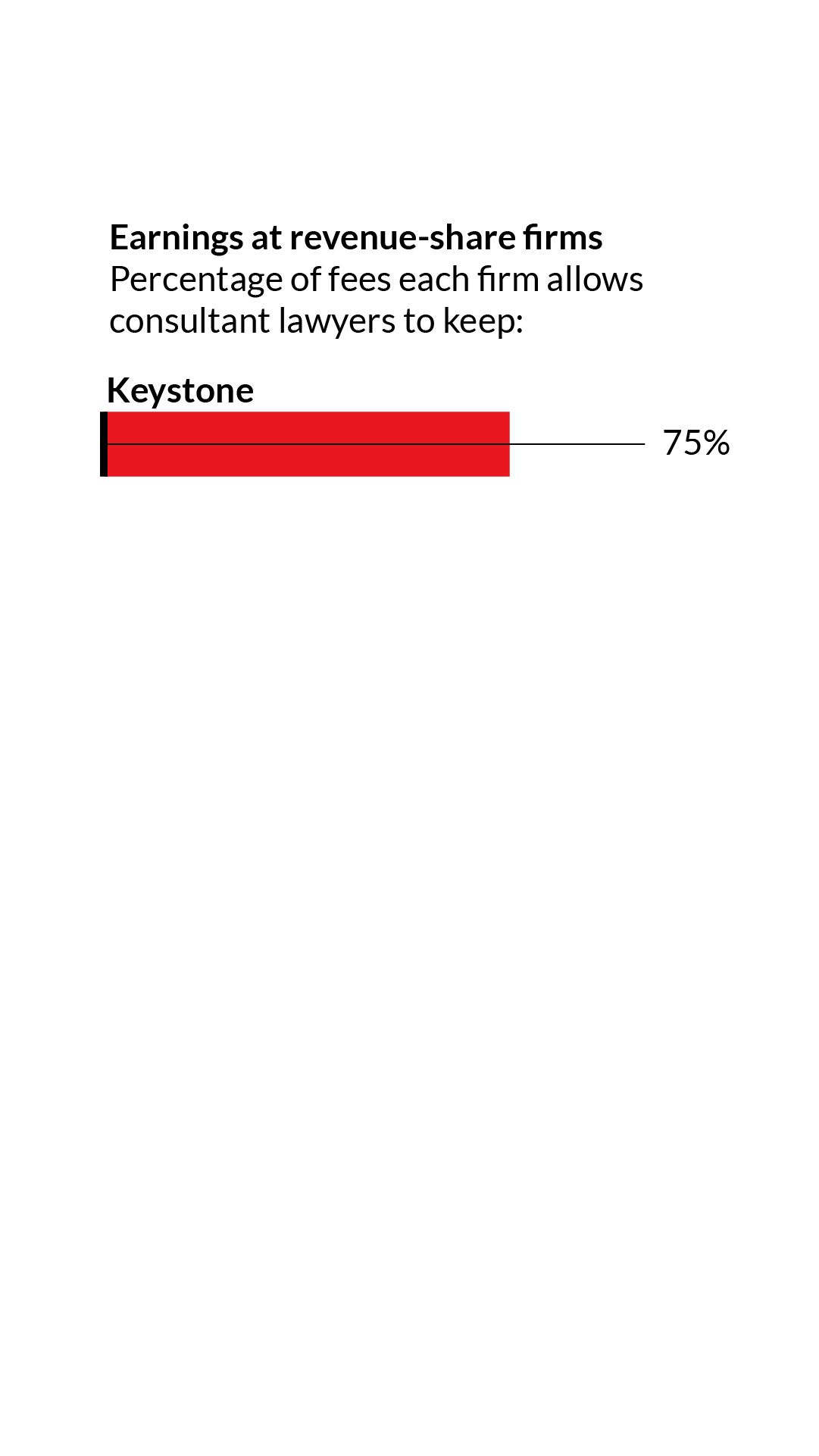

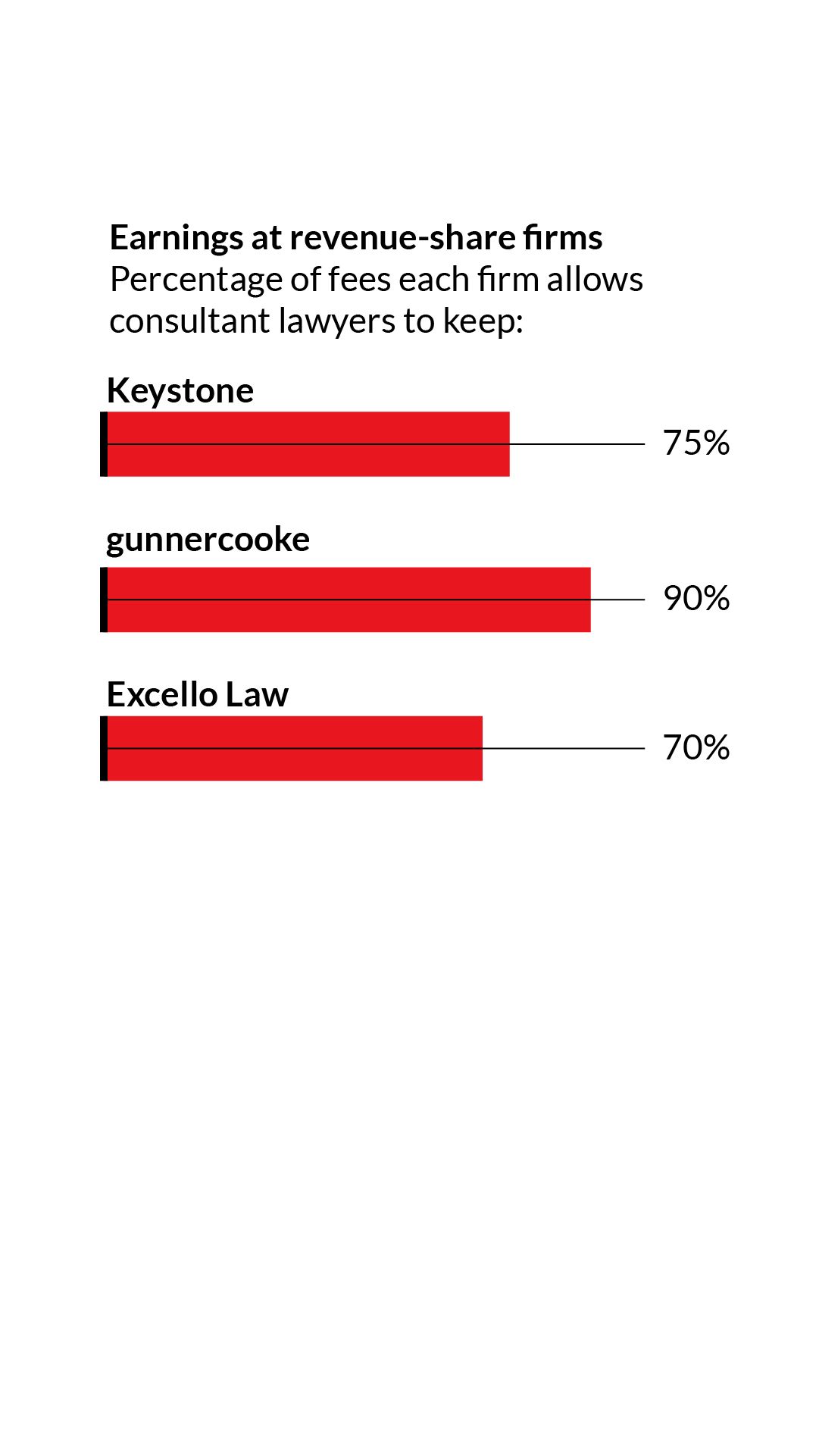

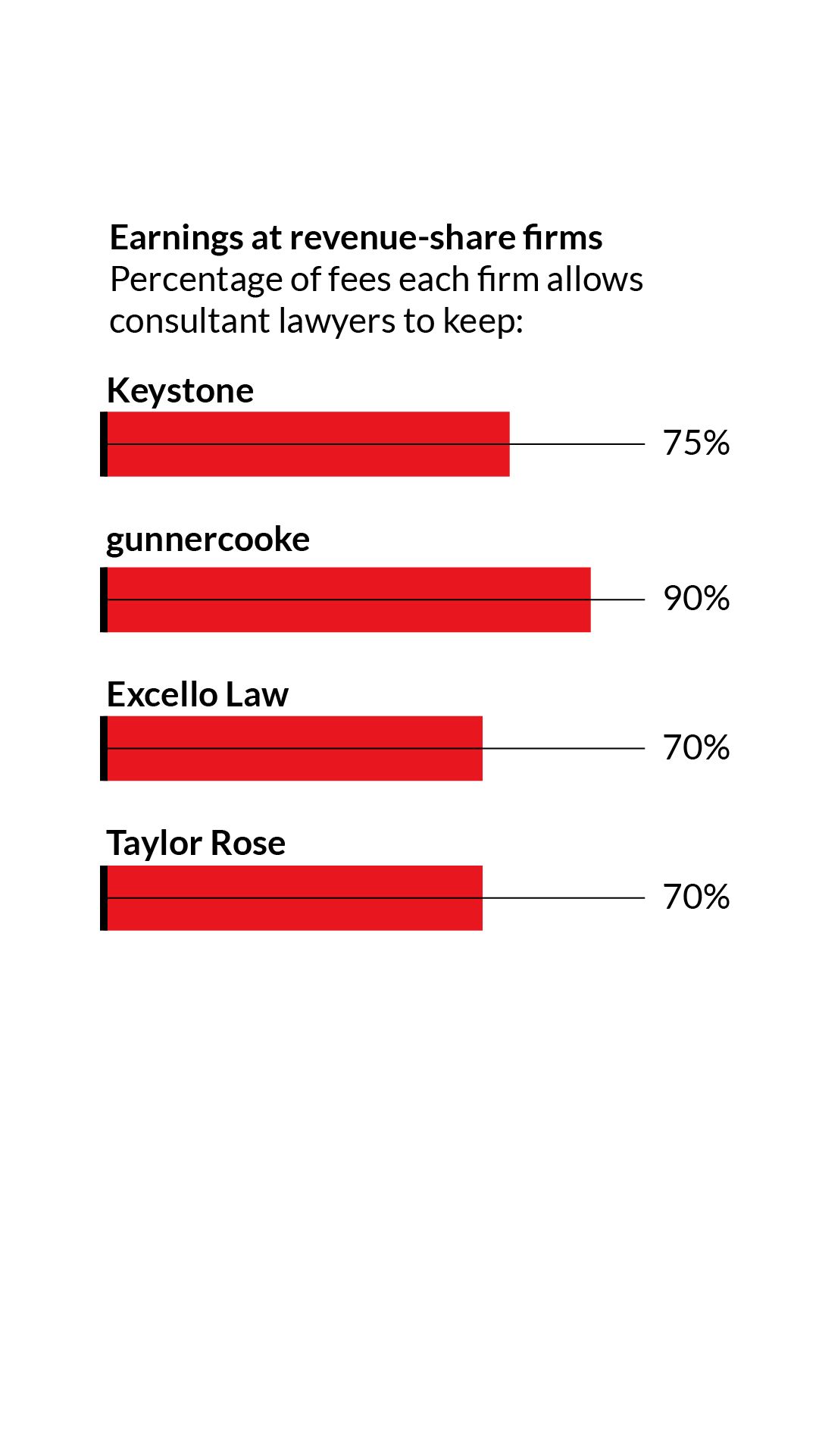

Most firms operating under the platform model offer similar terms on fees. Keystone, for example, allows its consultant solicitors to keep up to 75% of the fees. Gunnercooke, meantime, has a starting rate of 70% that rises to 75% and then 90% if certain revenue thresholds are hit. Excello Law also has a 70/30 split, while Taylor Rose’s consultants retain on average 70% of their billings, though the exact fee share varies according to their level of billing and also whether consultants work from home or use the firm’s offices.

Some firms also have referral programmes if consultants bring in work for other lawyers. Keystone pays them 15% of the overall fee, with 60% going to the consultant working on the matter and the firm retaining 25%.

“It’s a model that incentivises and drives the right behaviour, and it does mean that lawyers can earn considerably more than they used to,” said Knight.

Technology is also a critical part of running a dispersed firm so that lawyers can connect from wherever they are located.

“Without the benefit of technology we wouldn’t be able to do this,” said Joanne Losty, Recruitment Director at Excello Law, whose midmarket-focused practice areas span agriculture and estates to trade and investment. “Our focus is very much on providing supportive infrastructure for our team of consultant lawyers. We see them as a client base, so it’s key that we keep abreast of technological developments so we can continue to enhance and support and make life easier for them.”

That includes the sourcing and purchase of hardware, set up and ongoing service support where needed, as well as legaltech to enhance service delivery for clients, Losty says. Gunnercooke, meantime, is setting up a specialist legaltech office in Budapest to support its innovation efforts. Cooke says the firm is focused on ‘one-click technology’ to make the use of tech as simple as possible for its lawyers.

Covid-19 might also have increased the acceptance of the platform model among both lawyers and clients given that traditional firms have been forced to adopt remote working and rely far more on technology for service delivery.

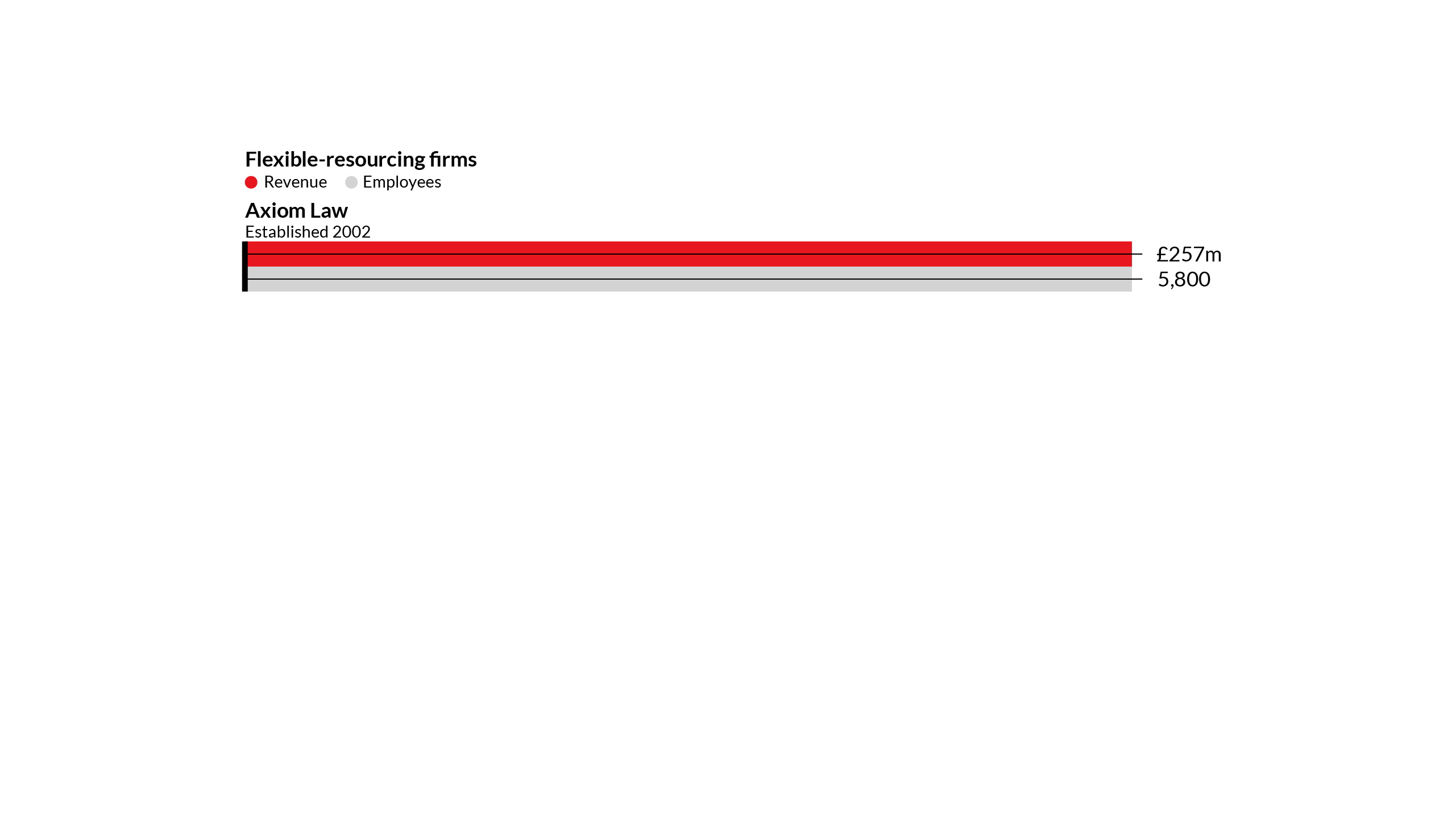

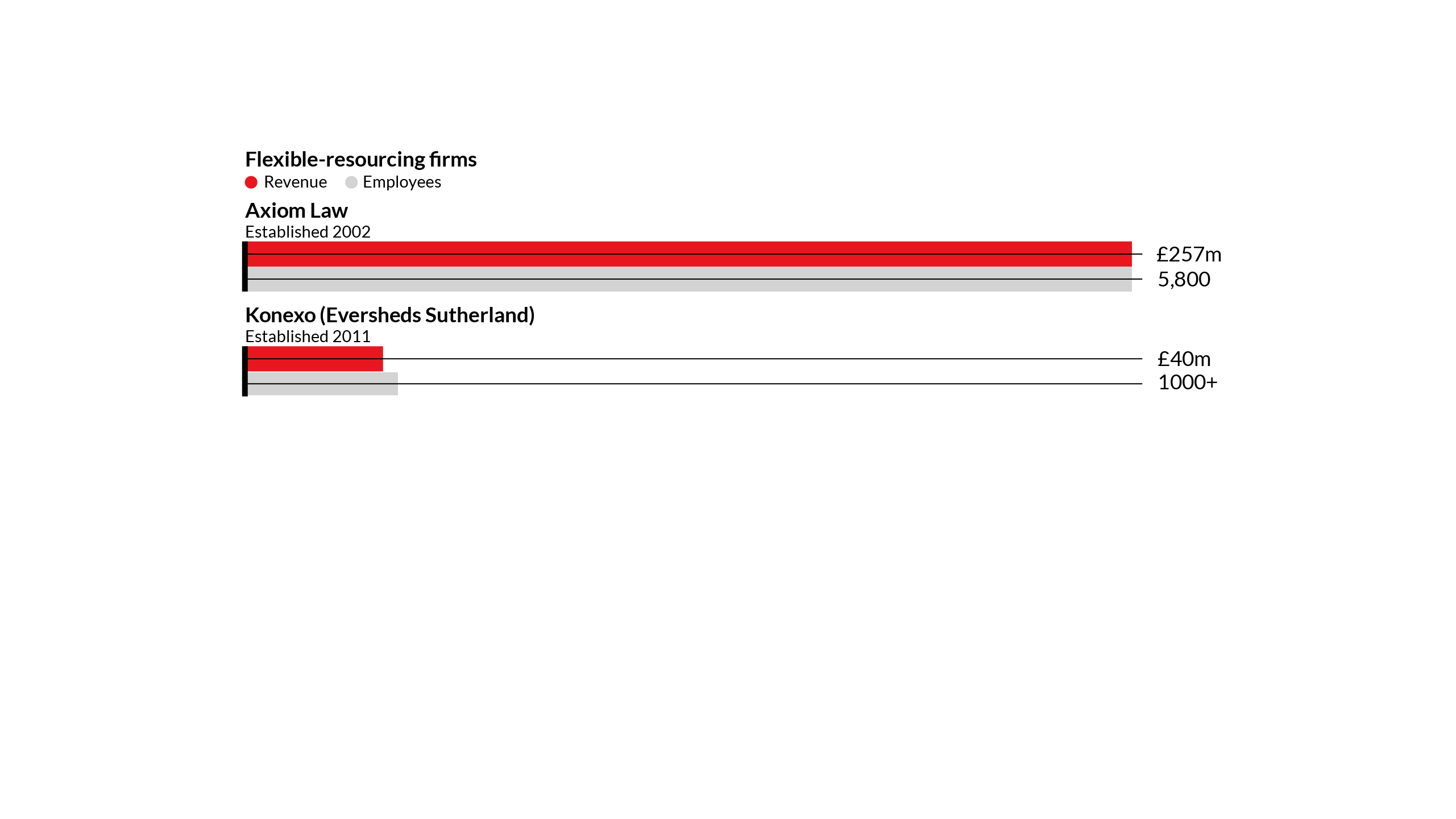

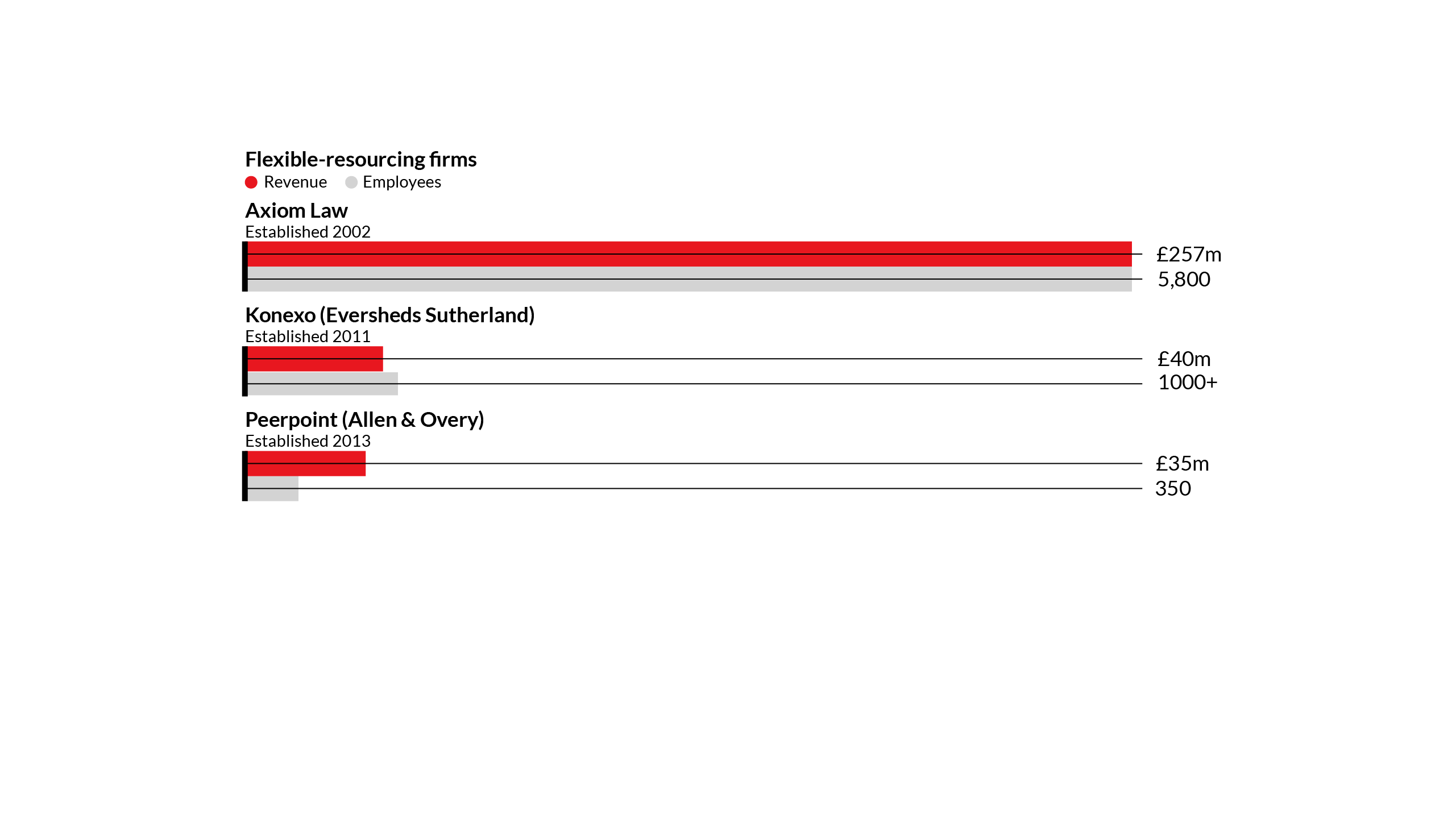

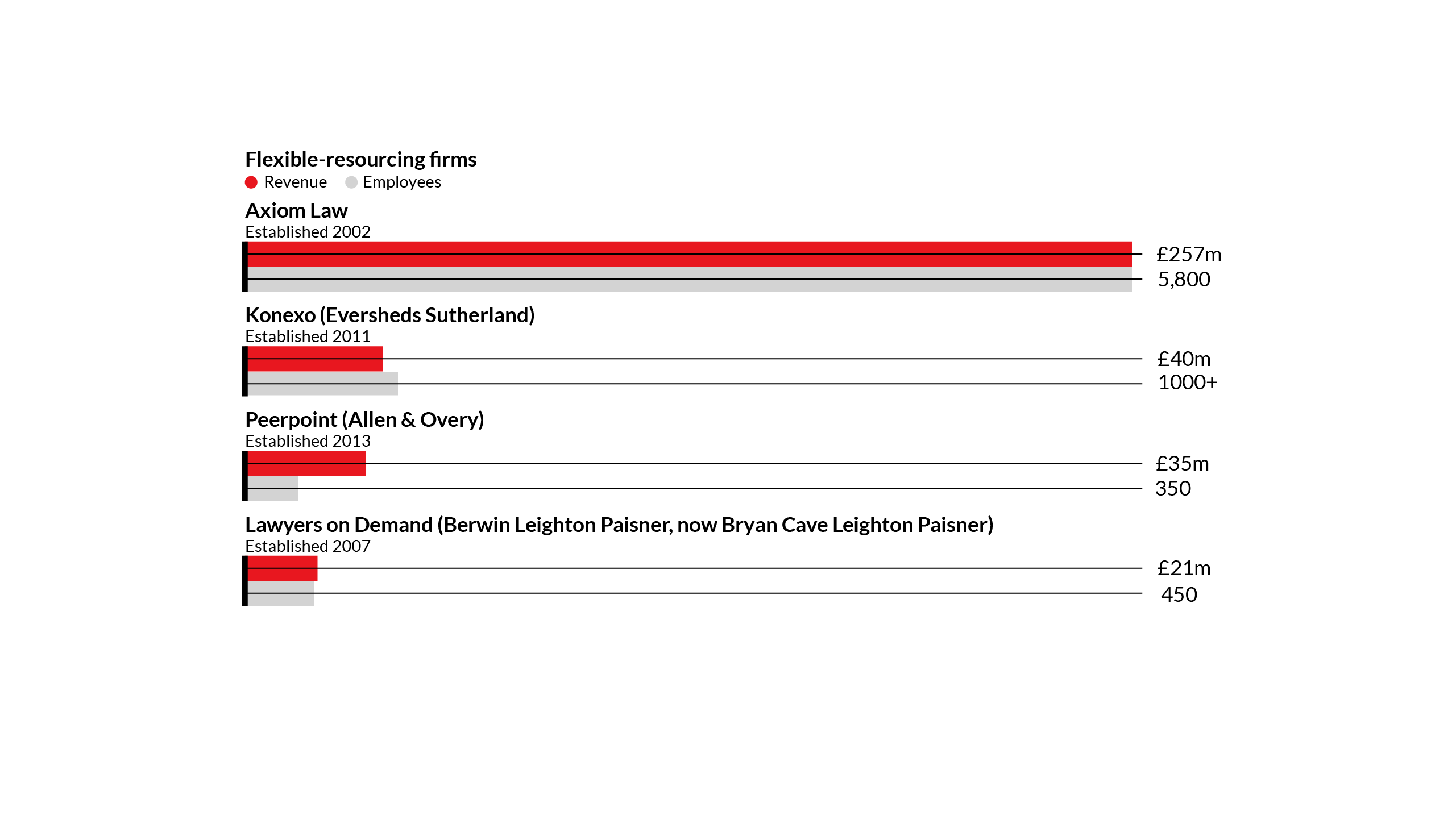

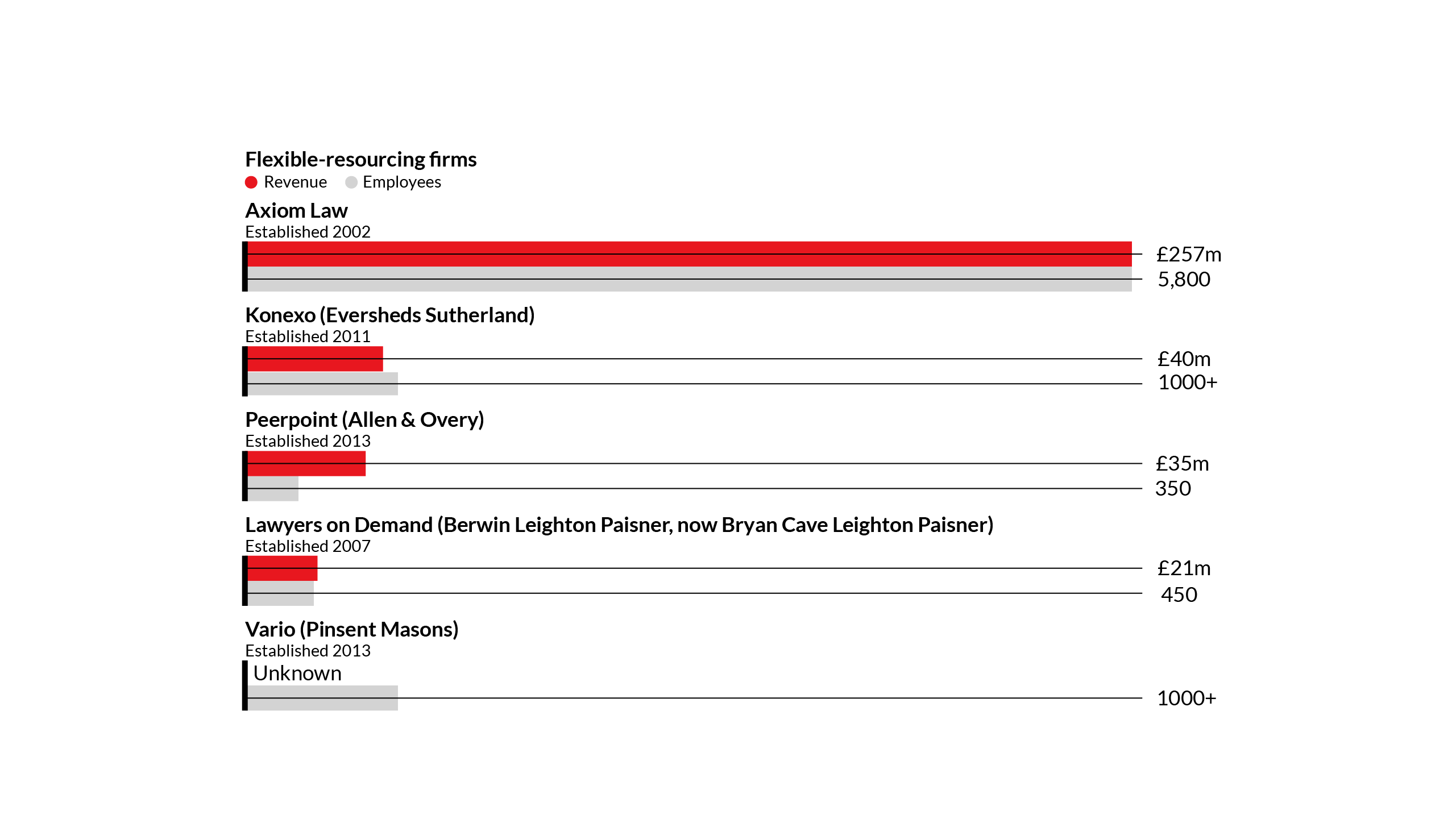

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

Source: Company info, media reports

“Insurers are becoming more risk-averse in areas such as conveyancing and have been pushing up premiums to cover potentially high pay-outs,” said Adrian Jaggard, CEO of Taylor Rose, which operates a revenue-share platform for self-employed consultant lawyers alongside a traditional law firm where fee-earners are employed directly and paid a salary, with equity partners earning a share of the profits. “The number of solicitors working from home since Covid has also increased risk for insurers, particularly for those working in smaller firms without well-established risk, compliance and quality control processes. As a result, we are seeing a lot of experienced solicitors who no longer want the responsibilities of compliance and increasing operating costs.”

Most firms operating under the platform model offer similar terms on fees. Keystone, for example, allows its consultant solicitors to keep up to 75% of the fees. Gunnercooke, meantime, has a starting rate of 70% that rises to 75% and then 90% if certain revenue thresholds are hit. Excello Law also has a 70/30 split, while Taylor Rose’s consultants retain on average 70% of their billings, though the exact fee share varies according to their level of billing and also whether consultants work from home or use the firm’s offices.

Some firms also have referral programmes if consultants bring in work for other lawyers. Keystone pays them 15% of the overall fee, with 60% going to the consultant working on the matter and the firm retaining 25%.

“It’s a model that incentivises and drives the right behaviour, and it does mean that lawyers can earn considerably more than they used to,” said Knight.

Technology is also a critical part of running a dispersed firm so that lawyers can connect from wherever they are located.

“Without the benefit of technology we wouldn’t be able to do this,” said Joanne Losty, Recruitment Director at Excello Law, whose midmarket-focused practice areas span agriculture and estates to trade and investment. “Our focus is very much on providing supportive infrastructure for our team of consultant lawyers. We see them as a client base, so it’s key that we keep abreast of technological developments so we can continue to enhance and support and make life easier for them.”

That includes the sourcing and purchase of hardware, set up and ongoing service support where needed, as well as legaltech to enhance service delivery for clients, Losty says. Gunnercooke, meantime, is setting up a specialist legaltech office in Budapest to support its innovation efforts. Cooke says the firm is focused on ‘one-click technology’ to make the use of tech as simple as possible for its lawyers.

Covid-19 might also have increased the acceptance of the platform model among both lawyers and clients given that traditional firms have been forced to adopt remote working and rely far more on technology for service delivery.

“Since the start of the pandemic there has been a wholesale shift in attitudes towards ways of working and processes, and those play into the distributed model,” said Christopher O’Connor, Director of Solutions at LexisNexis. “In the past when remote working wasn’t as accepted as it is now, there was a lot more friction to this type of model—both in terms of the supply of lawyers wanting to do it, and also on the client side. But people understand now that things are delivered in a different way and often can be delivered better or at least just as well.”

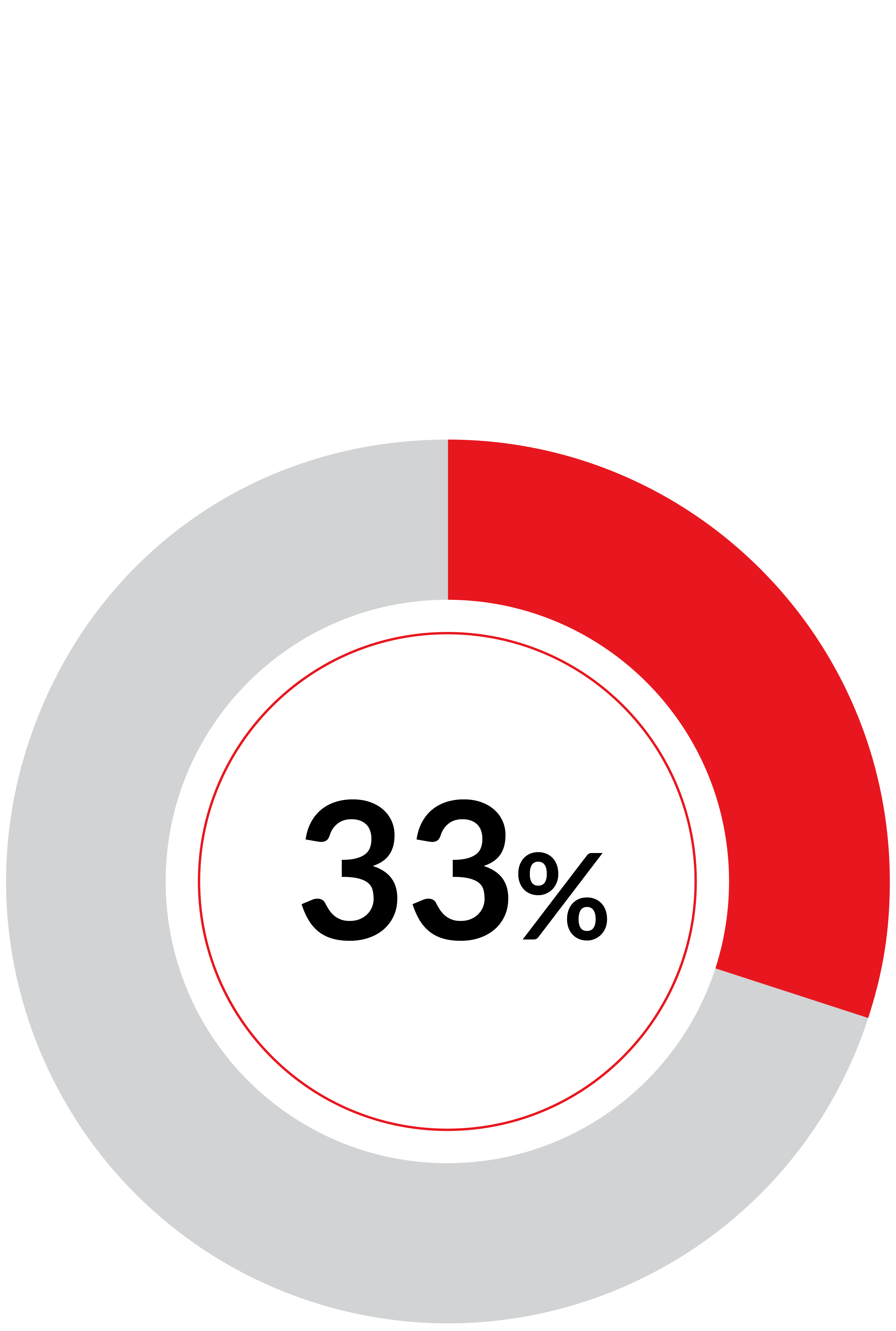

Some market watchers are bullish about the potential for the growth of the revenue-sharing model. A report by Arden Partners, a stockbroker, predicted that a third of all lawyers in the UK could be working under this model within the next five years. In part that is based on predictions that as many as 3,000 of the UK’s 10,000 law firms could be forced to close or merge over the next few years, with platform businesses more easily able to absorb teams of lawyers than traditional firms looking to scale through acquisition.

“How many lawyers are there who genuinely have the sort of following and the business development skills to feed themselves?”

Jaggard says Taylor Rose is currently adding between 15 and 20 new consultants every month, with its consultancy head count now above 350 lawyers. Gunnercooke is also expanding into other markets. It has recently opened in Berlin and is also in the process of opening a legal tech-focused unit in Budapest and offices in China and the US.

“In my view what will happen over the next five years is just like how the Magic Circle developed or the Big Four consultancy firms developed, there will be three or four law firms that will come out on top in the revenue-share model,” said Cooke.

Losty says Excello has also seen rapid growth recently, though the firm has been more cautious about who it takes on to avoid churn.

“Our team has grown 25% over the past 12 months (to around 130 self-employed consultants) and we’re seeing increased interest from teams and small firms and sole practitioners who are looking to transition their practices into firms like ours and then continue on as consultants,” she said. “Our approach has always been focused on quality lawyers, it’s not a stack-them-high approach, we want to make sure we get the right people into the firm so we’ve not got a revolving door of lawyers coming in, kicking the tyres and it not working for them.”

That is because while the flexibility might be appealing, the ability to grow and maintain a client base requires a different skill set than simply providing legal advice.

“There are no shortage of platforms but the challenge is how many lawyers are there who genuinely have the sort of following and the business development skills to feed themselves,” said Tony Williams, Founder of Jomati Consultants. “This model relies on a level of self-sufficiency. Fundamentally it’s a hunter-gatherer mentality. Clearly there are people who can do that but whether there are enough who can consistently do that, that will be a challenge.”

Family lawyer, Zoë Bloom, who worked at Keystone Law for 11 years before setting up her own firm, says lawyers shouldn’t join a revenue-sharing law firm under the impression that they will be referred work internally.

“You need to be self-sufficient – but it doesn’t take much to get there,” she says. “Keystone Law have a calculator which helps consultants assess the number of hours they need to work per week. If a solicitor cannot generate, bill and recover those hours of work each week to meet their outgoings, they might need to rethink their career choice!”

Another potential barrier for entry to the revenue-sharing model is not having a sufficient financial cushion to tide over newly self-employed lawyers while they attempt to drum up client work.

“As a consultant lawyer you are setting up your own business and if you don’t have the capital sitting behind you to cover yourself for the period of time when you’re not going to be earning much while you’re trying to build your reputation, that’s a barrier, and it’s also quite scary,” said James Harper, Senior General Counsel at LexisNexis.

That need to bring in client work also means the consultant model is more challenging for junior lawyers given they might not have developed enough contacts to support themselves.

“You need to be self-sufficient – but it doesn’t take much to get there.”

“For more junior lawyers it may depend on the maturity of the platform and the ability of others within the platform to generate work for juniors,” said Williams. That could be critical given that one perceived weakness of revenue-share platforms is that there are too many senior lawyers and not enough juniors to support them.

Some firms are attempting to address that issue by creating other employment opportunities for juniors. Keystone, for example, directly employs junior lawyers on a salaried model like a traditional law firm and makes those lawyers available to its consultants if they want to use them for individual matters. Keystone consultants also have the freedom to hire their own juniors and pay them out of their own pockets, for instance if their practice needs a full-time associate.

Likewise, gunnercooke consultants can directly employ juniors but the firm also has a specific programme for self-employed junior lawyers, providing them with a business coach, training and the opportunity to complete an executive MBA course.

“They still have to take a risk with us, but there’s a massive amount of work available if they market themselves internally, there’s always a lawyer who will need them,” said Cooke.

Yet it is not just juniors who might be unsuited as consultants at revenue-sharing firms, senior in-house lawyers may also struggle to generate enough work.

“I’m a General Counsel, I don’t worry about where my work is coming from, I don’t have to chase my clients—business development is not something I need to do,” said Harper. “Even junior lawyers coming out of private practice have some idea about business development. If you’re coming from in-house, while you’ve probably got contacts, you’re very out of practice to go and ask those contacts for money—that feels very uncomfortable.”

“If you’re coming from in-house, while you’ve probably got contacts, you’re very out of practice to go and ask those contacts for money - that feels very uncomfortable.”

Another challenge platform businesses face is being able to effectively collaborate across different practice areas or to handle more complex, cross-border work, such as M&A deals that may not just require cross-practice depth and expertise but also lawyers located in multiple jurisdictions—a level of reach revenue-share firms don’t yet have.

“You’re not going to get the continuity and collaboration that you get from a traditional law firm where these people work together on a day-to-day basis, and so for the large scale higher-end work there are limits to how much that model will grow,” said Mark Smith, Director of Strategic Markets at LexisNexis.

While such firms are not competing with Magic or Silver Circle firms, some top tier firms are also experimenting with a different type of platform model that can give lawyers more flexibility over how they work. Firms such as Allen & Overy, Eversheds Sutherland and Linklaters all have flexible resourcing units that provide freelance lawyers to clients on a project basis, with those lawyers typically paid on a day rate.

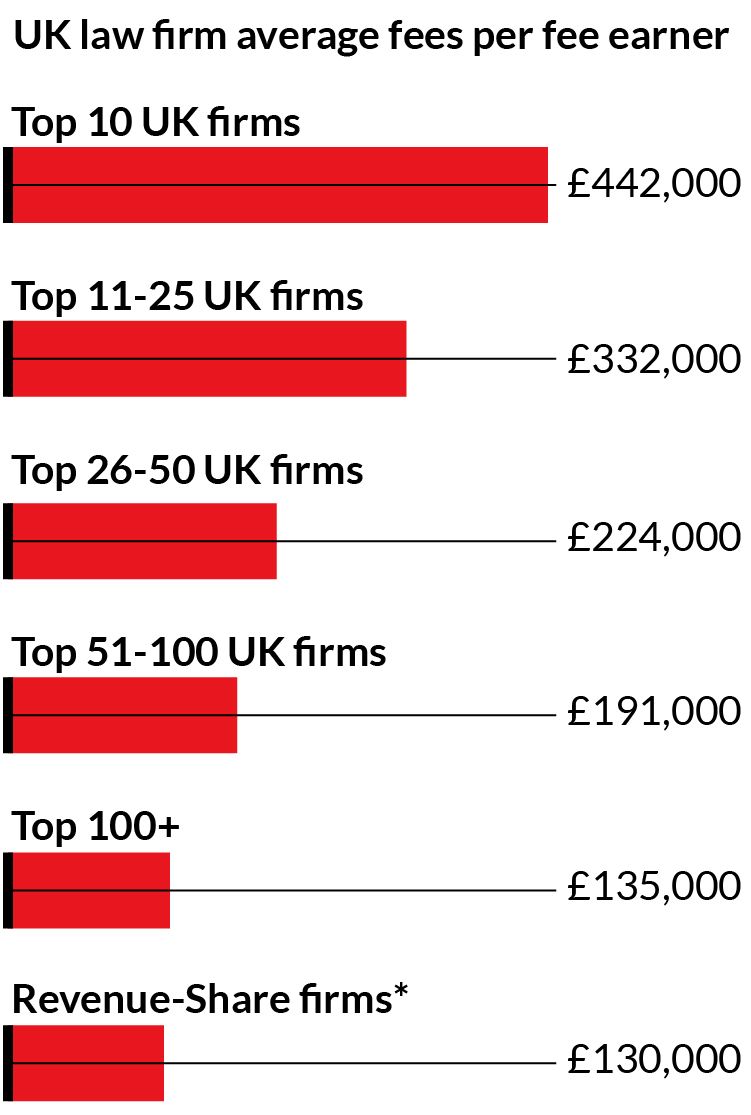

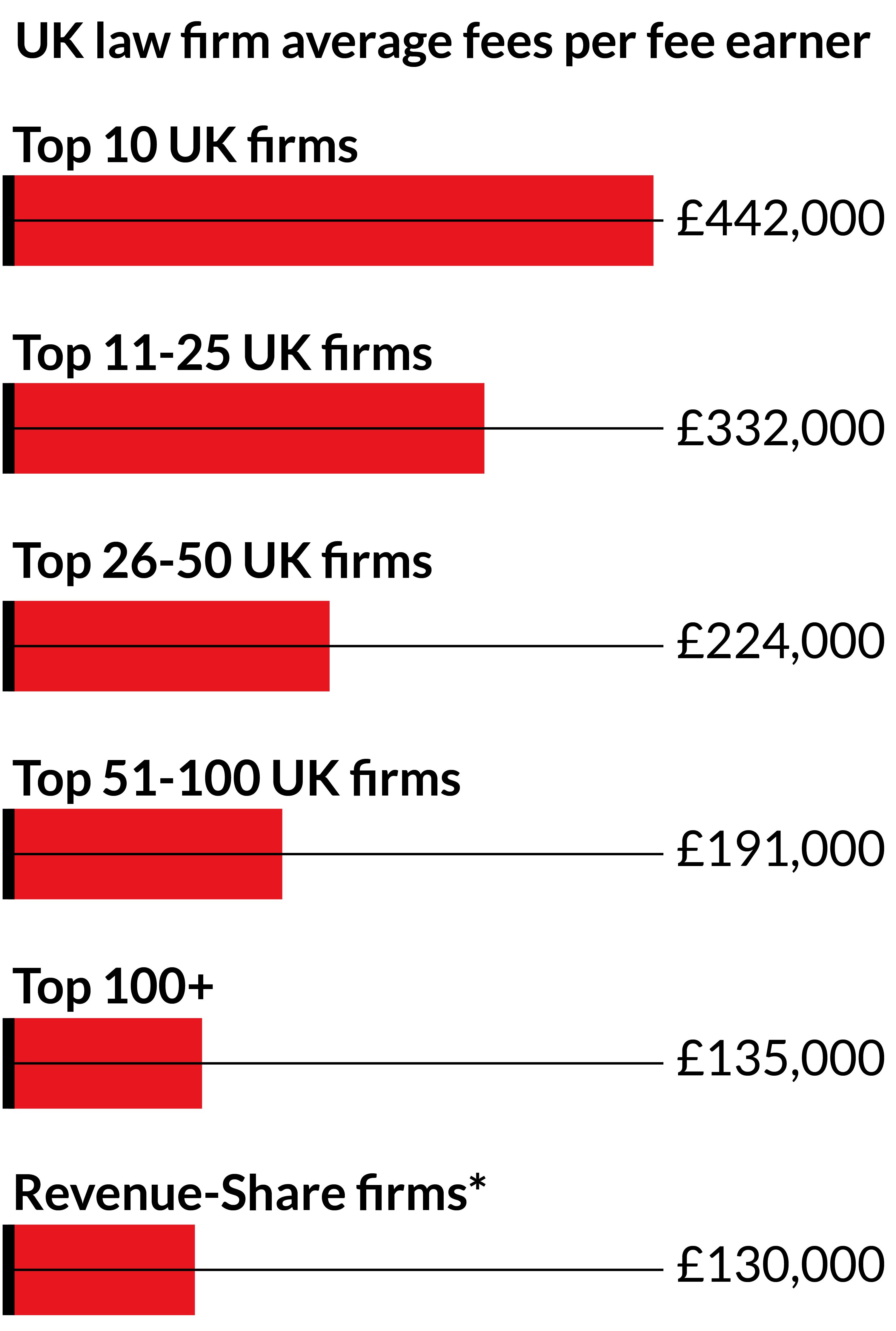

Source: PwC (UK law firm data) *Rough estimate of average fees per consultant lawyer based on largest two revenue-share firms

Source: PwC (UK law firm data) *Rough estimate of average fees per consultant lawyer based on largest two revenue-share firms

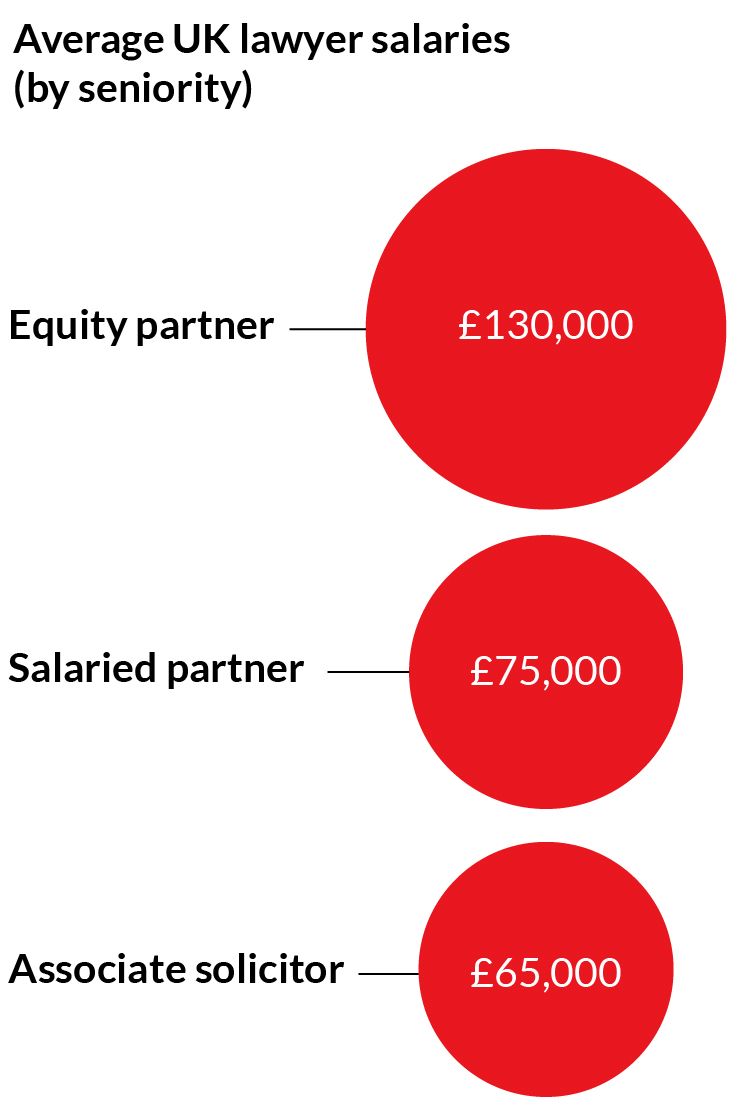

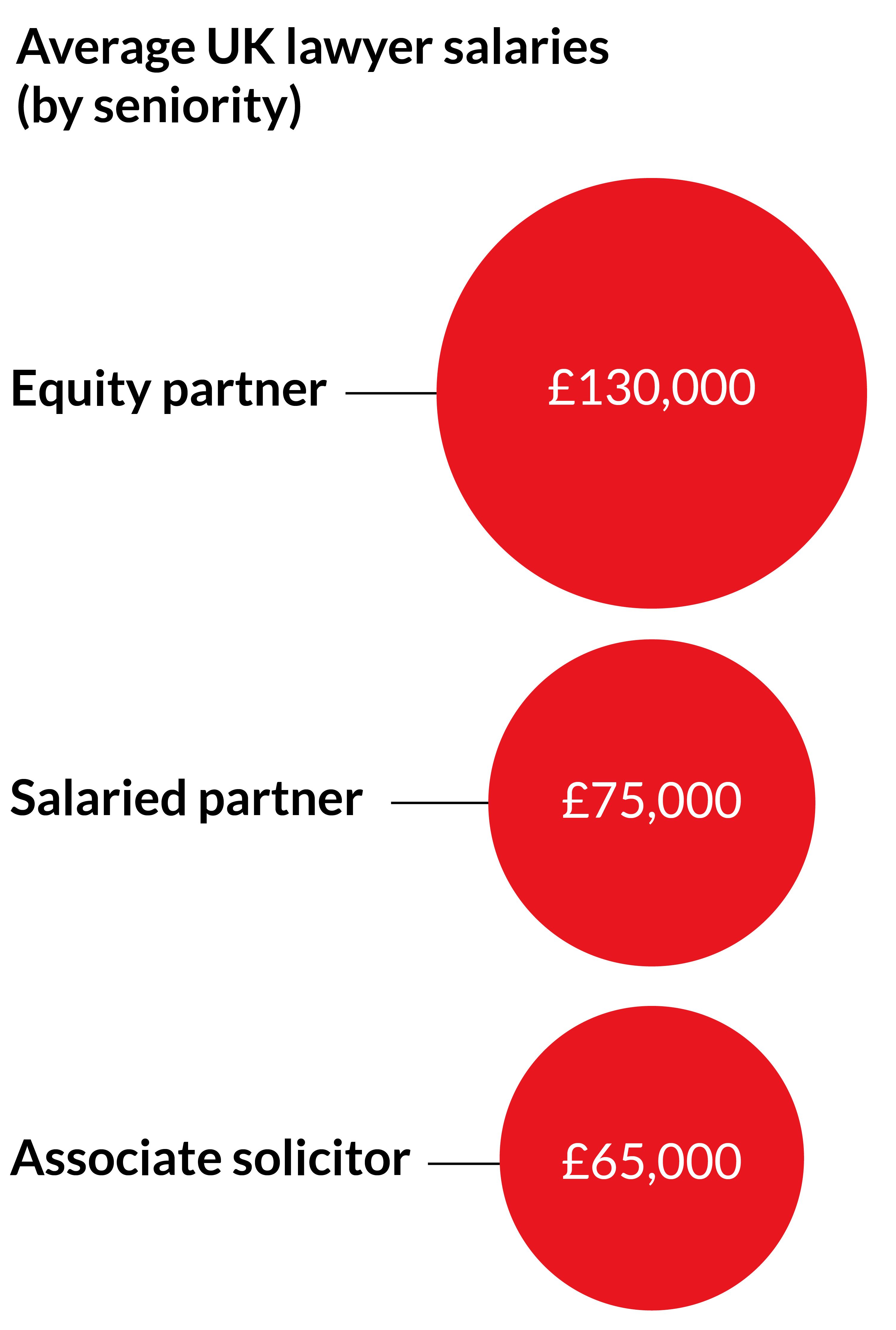

Source: Law Society (2018 data)

Source: Law Society (2018 data)

“Since the start of the pandemic there has been a wholesale shift in attitudes towards ways of working and processes, and those play into the distributed model,” said Christopher O’Connor, Director of Solutions at LexisNexis. “In the past when remote working wasn’t as accepted as it is now, there was a lot more friction to this type of model—both in terms of the supply of lawyers wanting to do it, and also on the client side. But people understand now that things are delivered in a different way and often can be delivered better or at least just as well.”

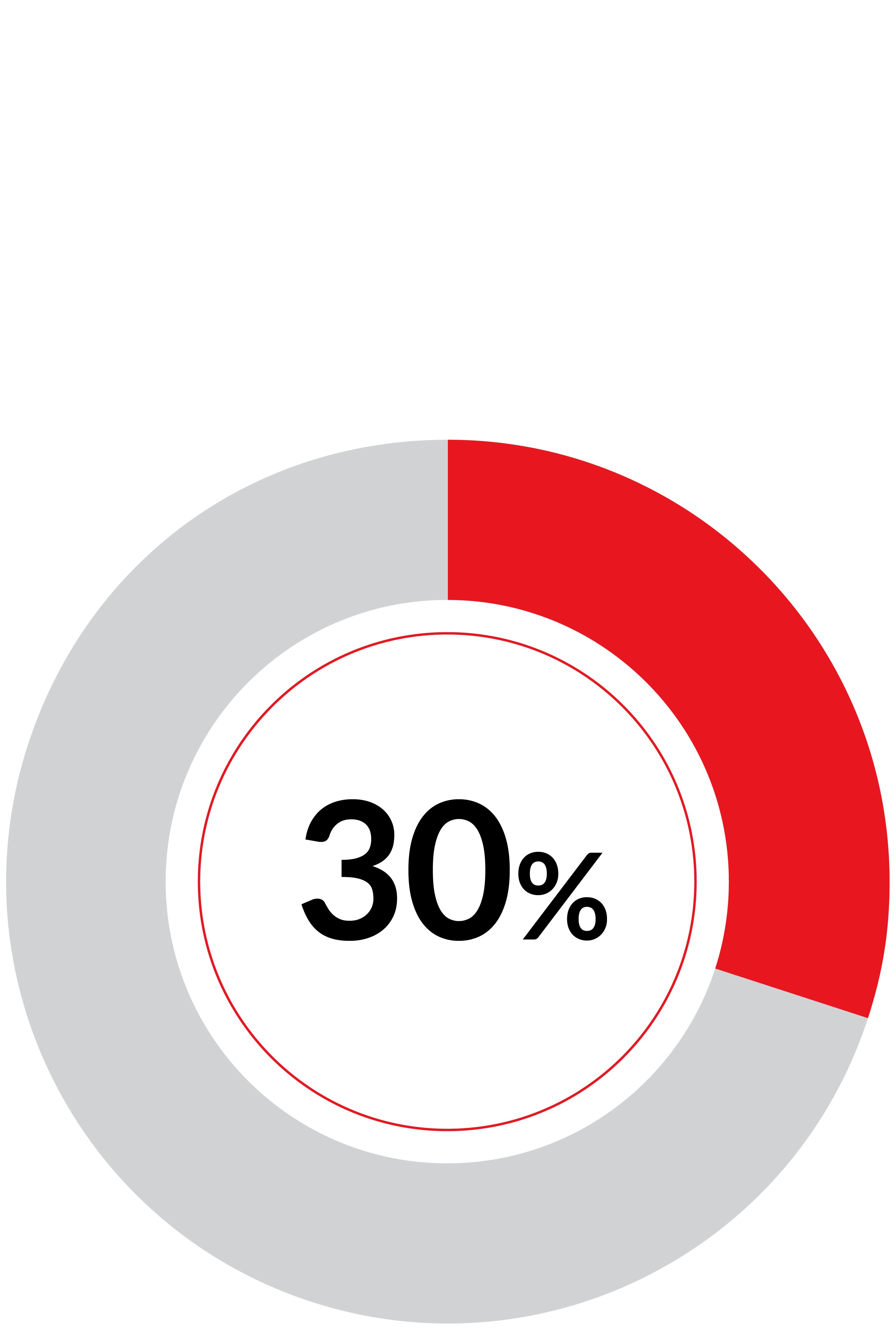

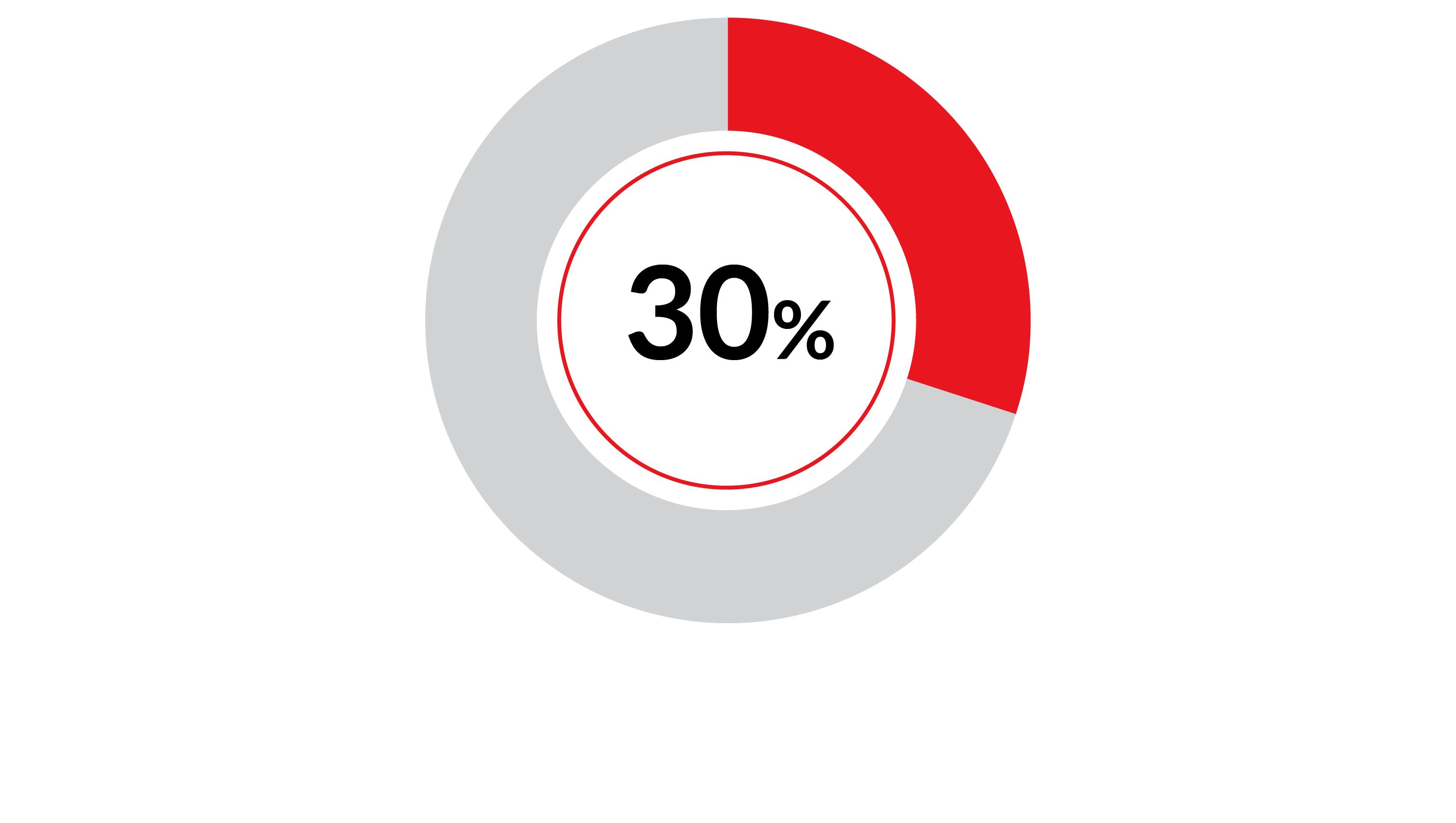

Some market watchers are bullish about the potential for the growth of the revenue-sharing model. A report by Arden Partners, a stockbroker, predicted that a third of all lawyers in the UK could be working under this model within the next five years. In part that is based on predictions that as many as 3,000 of the UK’s 10,000 law firms could be forced to close or merge over the next few years, with platform businesses more easily able to absorb teams of lawyers than traditional firms looking to scale through acquisition.

“How many lawyers are there who genuinely have the sort of following and the business development skills to feed themselves?”

Jaggard says Taylor Rose is currently adding between 15 and 20 new consultants every month, with its consultancy head count now above 350 lawyers. Gunnercooke is also expanding into other markets. It has recently opened in Berlin and is also in the process of opening a legal tech-focused unit in Budapest and offices in China and the US.

“In my view what will happen over the next five years is just like how the Magic Circle developed or the Big Four consultancy firms developed, there will be three or four law firms that will come out on top in the revenue-share model,” said Cooke.

Losty says Excello has also seen rapid growth recently, though the firm has been more cautious about who it takes on to avoid churn.

“Our team has grown 25% over the past 12 months (to around 130 self-employed consultants) and we’re seeing increased interest from teams and small firms and sole practitioners who are looking to transition their practices into firms like ours and then continue on as consultants,” she said. “Our approach has always been focused on quality lawyers, it’s not a stack-them-high approach, we want to make sure we get the right people into the firm so we’ve not got a revolving door of lawyers coming in, kicking the tyres and it not working for them.”

Source: PwC (UK law firm data) *Rough estimate of average fees per consultant lawyer based on largest two revenue-share firms

Source: PwC (UK law firm data) *Rough estimate of average fees per consultant lawyer based on largest two revenue-share firms

That is because while the flexibility might be appealing, the ability to grow and maintain a client base requires a different skill set than simply providing legal advice.

“There are no shortage of platforms but the challenge is how many lawyers are there who genuinely have the sort of following and the business development skills to feed themselves,” said Tony Williams, Founder of Jomati Consultants. “This model relies on a level of self-sufficiency. Fundamentally it’s a hunter-gatherer mentality. Clearly there are people who can do that but whether there are enough who can consistently do that, that will be a challenge.”

Family lawyer, Zoë Bloom, who worked at Keystone Law for 11 years before setting up her own firm, says lawyers shouldn’t join a revenue-sharing law firm under the impression that they will be referred work internally.

“You need to be self-sufficient – but it doesn’t take much to get there,” she says. “Keystone Law have a calculator which helps consultants assess the number of hours they need to work per week. If a solicitor cannot generate, bill and recover those hours of work each week to meet their outgoings, they might need to rethink their career choice!”

Another potential barrier for entry to the revenue-sharing model is not having a sufficient financial cushion to tide over newly self-employed lawyers while they attempt to drum up client work.

“As a consultant lawyer you are setting up your own business and if you don’t have the capital sitting behind you to cover yourself for the period of time when you’re not going to be earning much while you’re trying to build your reputation, that’s a barrier, and it’s also quite scary,” said James Harper, Senior General Counsel at LexisNexis.

That need to bring in client work also means the consultant model is more challenging for junior lawyers given they might not have developed enough contacts to support themselves.

“You need to be self-sufficient – but it doesn’t take much to get there.”

“For more junior lawyers it may depend on the maturity of the platform and the ability of others within the platform to generate work for juniors,” said Williams. That could be critical given that one perceived weakness of revenue-share platforms is that there are too many senior lawyers and not enough juniors to support them.

Some firms are attempting to address that issue by creating other employment opportunities for juniors. Keystone, for example, directly employs junior lawyers on a salaried model like a traditional law firm and makes those lawyers available to its consultants if they want to use them for individual matters. Keystone consultants also have the freedom to hire their own juniors and pay them out of their own pockets, for instance if their practice needs a full-time associate.

Source: Law Society (2018 data)

Source: Law Society (2018 data)

Likewise, gunnercooke consultants can directly employ juniors but the firm also has a specific programme for self-employed junior lawyers, providing them with a business coach, training and the opportunity to complete an executive MBA course.

“They still have to take a risk with us, but there’s a massive amount of work available if they market themselves internally, there’s always a lawyer who will need them,” said Cooke.

Yet it is not just juniors who might be unsuited as consultants at revenue-sharing firms, senior in-house lawyers may also struggle to generate enough work.

“I’m a General Counsel, I don’t worry about where my work is coming from, I don’t have to chase my clients—business development is not something I need to do,” said Harper. “Even junior lawyers coming out of private practice have some idea about business development. If you’re coming from in-house, while you’ve probably got contacts, you’re very out of practice to go and ask those contacts for money—that feels very uncomfortable.”

“If you’re coming from in-house, while you’ve probably got contacts, you’re very out of practice to go and ask those contacts for money - that feels very uncomfortable.”

Another challenge platform businesses face is being able to effectively collaborate across different practice areas or to handle more complex, cross-border work, such as M&A deals that may not just require cross-practice depth and expertise but also lawyers located in multiple jurisdictions—a level of reach revenue-share firms don’t yet have.

“You’re not going to get the continuity and collaboration that you get from a traditional law firm where these people work together on a day-to-day basis, and so for the large scale higher-end work there are limits to how much that model will grow,” said Mark Smith, Director of Strategic Markets at LexisNexis.

While such firms are not competing with Magic or Silver Circle firms, some top tier firms are also experimenting with a different type of platform model that can give lawyers more flexibility over how they work. Firms such as Allen & Overy, Eversheds Sutherland and Linklaters all have flexible resourcing units that provide freelance lawyers to clients on a project basis, with those lawyers typically paid on a day rate.

“There’s a whole bunch of work whereby it doesn’t make sense for in-house teams to pay for those skillsets internally—they typically don’t have enough volume on a consistent basis to warrant hiring someone to do it full time, so they typically need someone on a project basis and the flexible lawyer model can help solve those resourcing issues,” said Smith. “As the model has grown, we’ve seen more and more big firms put these defensive plays in place where they’ve effectively taken that model and are operating it themselves.”

One traditional firm that has embraced this model is Magic Circle firm Allen & Overy. It launched its Peerpoint platform in 2013 in the wake of the financial crisis to help meet the needs of A&O and its clients, with the latter not having enough internal staff to sustainably manage their workloads.

“That meant we were getting a lot of requests for secondments, but doing that from our permanent headcount was an expensive way of doing it,” said Carolyn Aldous, Managing Director of Peerpoint. “At the same time we had talent that the firm was training but the percentage that actually make it to partner from training contract is very low, so we wanted to give them a different way to build their career and stay with Allen & Overy, so those things led to the development of Peerpoint.”

Today, Peerpoint is the largest law firm-linked flexible working service, with a UK revenue understood to be upwards of £35m. It operates across six jurisdictions and has roughly 350 consultant lawyers on its books. Lawyers are paid a day rate which varies depending on their experience and the type of work they are doing—that can either be in-house for a client or inside Allen & Overy itself. Its consultants can then choose when they are available to work to better fit it around their lifestyles.

“You’re not going to get the continuity and collaboration that you get from a traditional law firm where these people work together on a day-to-day basis.”

“It’s not a one-size fits all model,” said Aldous. “For some lawyers, they will only work on one deal at a time, and when that deal needs to be done they will work it, and when that deal is not on, they will take a break and manage it accordingly. Other people choose to work for six months a year and then take off the next period to pursue whatever their interest is, so we’ve got professional yachtsmen, we’ve got people who are fiction writers, we have art dealers, property renovators, so some people use their law career to effectively fund the other part of their life.”

Another major law firm with a flexible resourcing arm is Pinsent Masons, which launched Vario in 2013 and has over 1,000 third-party lawyers who can be deployed for specific client projects as and when required.

David Halliwell, partner at Vario, said its flexible workforce enables permanently employed lawyers at Pinsent Masons to focus on higher value client work—and that comes with the additional benefit of having an army of specialist lawyers when the need arises.

“The growth of our flexible lawyer business has gone from strength to strength through the pandemic,” said Halliwell, who attributed this growth to the firm’s investment in legal technology.

“One of the key things is the way we use technology to make ourselves more efficient in our own delivery of services and the starting point for us on that front is document automation. The other area in which we've been really successful is using technology to do large scale document review.”

One of the pioneers of the flexible resourcing model is Axiom Law, which was founded in the US in 2000 and now has more than 5,800 lawyers globally and a revenue estimated to be upwards of $360m.

“I’ve always viewed Axiom as this escape route from these forced compromises that a lot of lawyers have reluctantly accepted,” said David Pierce, Chief Commercial Officer at Axiom. “As a lawyer you want good work, you want more control and you want to earn a good living, but you still want the living part, you want a balance of things that you care about or draw inspiration from. For a long time, you just haven’t been able to get all of those things at once, so Axiom is a place that optimises for each of those things.”

“The firms that find the best way to keep their talent are going to win, [but] some of them are going to keep succumbing to the talent wars.”

While the emergence of these alternative platforms may not prompt law firms to rip up their business models, it does mean competition for talent is going to get tougher.

“The firms that find the best way to keep their talent are going to win, some of them are going to keep succumbing to the talent wars that we’re constantly reading about, not just associates but partners decamping and taking entire wings of offices with them, so the firms that figure that out will win, as well as the firms that figure out how to prioritise client and lawyer equally,” said Pierce.

That means law firms need to be more agile and creative when it comes to employment terms and the types of career opportunities on offer if they want to continue attracting the best talent, not least given how competitive the market is right now. For instance, some UK firms are paying first-year associates upwards of £150,000.

“We’re not going to see the disappearance of the traditional law firm model, but it does mean that for all firms they have to be open to being more flexible if they want to retain the talent of the future,” said Joanne Losty, Recruitment Director at Excello Law. “As the younger generation of lawyers come through, who are more demanding about work-life balance and flexibility, that does create some challenges for law firms in terms of talent retention and career pathways.”

Meantime, while traditional firms are investing more in technology and enabling lawyers to work remotely, market watchers believe it is unlikely those firms will ever convert to a revenue-sharing model.

“The market is not big enough yet for traditional firms to be losing sleep over… but they are very worried about losing talent.”

“When you think about disruptors no matter what industry it is, they haven’t changed from a conventional business, they’ve started from ground zero,” said Knight. “The conventional can’t adapt and become the unconventional, it just doesn’t happen.”

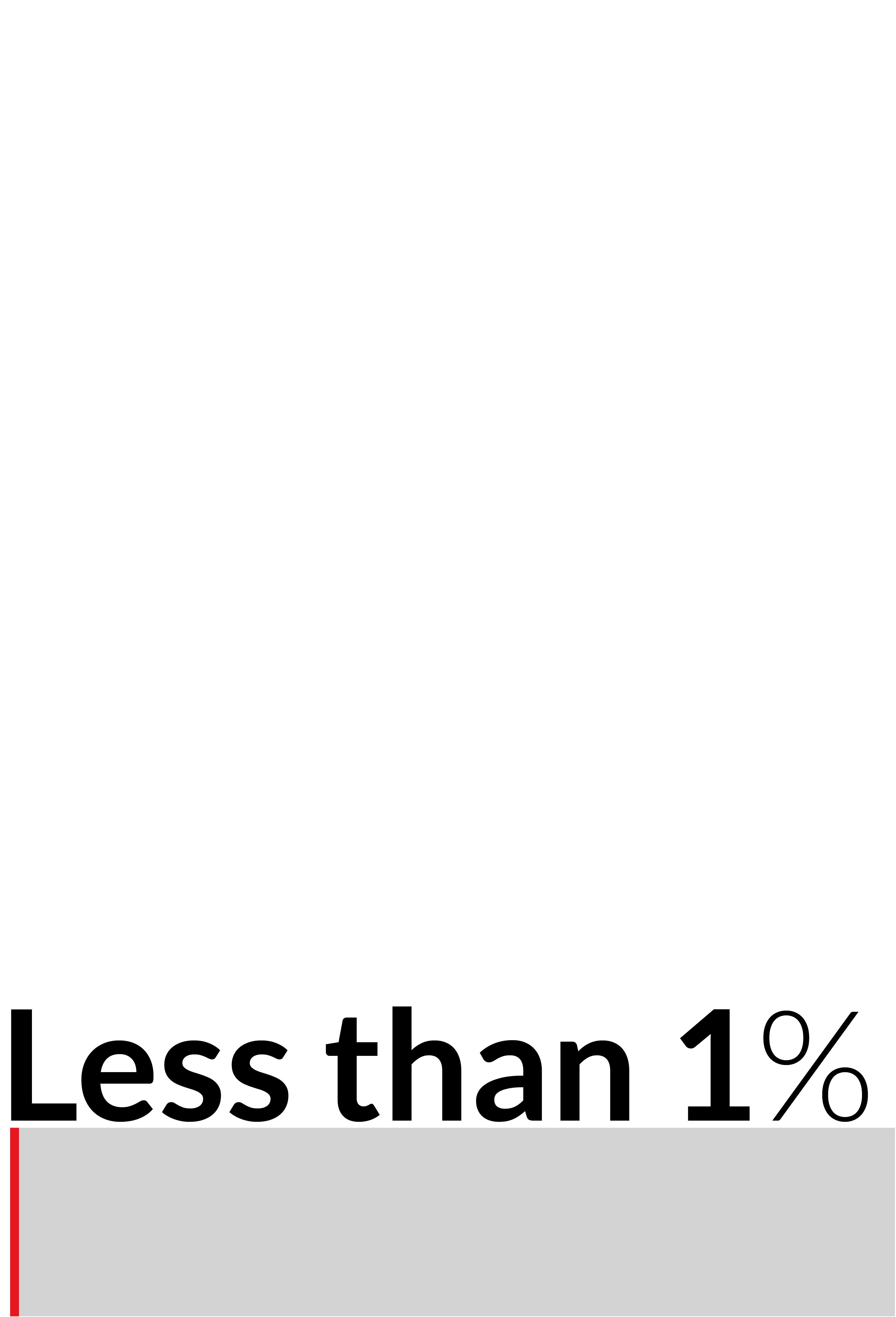

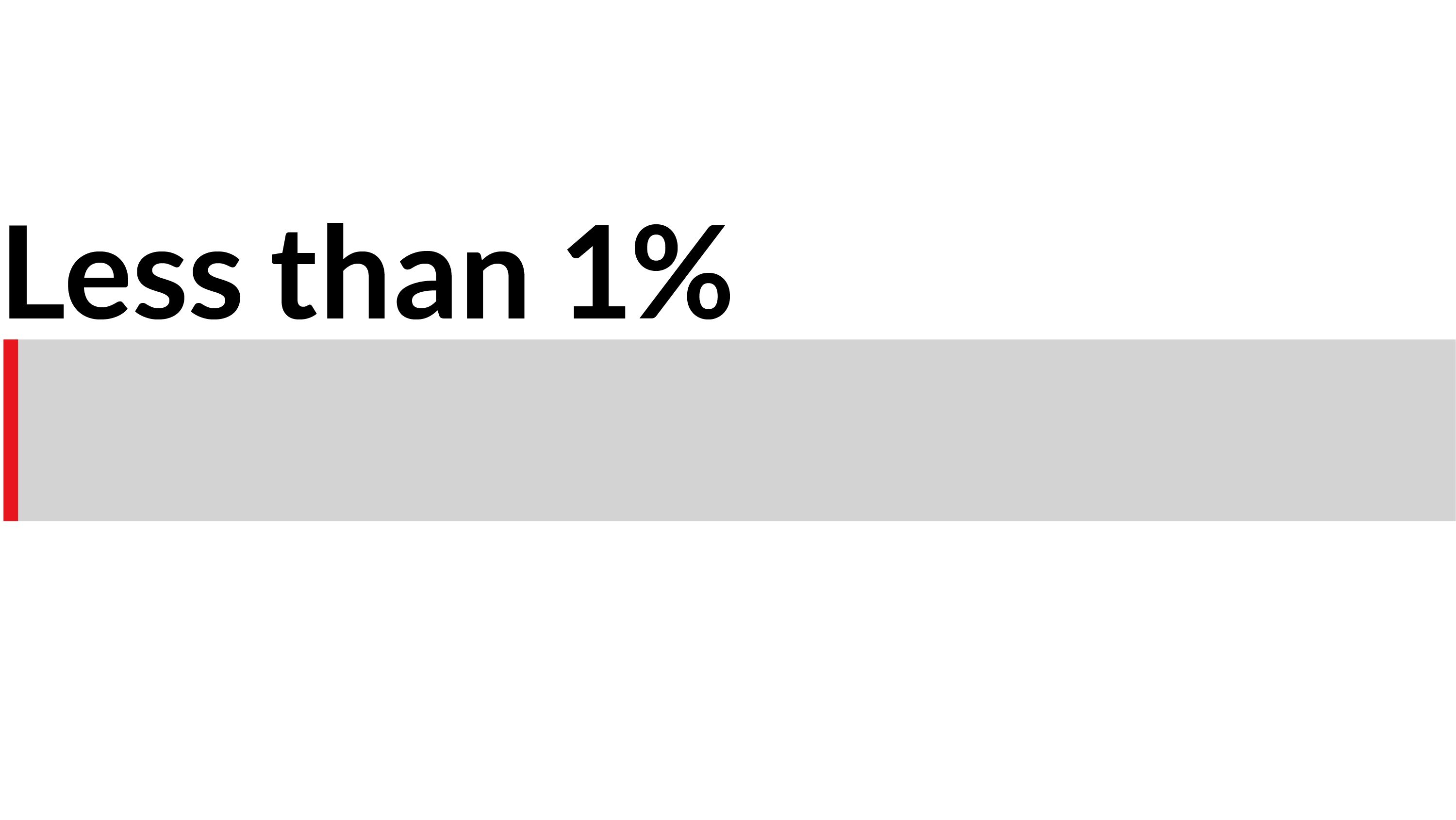

Given that revenue-sharing platforms currently only account for a tiny fraction of the UK legal market (Arden Partners estimates that consultants represent less than 1% of the market by value), their commercial impact is likely to be limited in the near term. However, with lawyers increasingly seeking better work-life balance, firms that operate under a revenue-sharing model could put more immediate pressure on talent retention.

“The market is not big enough yet for traditional firms to be losing sleep over, but where they are most worried at the moment is less on the business side and more on the talent side—they are very worried about losing talent and they have to change things to make life more attractive to retain their lawyers,” said O’Connor.

This suggests the revenue-share model is unlikely to radically transform the legal market, but it could force traditional firms to allow lawyers to work more flexibly in order to attract the best talent. And while revenue-share businesses are unlikely to trouble the top tier firms commercially, O’Connor believes the model will eventually be more disruptive in the mid-market where there is more competition on fees and firms are less distinctive, creating an opportunity for such platform operators to expand their footprints.

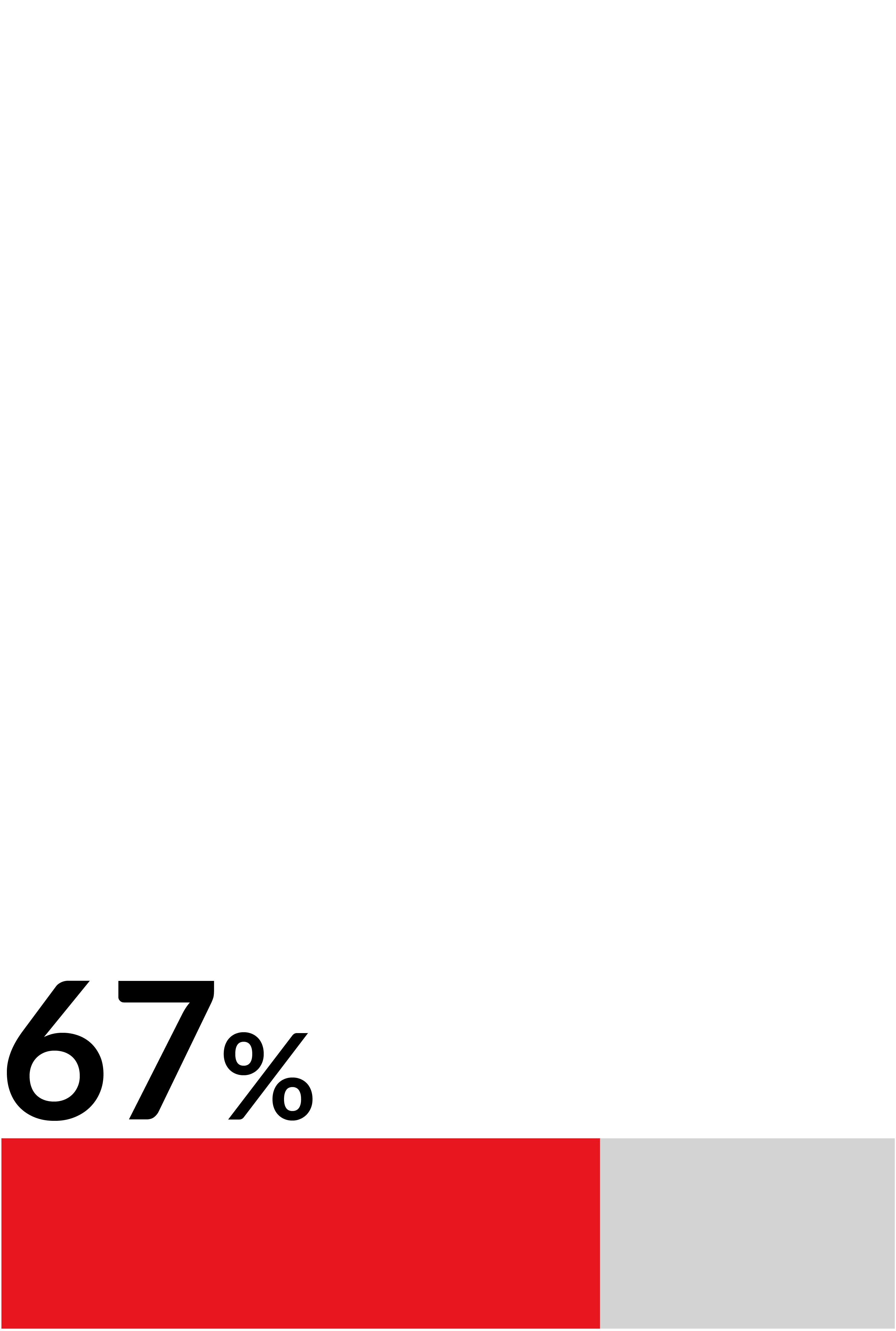

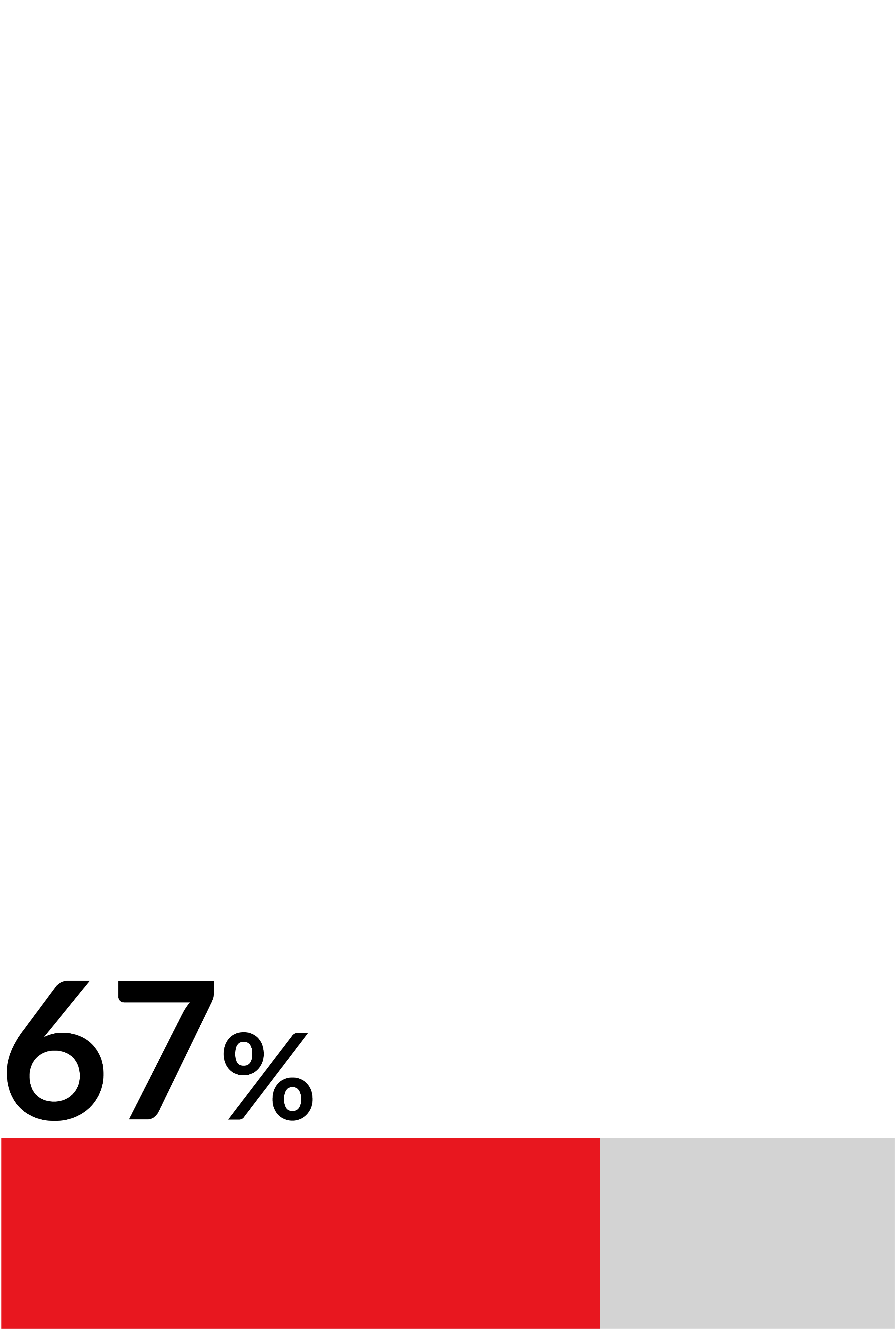

of lawyers in England and Wales currently work under a consultancy model – Arden Partners, 2021

of lawyers in England and Wales currently work under a consultancy model – Arden Partners, 2021

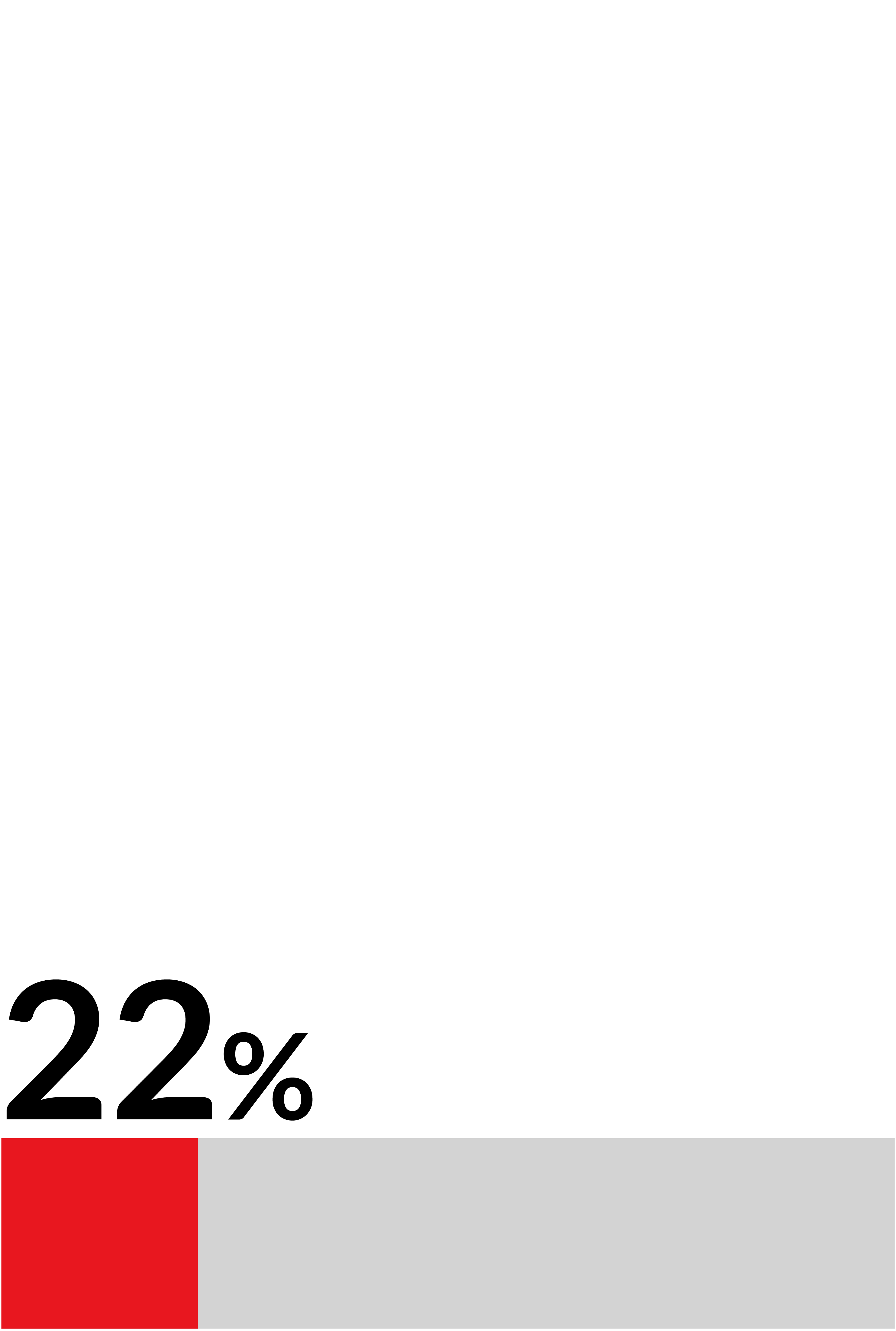

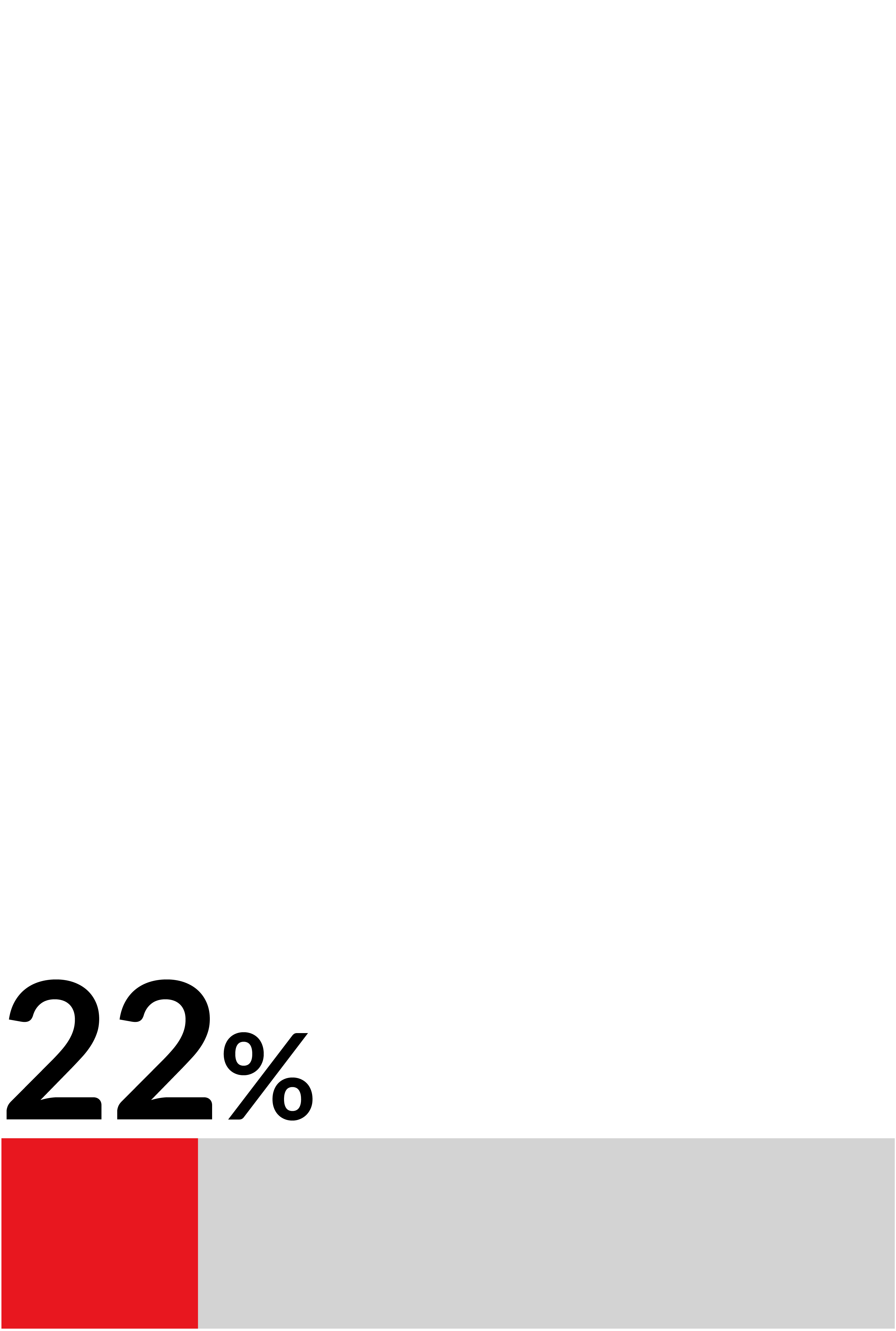

of all firms could be forced to close or merge in the near term – Arden Partners, 2021

of all firms could be forced to close or merge in the near term – Arden Partners, 2021

“There’s a whole bunch of work whereby it doesn’t make sense for in-house teams to pay for those skillsets internally—they typically don’t have enough volume on a consistent basis to warrant hiring someone to do it full time, so they typically need someone on a project basis and the flexible lawyer model can help solve those resourcing issues,” said Smith. “As the model has grown, we’ve seen more and more big firms put these defensive plays in place where they’ve effectively taken that model and are operating it themselves.”

One traditional firm that has embraced this model is Magic Circle firm Allen & Overy. It launched its Peerpoint platform in 2013 in the wake of the financial crisis to help meet the needs of A&O and its clients, with the latter not having enough internal staff to sustainably manage their workloads.

“That meant we were getting a lot of requests for secondments, but doing that from our permanent headcount was an expensive way of doing it,” said Carolyn Aldous, Managing Director of Peerpoint. “At the same time we had talent that the firm was training but the percentage that actually make it to partner from training contract is very low, so we wanted to give them a different way to build their career and stay with Allen & Overy, so those things led to the development of Peerpoint.”

Today, Peerpoint is the largest law firm-linked flexible working service, with a UK revenue understood to be upwards of £35m. It operates across six jurisdictions and has roughly 350 consultant lawyers on its books. Lawyers are paid a day rate which varies depending on their experience and the type of work they are doing—that can either be in-house for a client or inside Allen & Overy itself. Its consultants can then choose when they are available to work to better fit it around their lifestyles.

“You’re not going to get the continuity and collaboration that you get from a traditional law firm where these people work together on a day-to-day basis.”

“It’s not a one-size fits all model,” said Aldous. “For some lawyers, they will only work on one deal at a time, and when that deal needs to be done they will work it, and when that deal is not on, they will take a break and manage it accordingly. Other people choose to work for six months a year and then take off the next period to pursue whatever their interest is, so we’ve got professional yachtsmen, we’ve got people who are fiction writers, we have art dealers, property renovators, so some people use their law career to effectively fund the other part of their life.”

Another major law firm with a flexible resourcing arm is Pinsent Masons, which launched Vario in 2013 and has over 1,000 third-party lawyers who can be deployed for specific client projects as and when required.

David Halliwell, partner at Vario, said its flexible workforce enables permanently employed lawyers at Pinsent Masons to focus on higher value client work—and that comes with the additional benefit of having an army of specialist lawyers when the need arises.

“The growth of our flexible lawyer business has gone from strength to strength through the pandemic,” said Halliwell, who attributed this growth to the firm’s investment in legal technology.

of lawyers in England and Wales currently work under a consultancy model – Arden Partners, 2021

of lawyers in England and Wales currently work under a consultancy model – Arden Partners, 2021

“One of the key things is the way we use technology to make ourselves more efficient in our own delivery of services and the starting point for us on that front is document automation. The other area in which we've been really successful is using technology to do large scale document review.”

One of the pioneers of the flexible resourcing model is Axiom Law, which was founded in the US in 2000 and now has more than 5,800 lawyers globally and a revenue estimated to be upwards of $360m.

“I’ve always viewed Axiom as this escape route from these forced compromises that a lot of lawyers have reluctantly accepted,” said David Pierce, Chief Commercial Officer at Axiom. “As a lawyer you want good work, you want more control and you want to earn a good living, but you still want the living part, you want a balance of things that you care about or draw inspiration from. For a long time, you just haven’t been able to get all of those things at once, so Axiom is a place that optimises for each of those things.”

“The firms that find the best way to keep their talent are going to win, [but] some of them are going to keep succumbing to the talent wars.”

While the emergence of these alternative platforms may not prompt law firms to rip up their business models, it does mean competition for talent is going to get tougher.

“The firms that find the best way to keep their talent are going to win, some of them are going to keep succumbing to the talent wars that we’re constantly reading about, not just associates but partners decamping and taking entire wings of offices with them, so the firms that figure that out will win, as well as the firms that figure out how to prioritise client and lawyer equally,” said Pierce.

of all firms could be forced to close or merge in the near term – Arden Partners, 2021

of all firms could be forced to close or merge in the near term – Arden Partners, 2021

That means law firms need to be more agile and creative when it comes to employment terms and the types of career opportunities on offer if they want to continue attracting the best talent, not least given how competitive the market is right now. For instance, some UK firms are paying first-year associates upwards of £150,000.

“We’re not going to see the disappearance of the traditional law firm model, but it does mean that for all firms they have to be open to being more flexible if they want to retain the talent of the future,” said Joanne Losty, recruitment director at Excello Law. “As the younger generation of lawyers come through, who are more demanding about work-life balance and flexibility, that does create some challenges for law firms in terms of talent retention and career pathways.”

Meantime, while traditional firms are investing more in technology and enabling lawyers to work remotely, market watchers believe it is unlikely those firms will ever convert to a revenue-sharing model.

“The market is not big enough yet for traditional firms to be losing sleep over… but they are very worried about losing talent.”

“When you think about disruptors no matter what industry it is, they haven’t changed from a conventional business, they’ve started from ground zero,” said Knight. “The conventional can’t adapt and become the unconventional, it just doesn’t happen.”

Given that revenue-sharing platforms currently only account for a tiny fraction of the UK legal market (Arden Partners estimates that consultants represent less than 1% of the market by value), their commercial impact is likely to be limited in the near term. However, with lawyers increasingly seeking better work-life balance, firms that operate under a revenue-sharing model could put more immediate pressure on talent retention.

“The market is not big enough yet for traditional firms to be losing sleep over, but where they are most worried at the moment is less on the business side and more on the talent side—they are very worried about losing talent and they have to change things to make life more attractive to retain their lawyers,” said O’Connor.

This suggests the revenue-share model is unlikely to radically transform the legal market, but it could force traditional firms to allow lawyers to work more flexibly in order to attract the best talent. And while revenue-share businesses are unlikely to trouble the top tier firms commercially, O’Connor believes the model will eventually be more disruptive in the mid-market where there is more competition on fees and firms are less distinctive, creating an opportunity for such platform operators to expand their footprints.

A New Career Path

Could the revenue-share model offer an alternative route to career progression?

A career in private practice traditionally involved putting in the hours and working your way up to partner. Those who didn’t want to climb the partnership ladder or who were overlooked either had to take on counsel roles or move in-house. Now with the emergence of the revenue-sharing platform model, lawyers can potentially make partner-like returns without the strains and demands of a law firm partnership.

Take private property lawyer Ian Cooke. He has been in private practice for three decades, first for Norton Rose Fulbright and later as an equity partner at Charles Russell Speechlys for more than 20 years. There he felt he was spending too much time on management tasks rather than spending time with clients and prioritising their work.

“I’ve always loved the law, always loved looking after clients, but the thing about getting senior in a big City law practice is that you can pick up a lot of management responsibilities and I felt my practice was being a bit ignored—I didn’t become a lawyer to be a manager,” said Cooke, who now works as a legal consultant at Keystone Law.

That desire to focus on client work rather than getting sidetracked by management committee meetings was also the reason corporate lawyer Nick Ducker swapped equity partnership at Manchester-based firm Shammah Nicholls in favour of going self-employed at gunnercooke, where he has been now for almost a decade.

“It’s a little bit like leaving school and going to university - you can go to university and have a great time but if you don’t get out of bed in the morning and go to lectures, you’re not going to pass your exams.”

“The whole model made perfect sense to me, the flexibility around the way you work but more importantly around the way that you interact with your clients,” he said. “The profession has a certain reputation of billing every minute of every day to the client, but being in gunnercooke on a fixed-fee basis allowed me to just engage better with my clients.”

While the coronavirus pandemic might have given some lawyers a taste of working in a dispersed way, the revenue-share platform model might not be suitable for everyone.

“You’ve got to be disciplined,” said Ducker. “I was told very early on it’s a little bit like leaving school and going to university—you can go to university and have a great time but if you don’t get out of bed in the morning and go to lectures, you’re not going to pass your exams. So you need self-discipline but you also need to be driven and a bit entrepreneurial.”

Employment lawyer Karen Coleman was attracted by the autonomy offered by the revenue-share model. She joined Excello Law five years ago when she was at a crossroads in her career. Not wanting to become a partner at her previous firm, she had the choice of setting up her own independent firm or joining a revenue-share platform. Given the regulatory burden of going solo, Coleman chose the latter.

“You get all the benefits of being in a firm in terms of resources but you don’t get all the negatives in terms of targets and politics.”

“You don’t have to worry about the COLP (Compliance Officer for Legal Practice) and the COFA (Compliance Officer for Finance and Administration) regulations and you get access to all of the compliance support, so you get all the benefits of being in a firm in terms of resources but you don’t get all the negatives in terms of targets and politics,” Coleman said.

For lawyers considering going it alone as a sole practitioner, there is another reason why they might join a platform firm beyond the everyday back office support.

“If you have your own firm and then you shut it down or you retire, you’ve got to try and sell it—and that’s a lot harder than it used to be if you’ve got the worry of PI (professional indemnity) run off cover, which is quite expensive,” Coleman said. “Whereas with Excello when I retire, while I won’t get a lump sum for my share of the business, any clients that I pass on to colleagues I will still get a percentage of their fees for a certain amount of time afterwards, so it’s a very easy start up and it’s a very easy end.”

The platform model can also offer a way back for lawyers who have paused their careers, either to have children or provide family care—potentially helping to improve diversity in the legal profession.

“It can offer things that other law firms can’t, for example the flexibility of someone returning after maternity and being able to work around school hours,” said James Harper, Senior General Counsel at LexisNexis. “If you look at the upper echelons of law firms and their lack of diversity, particularly of senior female leadership, that is something that would suit this model and is an opportunity for growth.”

Family lawyer Zoe Bloom joined Keystone Law 11 years ago after realising the traditional legal career path wasn’t for her.

“I wanted more autonomy and wasn’t really prepared to play the games expected in a traditional practice,” said Bloom.

However, Bloom recently left the leading consultancy firm to establish a new family law boutique practice with Keystone Law colleague Hannah Budd.

“[The consultancy model] is a commercial business which offers you, the solicitor, facilities - you can take or leave those facilities but you can’t complain or expect to shape them”

“We left Keystone Law for the same reasons we joined; autonomy and independence,” she said. “The consultancy model is fantastic, but you have to accept that it is a commercial business which offers you, the solicitor, facilities – you can take or leave those facilities but you can’t complain or expect to shape them. Over time, our needs changed.”

Instead, Bloom says they’ve applied the best aspects of a consultancy model to their new law firm, BloomBudd LLP.

“We want to offer clients honest, straightforward legal advice, be transparent over fees and keep the team supported. We don’t have billing targets because they create a conflict between the client and solicitor. We don’t double charge our time by billing clients to train junior solicitors as well as pay for our time.”

of all lawyers could be working as consultants by 2026 – Arden Partners, 2021

of all lawyers could be working as consultants by 2026 – Arden Partners, 2021

of all lawyers could be working as consultants by 2026 – Arden Partners, 2021

of all lawyers could be working as consultants by 2026 – Arden Partners, 2021

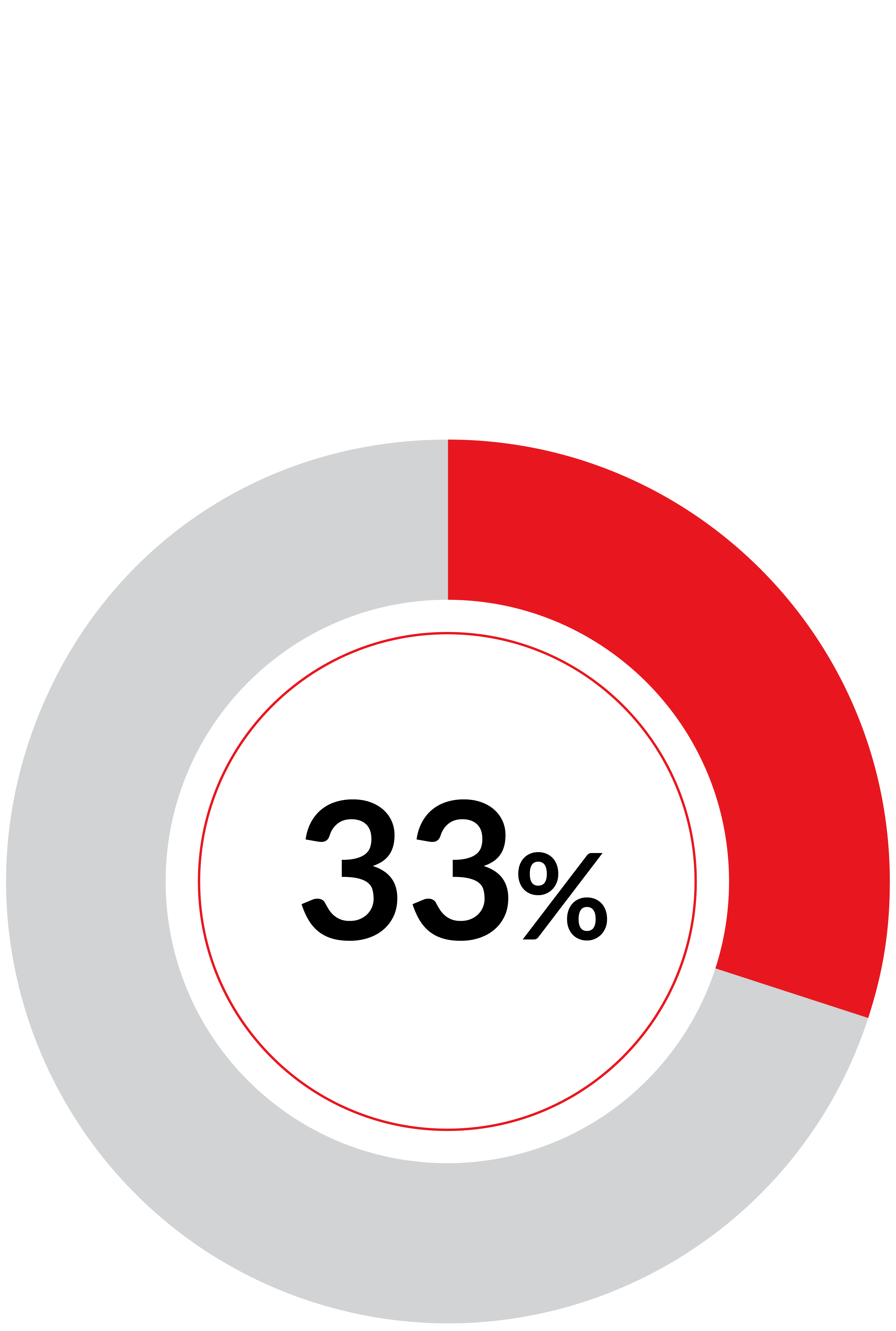

of lawyers prefer a hybrid home/office work model – Atlas Cloud, 2020

of lawyers prefer a hybrid home/office work model – Atlas Cloud, 2020

of lawyers prefer a hybrid home/office work model – Atlas Cloud, 2020

of lawyers prefer a hybrid home/office work model – Atlas Cloud, 2020

want to work from home full time – Atlas Cloud, 2020

want to work from home full time – Atlas Cloud, 2020

want to work from home full time – Atlas Cloud, 2020

want to work from home full time – Atlas Cloud, 2020

Hiring Consultant Lawyers:

The Client Perspective

In a market where legal clients have more choice than ever, will they opt for a revenue-share firm?

The opening up of the legal services market to non-traditional firms has meant buyers of legal services have more choice than ever when seeking to engage external counsel.

One reason clients might choose a firm that has a revenue-share structure is the level of access and service you can get from a consultant lawyer whose ability to earn is directly linked to the success of that client relationship.

“You get direct and immediate access to an expert in their field—you haven’t got to go through tiers of juniors to get to them,” said Mark Swann, a Director at UK Business IT, an IT services company and Excello Law client. “The price is also more competitive because these people are generally working remotely, so they can afford to do things at a reasonable rate. And because of the way these firms are structured, because we are a source of income for the lawyer, they care much more about me and my business, so you get a much more caring service.”

“During lockdown you had the lawyer on the screen all the time so all of the theatre of the big law firm gets stripped away.”

Other factors have also started to chip away at client expectations. For instance, government-imposed lockdowns and office shutdowns during the coronavirus pandemic not only changed the way clients had to interact with their law firms, but also how lawyers within those firms were able to collaborate with each other. That was a challenge for the traditional firms that lacked the infrastructure and processes for their lawyers to work in a dispersed fashion, disrupting the client experience.

“During lockdown you had the lawyer on the screen all the time so all of the theatre of the big law firm gets stripped away,” said Andrew Cooke, General Counsel at esports company Fnatic.

While Cooke says he has yet to use a platform firm to access legal services, he wouldn’t hesitate to use one if an external lawyer he had a good relationship with jumped ship.

“If somebody moves from a small firm or a firm we like working with to a big US law firm and all of a sudden their rates triple then we’re not going to continue to use them, but if they went off to work under a platform model, then yes we would go with them.”

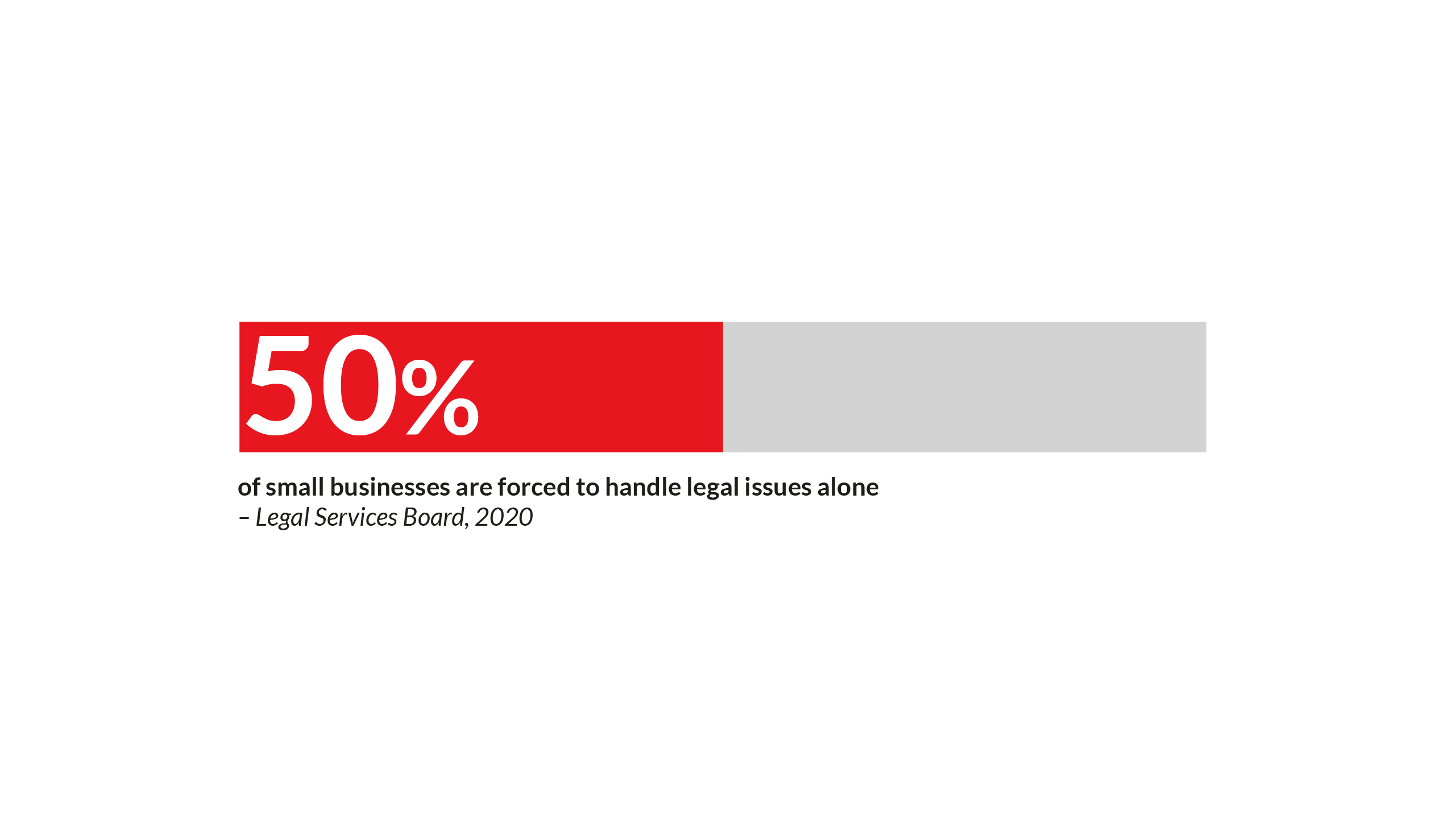

adults have an unmet legal need involving a dispute every year – Legal Services Board, 2020

adults have an unmet legal need involving a dispute every year – Legal Services Board, 2020

The opening up of the legal services market to non-traditional firms has meant buyers of legal services have more choice than ever when seeking to engage external counsel.

One reason clients might choose a firm that has a revenue-share structure is the level of access and service you can get from a consultant lawyer whose ability to earn is directly linked to the success of that client relationship.

adults have an unmet legal need involving a dispute every year – Legal Services Board, 2020

adults have an unmet legal need involving a dispute every year – Legal Services Board, 2020

“You get direct and immediate access to an expert in their field—you haven’t got to go through tiers of juniors to get to them,” said Mark Swann, a director at UK Business IT, an IT services company and Excello Law client. “The price is also more competitive because these people are generally working remotely, so they can afford to do things at a reasonable rate. And because of the way these firms are structured, because we are a source of income for the lawyer, they care much more about me and my business, so you get a much more caring service.”

“During lockdown you had the lawyer on the screen all the time so all of the theatre of the big law firm gets stripped away.”

Other factors have also started to chip away at client expectations. For instance, government-imposed lockdowns and office shutdowns during the coronavirus pandemic not only changed the way clients had to interact with their law firms, but also how lawyers within those firms were able to collaborate with each other. That was a challenge for the traditional firms that lacked the infrastructure and processes for their lawyers to work in a dispersed fashion, disrupting the client experience.

“During lockdown you had the lawyer on the screen all the time so all of the theatre of the big law firm gets stripped away,” said Andrew Cooke, general counsel at esports company Fnatic.

While Cooke says he has yet to use a platform firm to access legal services, he wouldn’t hesitate to use one if an external lawyer he had a good relationship with jumped ship.

“If somebody moves from a small firm or a firm we like working with to a big US law firm and all of a sudden their rates triple then we’re not going to continue to use them, but if they went off to work under a platform model, then yes we would go with them.”

However, the platform model set up might not be appropriate for all client matters, with some types of work more suited to it than others, says James Harper, Senior General Counsel at LexisNexis.

“My principle has always been I hire the lawyer not the firm,” he said. “You can find good lawyers at rubbish firms and you can find rubbish lawyers at good firms, there is no correlation between the quality of advice you get and the size or turnover of a firm. But there are probably a couple of exceptions where you would look at the firm itself.”

“Lawyers are closer to the clients, and it’s really important that they give good service because they’ve got skin in the game.”

For instance, an in-house counsel might wish to have the name of the firm on the letterhead to intimidate the opposing party. The other is for deals where there is a lot of additional work involved.

“Big corporate M&A—if there is a big pile of due diligence to do or just data sifting where you just want a body of cheaper labour, and therefore a big pool of trainees or juniors would be useful, in that instance I’m not sure the consultancy model is one you would go for,” he said.

Revenue-share platform firms say clients are also now much more comfortable with the model and how it works.

“We used to be a little bit frightened about telling people how we remunerate but now I think it’s a massive plus,” said Darryl Cooke, Co-Founder and Executive Chairman at gunnercooke. “Lawyers are closer to the clients, and it’s really important that they give good service because they’ve got skin in the game.”