LexisNexis® Regulatory Compliance

LexisNexis® Regulatory ComplianceWelcome to a new era of compliance

Elevate your compliance strategy with LexisNexis® Regulatory Compliance.

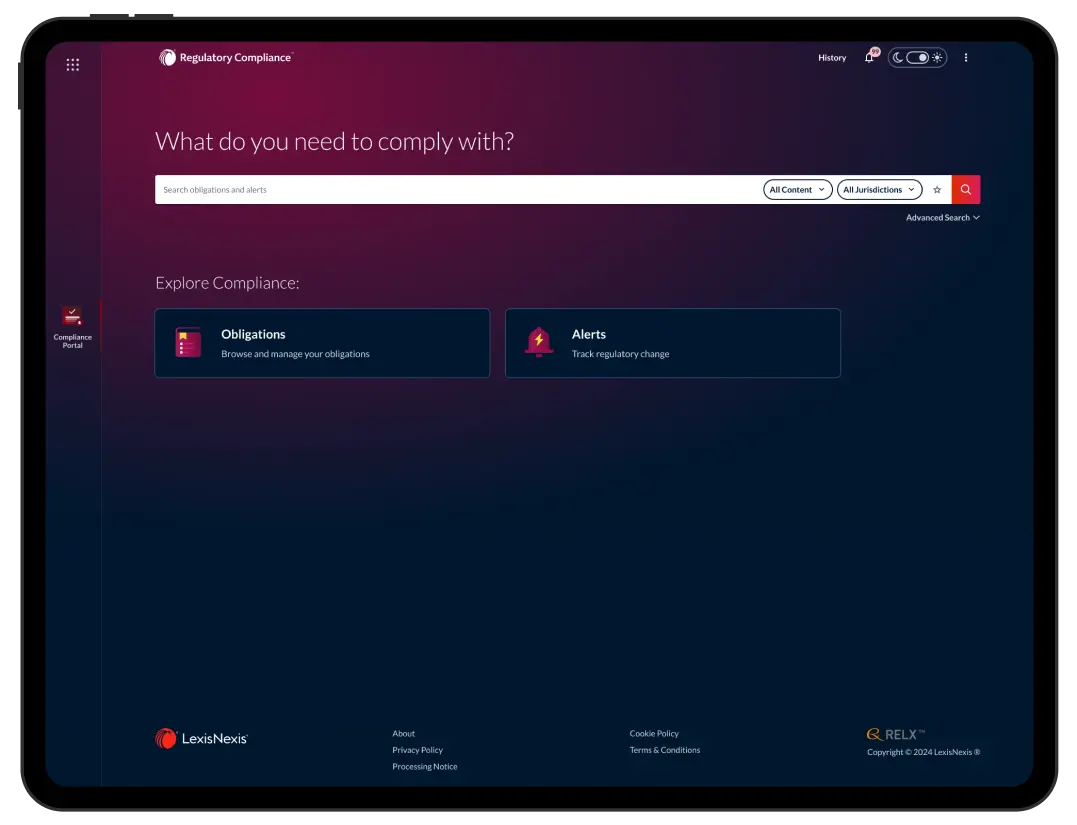

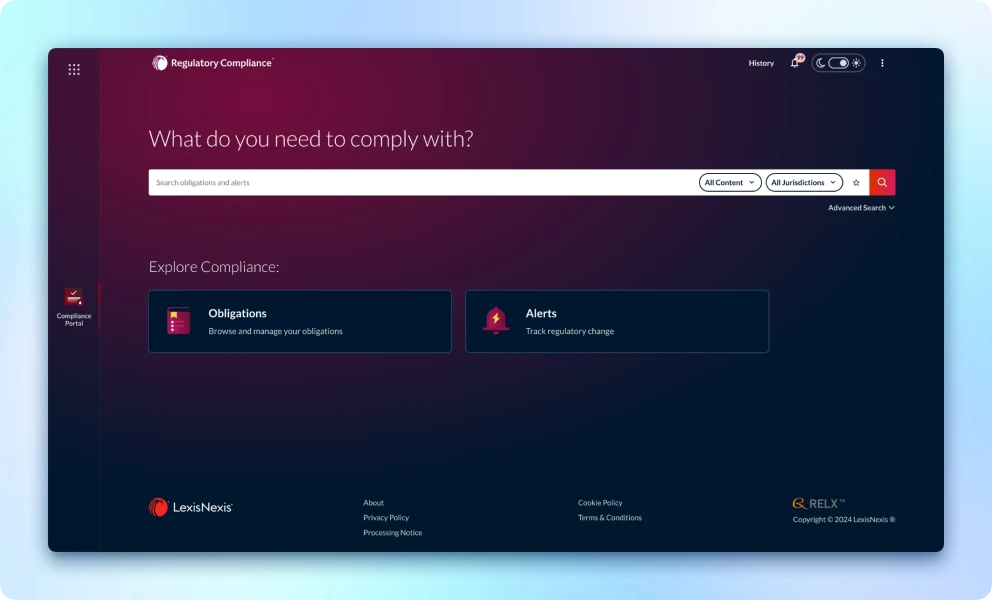

Powerful search. Intuitive navigation.

Get answers faster with unified search and quick access to obligations and alerts.

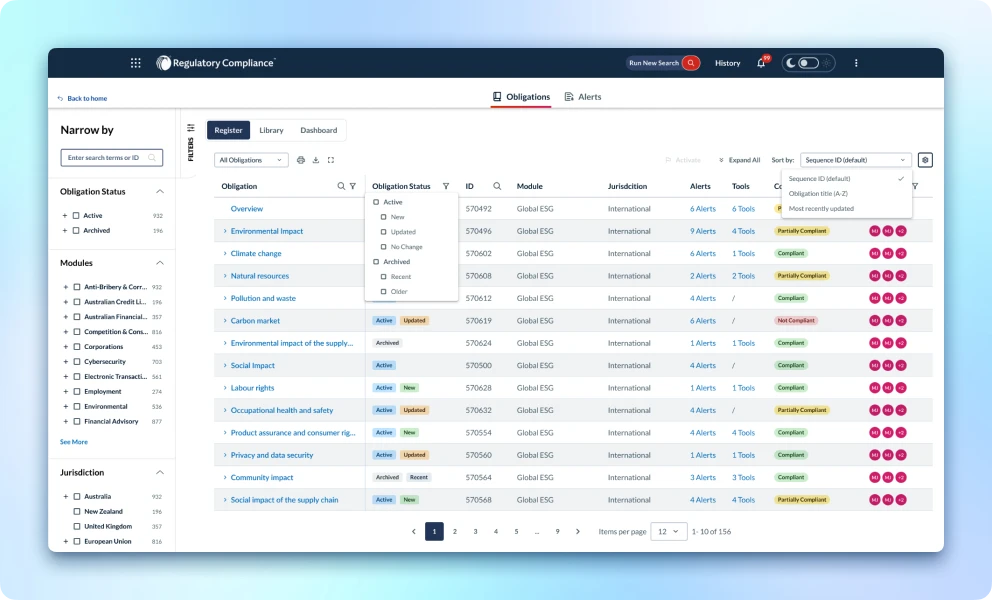

Prioritise tasks. Reduce risk.

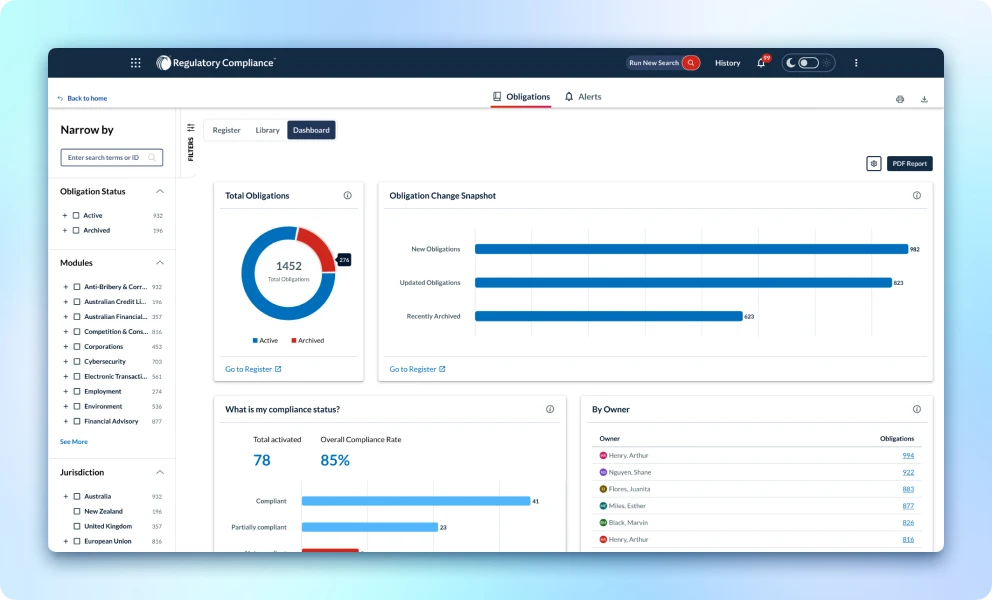

Boost operational efficiency and resilience with enhanced obligation filters based on jurisdiction, industry, compliance status, and risk grading.

Your story in a single view.

Dynamic dashboard provides a snapshot of your compliance tracking, obligations management, and risk insights. This enables proactive compliance management and informed reporting.

Elevate your risk and compliance program

Your Compliance, Made Clear.

Stay ahead of evolving regulations with LexisNexis Regulatory Compliance — the trusted solution that turns complex obligations into actionable insights.

Download our brochure to see how we help you manage risk efficiently and achieve peace of mind.

What our customers say about us

Core Modules

We offer 11 core modules that cover the baseline compliance requirements for businesses.

Industry Modules

No matter your field, we’ll help you find a clear path to compliance with 10 industry modules.

EU Modules

Covering obligations pertaining to EU Member states, these 8 modules have you covered.

Why use LexisNexis Regulatory Compliance?

Spend more time adding value and less time chasing compliance. We’ll do the hard work for you.

Stay on the ball

Content is updated regularly, so you can access obligations which reflect the current legislative framework

Obligations you’ll understand

Experts explain your legal responsibilities in easy-to-apply business language.

Choose your content

Core and specialist modules matched to your industry and location.

Be prepared for everything

Receive alerts when regulatory changes approach.

Streamline compliance management

Checklists. Decision trees. Policy templates. All the tools you need to manage, monitor and demonstrate your compliance.

Turn words into actions

Plain language and practical directions for crystal clear guidance on control actions.

Resources and Insights

Legal Experts

Our experts review, interpret, and translate the many obligations that arise from a range of compliance sources including legislation, codes, standards, and more.

Request a demo for LexisNexis Regulatory Compliance

* denotes a required field